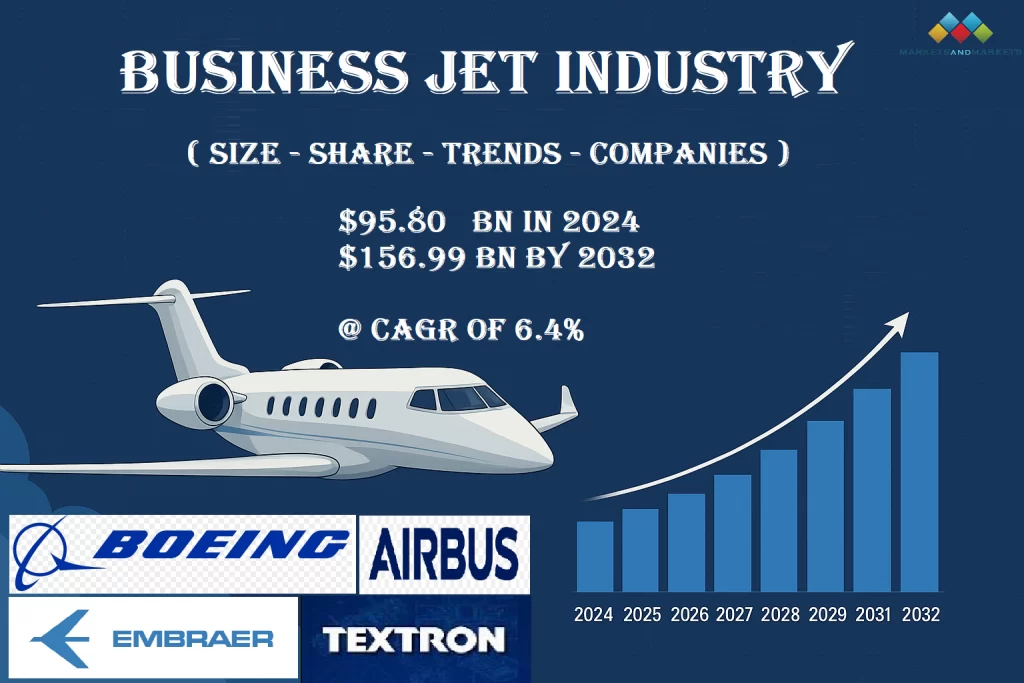

The global business jet market is on a steady growth trajectory, reflecting structural changes in private aviation demand, new technology integration, and the resilience of high-net-worth and corporate travel segments. According to the latest forecast, the market will expand from USD 95.80 billion in 2024 to USD 156.99 billion by 2032, registering a compound annual growth rate (CAGR) of 6.4 %. New jet deliveries are expected to climb from 662 units in 2024 to 793 units by 2032, while used aircraft retail transactions are projected to rise from 2,578 to 3,289 in the same period.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=33698426

The industry’s momentum is supported by several macro drivers. Business aviation continues to provide a decisive edge in productivity, offering time savings, direct point-to-point connectivity, and access to smaller airports that are not well served by commercial airlines. This demand is reinforced by a growing pool of high-net-worth individuals across regions, particularly in emerging markets. At the same time, advances in hybrid and electric propulsion technologies are setting the stage for more efficient and environmentally sustainable platforms, expanding the potential appeal of business jets to new user segments.

Segment-level analysis highlights several important growth vectors. Light jets are expected to post the second-highest CAGR through 2032. Their comparatively lower acquisition and operating costs make them ideal for regional routes, while their balance between cost efficiency and convenience has increased appeal for owner-pilots, corporates, and charter operators. Models such as the Cirrus SF50, Embraer Phenom 300, and Bombardier Learjet 70/75 Liberty represent this segment, which is also likely to serve as the proving ground for hybrid and electric technologies. In the mid-size and large-cabin categories, demand continues to be driven by corporations and government agencies, where cabin space, connectivity, and long-range performance are critical.

The market outlook by point of sale indicates that the OEM segment is positioned for strong growth. New models entering service between 2024 and 2025—such as Dassault’s Falcon 10X, Bombardier’s Global 8000, and Gulfstream’s G800—are expected to boost demand for new aircraft, as buyers seek the latest avionics, cabin innovation, and warranty packages. OEMs also continue to drive competitiveness through customization and advanced systems integration. The aftermarket remains vital as a long-term revenue stream, with modifications, connectivity upgrades, and predictive maintenance programs becoming increasingly valuable for fleet operators. Pre-owned aircraft transactions, meanwhile, highlight the liquidity of the secondary market and its role in expanding accessibility.

Range-based segmentation underscores the strong outlook for aircraft below 3,000 nautical miles, which are forecast to grow at the highest CAGR. These jets offer high fuel efficiency, operational flexibility, and attractive purchase prices, making them ideal for short regional hops. Aircraft such as the Embraer Phenom 300E, Legacy 450, Gulfstream G280, and HondaJet HA-420 exemplify this class, which is expected to remain the backbone of short-haul business aviation growth.

Regionally, Latin America stands out with the second-highest projected growth rate in the business jet market. Corporate expansion in countries such as Brazil, Mexico, Argentina, and Colombia has fueled rising adoption of private aviation solutions. Regional growth is further supported by significant infrastructure developments, including airport expansions and new maintenance, repair, and overhaul (MRO) facilities, which provide stronger support ecosystems for both private operators and corporate fleets.

The competitive environment is shaped by a handful of global players. Airbus and Boeing continue to participate in the high-end segment through corporate and VIP jet conversions, while Textron Aviation dominates in light and midsize jets, benefiting from strong aftermarket services. Bombardier maintains leadership in large-cabin and ultra-long-range jets, with the Global family providing both range and speed advantages. Embraer has built a reputation for value-oriented yet reliable offerings in light and super-midsize jets, serving both owner-pilots and fleet operators. General Dynamics, through Gulfstream, holds strong brand recognition in the ultra-long-range category, while Dassault seeks to reinforce its position with the Falcon 10X.

Ask for Sample Report @

https://www.marketsandmarkets.com/requestsampleNew.asp?id=33698426

Looking ahead to 2032, the business jet market will continue to evolve around three central themes: the push for advanced technology adoption, the resilience of private aviation demand across global regions, and the increasing importance of sustainable solutions. Light and short-range jets are expected to carry much of the volume growth, while large and ultra-long-range aircraft will continue to define brand prestige and capture premium margins. OEMs, aftermarket providers, and operators who can combine performance, sustainability, and service innovation will be best positioned to capture the next phase of business aviation growth.