The global generator industry is undergoing a transformative phase, fueled by the growing need for reliable and uninterrupted power supply across sectors. With the market valued at USD 24.11 billion in 2024 and projected to reach USD 32.98 billion by 2030 at a CAGR of 5.4%, the generator market is poised for robust growth. This surge is driven by rapid industrialization, expanding manufacturing sectors, and the critical importance of business continuity in an increasingly electrified world.

Market Drivers: Why Demand for Generators Is Rising

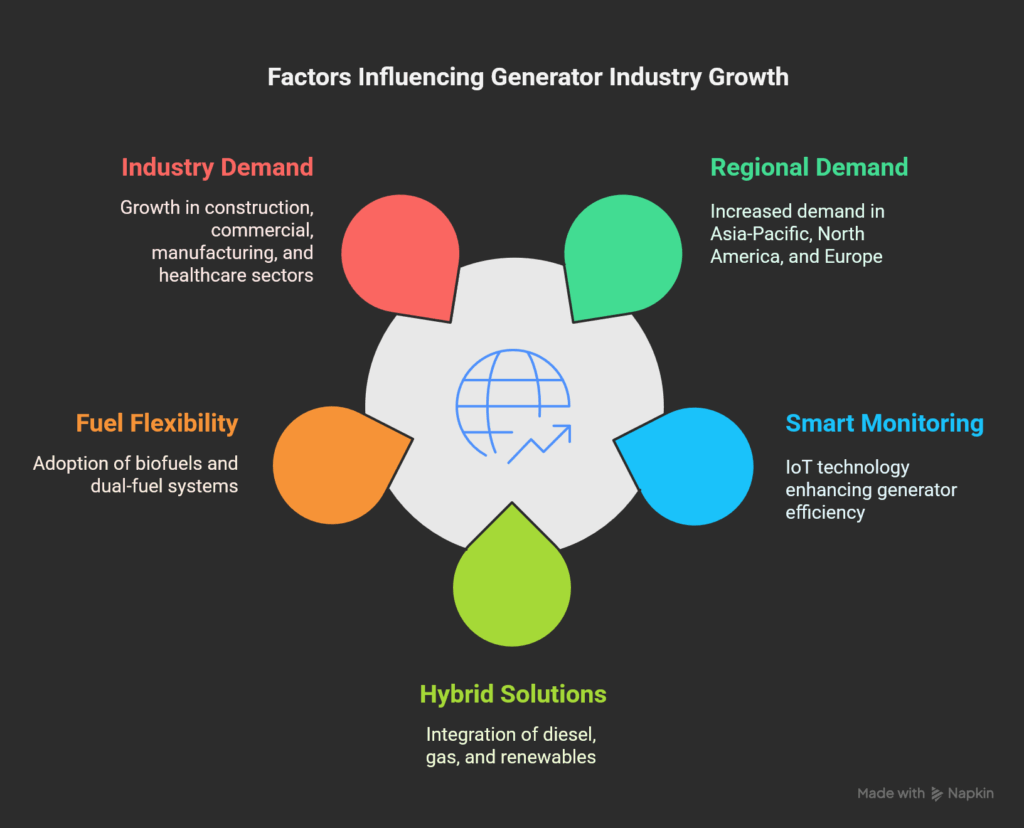

Several factors are propelling the generator industry forward:

- Uninterrupted Power Needs: As industries like IT, healthcare, data centers, and public infrastructure expand, the demand for backup power solutions has become essential. Power outages—whether due to aging infrastructure, rising electricity demand, or natural disasters—underscore the need for dependable generators to ensure operational continuity.

- Urbanization and Industrial Growth: Rapid industrialization, particularly in developing regions, is placing additional pressure on electrical grids, leading to more frequent outages and a greater reliance on generators.

- Natural Disasters: Events such as cyclones and storms have highlighted vulnerabilities in power infrastructure, further driving the adoption of backup generators. For instance, 33.9 million U.S. households experienced a power outage in 2023, illustrating the widespread need for reliable backup power.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=47544335

Regional Insights: Asia Pacific Leads the Charge

The Asia Pacific region is expected to dominate the generator market through 2030, driven by industrial growth in countries like China and India. Government initiatives such as “Make in India” and significant investments in data centers are fueling demand for generators, with India projected as the fastest-growing market. North America and Europe follow, benefiting from established commercial and industrial sectors and ongoing upgrades to power infrastructure.

Innovations and Sustainability: Shaping the Future

The generator industry is responding to environmental concerns and rising fuel costs with a wave of innovation:

- Hybrid and Bi-Fuel Generators: Hybrid gensets, combining internal combustion engines with batteries, optimize fuel usage and reduce emissions. Bi-fuel generators, which primarily use gas but can switch to diesel in emergencies, offer flexibility and improved efficiency. These innovations address both operational costs and stricter emission standards.

- Cleaner Power Solutions: The introduction of inverter generators and advanced emission control technologies is making generators more suitable for sensitive applications and environmentally regulated markets. Companies like Generac and Ecoflow are leading with products that offer cleaner and quieter operation, catering to both residential and commercial needs.

- Regulatory Compliance: Governments worldwide are enforcing stricter emission and noise standards, prompting manufacturers to invest in cleaner technologies. For example, the US EPA’s Tier 4 Final standards and the EU’s Environmental Noise Directive are shaping product development and market offerings.

Market Challenges: Navigating Costs and Regulations

Despite the positive outlook, the generator industry faces notable challenges:

- Rising Fuel Prices: The operational cost of diesel generators is increasingly affected by volatile fuel prices, making them less economical compared to alternatives like natural gas or renewables. This has prompted a shift toward more cost-effective and sustainable power solutions.

Environmental Regulations: Stricter emission standards are increasing production costs and reducing the availability of traditional diesel and gasoline generators. Manufacturers are compelled to innovate, which can raise product prices and affect market dynamics.

Market Structure and Key Players

The generator market ecosystem comprises raw material suppliers, component manufacturers, OEMs, distributors, and service providers. Major players such as Caterpillar (US), Cummins Inc. (US), Rolls-Royce Holdings (UK), Generac (US), Mitsubishi Heavy Industries (Japan), MAN Energy Solutions (Germany) and Briggs & Stratton (US) dominate the market, leveraging extensive distribution networks and partnerships to reach diverse end-users. Indirect sales channels, including retailers and equipment rental companies, play a crucial role in expanding market reach and providing customer support.

Applications and End-User Segments

Generators are indispensable across a range of applications:

- Industrial: Pharmaceuticals, chemicals, and oil & gas industries rely on stationary generators for continuous, high-power backup to ensure safety and process integrity.

- Commercial: Data centers, hospitals, and retail outlets depend on generators for uninterrupted operations during grid failures.

- Residential: Increasing frequency of outages and extreme weather events are driving homeowners to invest in portable and stationary backup generators.

Ask Sample Pages of the Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=47544335

Outlook: Opportunities and the Road Ahead

Looking forward, the generator industry is set to benefit from:

- Product Launches and Partnerships: Continued innovation and strategic partnerships will open new growth avenues for market players.

- Sustainable Solutions: The shift toward hybrid, bi-fuel, and renewable-powered generators aligns with global sustainability trends and regulatory requirements.

- Expanding Markets: Emerging economies, particularly in Asia Pacific, present significant opportunities as infrastructure development and industrialization accelerate.