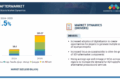

The global automotive aftermarket was USD 674.61 billion in 2024 and is projected to reach USD 804.87 billion by 2030, at a CAGR of 2.9% during the same period.

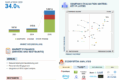

The global automotive aftermarket is driven by the increasing age and mileage of EVs across all regions in the future, the rising focus on harnessing the power of vehicle telematics to offer services, and the growing adoption of digitalization across the value chain to provide better customer experiences.

“Aftermarket industry to see consolidation”

The aftermarket industry is expected to have gradual consolidation, characterized by mergers and acquisitions of parts manufacturers, distributors, and service providers, and is expected to impact the overall automotive aftermarket. This trend often leads to increased market power for larger entities, potentially resulting in greater economies of scale, enhanced negotiating leverage with suppliers and retailers, and optimized supply chain efficiencies. However, it can also reduce competition, potentially causing higher prices for consumers and independent repair shops. Innovation might be stifled if dominant players prioritize cost-cutting over research and development. Furthermore, smaller, specialized businesses could face challenges competing with consolidated giants’ broader product portfolios and distribution networks. The impact on job markets within acquired companies and the overall diversity of product and service offerings remain key considerations as the aftermarket undergoes further consolidation. For example, LKQ acquired Uni-Select in 2023. Similarly, private equity firms are acquiring many aftermarket service providers in markets like North America and Europe.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=234818115

“Remanufactured parts to become a major product in automotive aftermarket domain”

Automotive component remanufacturing is expected to be a significant product in the automotive aftermarket. Remanufactured parts offer cost-effective and environmentally sustainable alternatives compared to new parts. This is likely to expand the market by attracting budget-conscious consumers and repair shops. Remanufacturing reduces waste, conserves resources, and lowers the energy consumption associated with manufacturing new components, aligning with increasing environmental concerns and regulations. This provides opportunities to companies involved in remanufacturing and potentially creates new revenue streams from the core collection, the remanufacturing process itself, and the sale of remanufactured units. Furthermore, as the vehicle parc ages, the demand for affordable repair solutions grows, making remanufactured parts an increasingly attractive option and a vital segment within the broader automotive aftermarket.

“EVs to become a transformational driver in aftermarket industry”

This study will explore the significant impact of the growing electric vehicle (EV) market on the traditional automotive aftermarket. As EV adoption increases, the demand for conventional maintenance services and parts associated with internal combustion engines will decline. Conversely, this shift will create new opportunities and demands for specialized services and components unique to EVs, such as battery diagnostics, repairs and replacements, electric motor servicing, and charging infrastructure maintenance. The study will analyze how aftermarket businesses need to adapt their service offerings, invest in new skills and equipment, and navigate the evolving landscape to cater to the specific needs of EV owners, ultimately reshaping the future of the automotive aftermarket industry.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=234818115