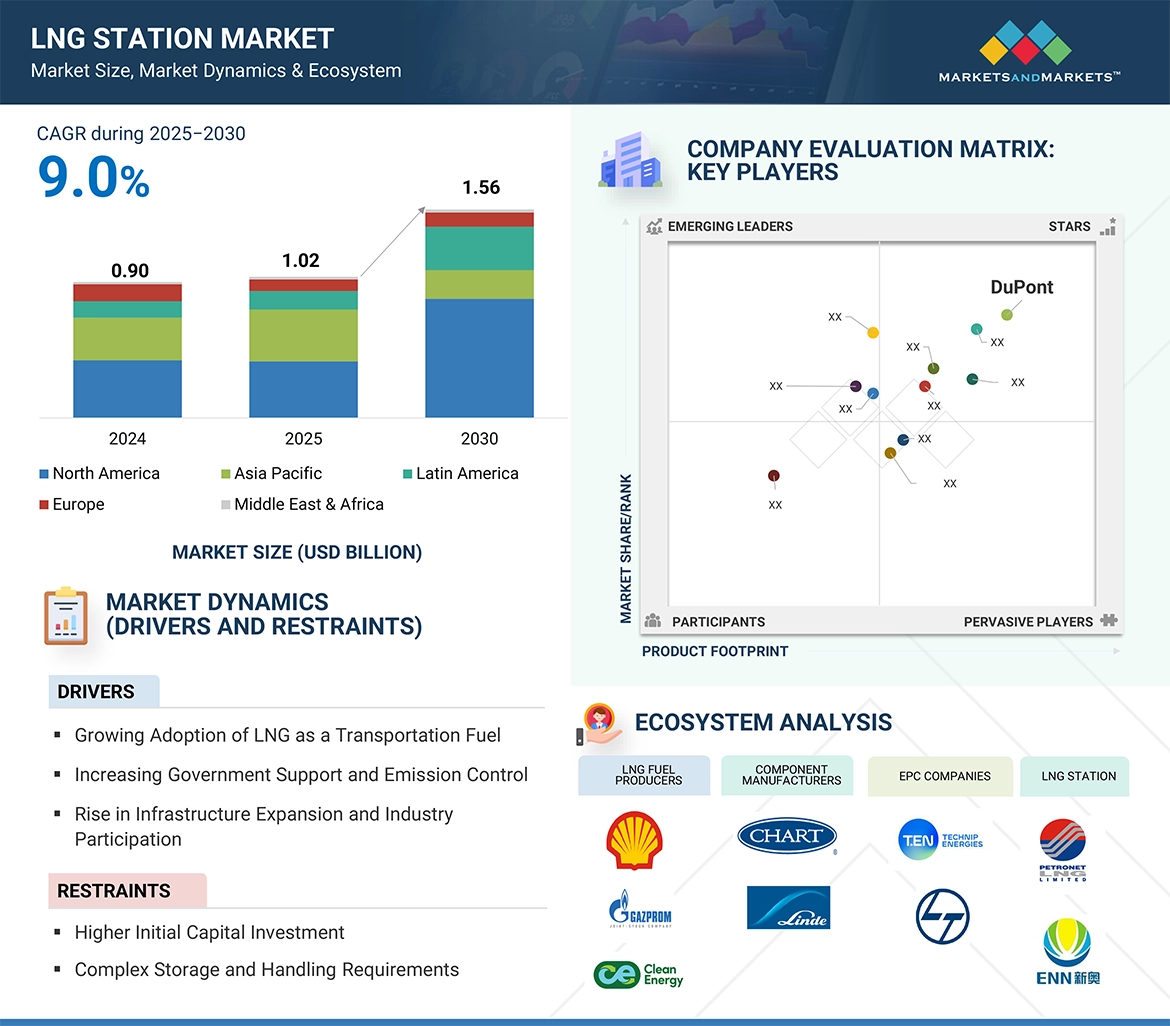

According to a research report “LNG Station Market by Solution (EPC, Components), Station Type (Fixed LNG, Mobile LNG, Bunkering LNG), Application (Heavy-duty Vehicles, Light-duty Vehicles, Marine), Capacity (Small Scale, Medium Scale, Large Scale), and Region – Global Forecast to 2030″, the global LNG station market is projected to reach USD 1.56 billion by 2030 from an estimated USD 1.02 billion in 2025, at a CAGR of 9.0% during the forecast period. The market is witnessing notable growth driven by the global shift toward cleaner transportation fuels and the need to reduce greenhouse gas emissions, particularly in the heavy-duty vehicle segment. Rapid development of natural gas infrastructure and increasing LNG adoption in commercial transport are propelling demand for efficient and scalable refueling stations. LNG stations offer a low-emission, cost-competitive alternative to diesel, making them attractive for long-haul logistics. Additionally, supportive government policies, advances in cryogenic technology, and public-private investments in fueling infrastructure are accelerating deployment. The market is further supported by expanding fleet conversion programs and growing interest in sustainable mobility across emerging economies.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=133282916

Components, by solution, are expected to grow at the highest CAGR during the forecast period.

The components segment is expected to be the fastest-growing in the LNG station market due to the rising demand for advanced, modular, and cost-efficient equipment such as cryogenic pumps, vaporizers, dispensers, and storage tanks. Increasing focus on improving operational efficiency, safety, and fueling speed drives innovation and adoption of high-performance components. As LNG infrastructure expands, operators prioritize scalable and reliable parts that ensure optimal performance and ease of maintenance. Additionally, technological advancements, standardization, and growing investments in station upgrades accelerate the need for sophisticated components, fueling strong growth in this segment.

Bunkering LNG station, by station type, is expected to grow at the highest CAGR during the forecast period

The bunkering LNG station segment is poised for the fastest growth due to the rising adoption of LNG as a marine fuel, driven by stringent global emission regulations and the maritime industry’s transition toward cleaner energy solutions. The growing fleet of LNG-fueled vessels, coupled with increased international shipping activity, is driving demand for reliable and efficient bunkering infrastructure. Strategic investments in port-based LNG fueling facilities and supportive government policies are further enabling market expansion. As global ports prioritize sustainability and compliance, the need for dedicated LNG bunkering stations continues to accelerate.

Europe is expected to be the fastest-growing region in the LNG station market

Europe is projected to be the fastest-growing region in the LNG station market, driven by strong environmental regulations and a firm commitment to reducing transport emissions. The region is witnessing increased adoption of LNG in both heavy-duty road transport and maritime sectors, supported by targeted government incentives and funding programs. Expanding LNG corridors, rising investments in fueling infrastructure, and a strategic shift toward alternative fuels to enhance energy security are further accelerating growth. As countries prioritize cleaner mobility solutions, LNG stations are becoming integral to Europe’s sustainable transport framework.

Make an Inquiry – https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=133282916

Key Market Players

Some of the major players in the LNG station market are CNPC (China), Shell Plc (UK), Chart Industries (US), Jereh Oil & Gas Engineering Corporation (China), Westfalen (Germany), Axegaz T&T (France), Cryonorm Group (Netherlands), Cryostar (France), and INOX India Limited (India). The major strategies adopted by these players include acquisitions, sales contracts, product launches, agreements, alliances, partnerships, and expansions.