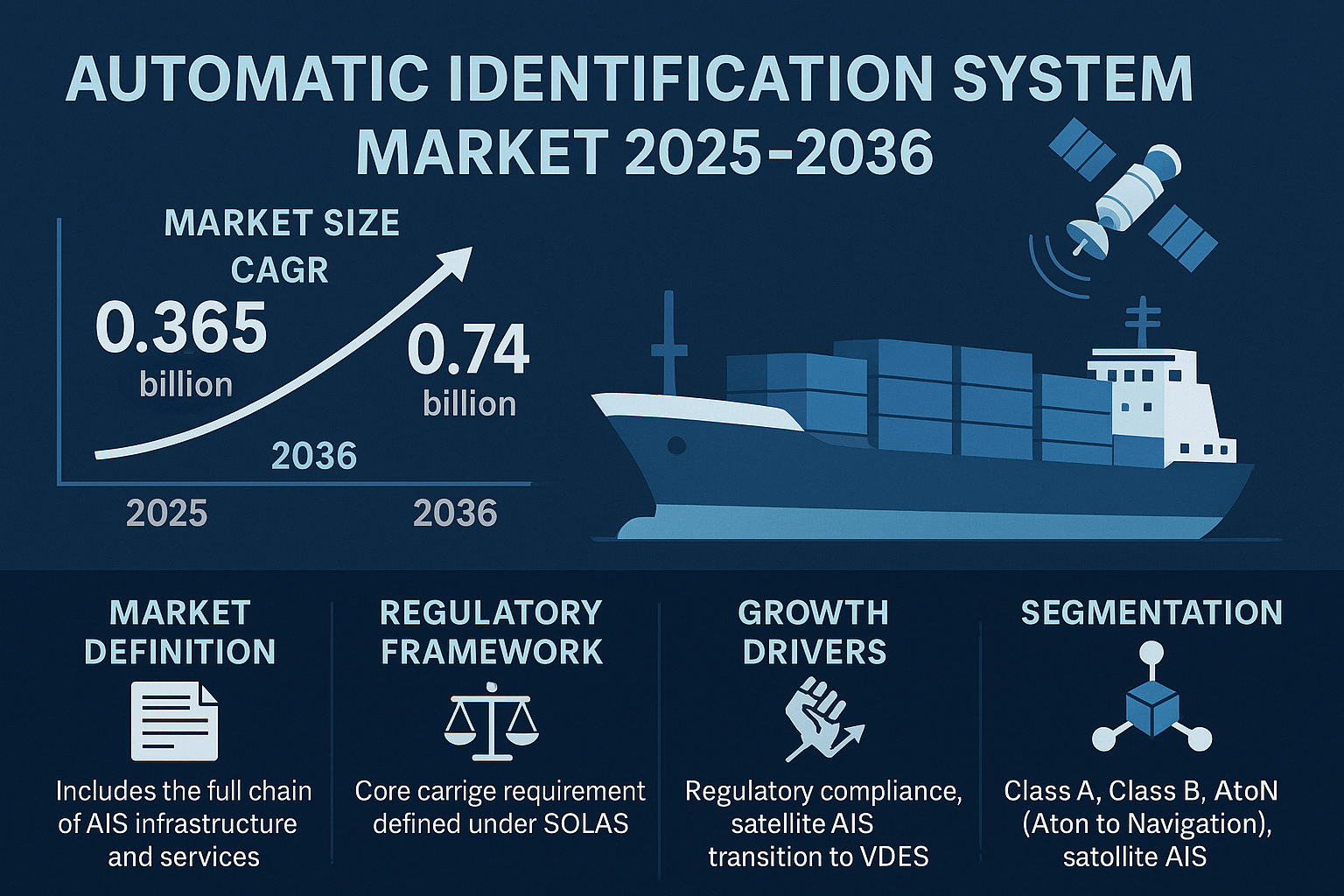

The Automatic Identification System Market is entering a decisive new phase as regulators tighten carriage rules, satellite constellations close long standing coverage gaps, and ports turn AIS data into a core operational resource. Using 2025 as the base year, the Automatic Identification System Market is estimated at about USD 0.365 billion and is projected to reach approximately USD 0.74 billion by 2036, implying a healthy CAGR of ~ 6.6%. This trajectory aligns with mid single digit growth expectations through 2030 and extends them into the next decade as AIS evolves into a broader VHF data ecosystem.Growth in the Automatic Identification System Market is no longer just about putting a transponder on a ship. It is about building a global, multi layered digital fabric that connects shipborne equipment, coastal Aids-to-Navigation, satellite AIS constellations and analytics platforms used by ports, fleet operators and maritime authorities. As AIS transitions toward VDES, the Automatic Identification System Market is expanding from collision avoidance hardware to two way data services that underpin e-Navigation, emissions compliance and maritime domain awareness.

Market Definition and Regulatory Framework

For this analysis, the Automatic Identification System Market includes the full chain of AIS infrastructure and services. That means shipborne Class A and Class B transponders, ancillary receivers and antennas, Aids-to-Navigation (AtoN) units and coastal base station equipment, as well as terrestrial and satellite AIS data feeds and the software platforms that transform raw messages into operational insights.

Regulation remains the backbone of the Automatic Identification System Market. The International Maritime Organization defines the core AIS carriage requirements under SOLAS, particularly Class A systems for larger commercial ships. National authorities such as the US Coast Guard add local carriage and equipment approval rules, specifying which vessels must carry Type approved AIS and how the systems should be configured and maintained. The ITU and IALA govern the technical aspects of AIS and the evolution toward the VHF Data Exchange System, often called AIS 2.0 or VDES. These regulatory anchors give the Automatic Identification System Market a high degree of stability and predictability, which is why investors are comfortable with a mid-single-digit CAGR out to 2036.

As VDES matures, regulators will increasingly protect the original AIS channels for collision avoidance while opening adjacent capacity for data exchange, e-Navigation messaging and value added port and coastal services. This evolution does not replace AIS; it deepens the Automatic Identification System Market by layering richer services on top of a safety critical core.

Growth Drivers Reshaping the Automatic Identification System Market

Three overlapping forces are currently shaping demand in the Automatic Identification System Market.

The first is regulatory compliance. Class A carriage under SOLAS is well established and continues to drive replacement demand on commercial ships. Class B adoption is expanding among fishing vessels, workboats and coastal craft as authorities encourage or mandate visibility for smaller platforms. Carriage rules are enforced not just through port state control but also through coastal monitoring and occasional penalties for operating “dark.” This creates an ongoing pipeline of new installations and replacements across the Automatic Identification System Market.

The second driver is satellite AIS, often called S-AIS. Over the past decade, the quality and density of S-AIS constellations have improved significantly. Coupled with terrestrial coastal networks, S-AIS enables near global tracking that is crucial for high latitude operations, blue water trade lanes and polar routes where shore based towers are sparse or impossible to install. Satellite coverage turns AIS from a coastal collision avoidance tool into a global domain awareness layer, and this shift has expanded the Automatic Identification System Market into the satellite data and analytics domain.

The third driver is the transition from basic AIS messaging to VDES. VDES adds two way VHF data channels that allow richer, more frequent and more secure communication than legacy text messages embedded in AIS slots. This shift is central to the future of the Automatic Identification System Market because it moves the value proposition beyond “tell me where this ship is” into “exchange structured data with this ship about routes, emissions, ice, pilotage and port calls.”

Taken together, these drivers solidify the Automatic Identification System Market as a growth segment where hardware, data services and analytics reinforce each other rather than competing for the same spend.

To Know About the Assumptions Considered for the Study Download the PDF Brochure

Segmentation by Component: Hardware and Data Layers

The Automatic Identification System Market can be split into several component layers.

Shipborne transponders and receivers remain the core hardware foundation. Class A units, with their higher reporting rates and integration with bridge systems, dominate value on SOLAS class vessels. Class B and Class B+ transponders serve smaller commercial craft, fishing vessels and workboats that require visibility but may not be subject to full SOLAS carriage rules. Ancillary antennas, power supplies and UPS modules complete the onboard hardware stack.

Aids-to-Navigation and base station equipment form the coastal infrastructure. Buoy based AIS AtoN units help mark hazards and channel entries, while land based base stations collect and relay AIS messages into national and regional networks. Investments in these systems underpin safe navigation in chokepoints, estuaries and port approaches, reinforcing the Automatic Identification System Market on the infrastructure side.

Terrestrial and satellite AIS data services form the fastest growing component layer. Service providers ingest raw AIS/S-AIS messages, clean and enrich them, and then sell them as feeds or analytics dashboards to ports, fleet operators, insurers and authorities. As more organizations rely on AIS to manage capacity, emissions and risk, the Automatic Identification System Market is seeing a growing share of value shift upstream from hardware into software and services.

Finally, operational software and analytics platforms sit at the top of the stack. These platforms provide vessel tracking, ETA prediction, congestion mapping, fishing effort analysis, environmental surveillance and risk scoring. They are increasingly used to detect spoofing, dark activity and anomalous routing that may indicate safety issues, sanctions evasion or illegal fishing. As this layer matures, it cements the Automatic Identification System Market as an information industry as much as a hardware business.

Segmentation by Class and Link: Class A, Class B, AtoN and S-AIS

Class A systems will remain the primary revenue generator in the Automatic Identification System Market because they are compulsory on most larger commercial vessels under SOLAS and national regulations. These transponders integrate tightly with bridge equipment such as ECDIS, radar and autopilot systems, and they are subject to robust type approval and testing regimes.

Class B and similar lower power devices expand the Automatic Identification System Market into smaller vessels that do not fall under full SOLAS regulations but still benefit from collision avoidance and visibility. Fishery authorities and coastal states increasingly promote or mandate AIS for small fleets to improve safety and traceability.

AtoN and base station systems provide an essential backbone for coastal coverage, especially in congested areas and complex approaches. They are crucial for any country that wants to build reliable Vessel Traffic Services or modern port management centers. Their use of AIS channels to broadcast navigation warnings, weather and local information further strengthens the Automatic Identification System Market.

Satellite AIS fills the gaps far from shore. It ensures that AIS is not limited by the curvature of the Earth or the placement of coastal towers. In many blue water and polar applications, satellite services are the primary enabler of the Automatic Identification System Market, especially for shipping companies, navies and coast guards that need global situational awareness.

VDES will eventually bridge these elements by providing both AIS safety messaging and richer two way data channels. For vendors, it means that the Automatic Identification System Market will increasingly reward solutions that combine transponder hardware with VDES ready modems and software stacks.

Applications Driving Demand in the Automatic Identification System Market

The Automatic Identification System Market supports a broad set of applications across the maritime value chain.

Collision avoidance and voyage safety remain the foundational use case. AIS data allows ships and VTS centers to see each other’s positions, courses and speeds in real time, reducing the risk of close quarters incidents. Integration with radar and ECDIS enhances situational awareness, especially in high traffic lanes.

Compliance and security monitoring are now central to many authorities’ use of the Automatic Identification System Market. AIS provides a baseline of vessel identity and movement that can be cross checked against licensing, customs and security databases. This is critical for detecting spoofed identities, unusual behavior and ships that deliberately switch AIS off to avoid scrutiny.

Port and VTS optimization is another major driver. Ports use AIS feeds to manage berthing windows, anchorage queues and tug and pilot allocation. This reduces congestion, cuts waiting time at anchor and supports just in time arrival strategies. As a result, port authorities and VTS centers are important recurring customers in the Automatic Identification System Market.

Fishing activity tracking and enforcement rely increasingly on AIS. Authorities and NGOs analyze AIS tracks to infer fishing effort, identify incursions into protected zones and distinguish legitimate operations from suspicious behavior. This expands the Automatic Identification System Market into fisheries management and environmental governance.

Environmental surveillance and emissions initiatives use AIS as a reference layer for vessel speed, routing and time in designated zones. AIS data feeds into Carbon Intensity Indicator calculations, slow steaming compliance checks and emissions corridor enforcement. As decarbonization initiatives gain traction, this adds another structural pillar to the Automatic Identification System Market.

End-User Landscape: Shipping, Fishing, Authorities and Ports

Commercial shipping is the largest end user group in the Automatic Identification System Market. Deep sea carriers, bulkers, tankers and cruise lines rely on AIS both to meet regulatory requirements and to manage fleet operations. Their buying behavior tends to be driven by compliance deadlines, fleet renewal cycles and adoption of fleet management analytics.

Fishing and offshore services are a rapidly evolving segment. Many countries are tightening rules around AIS for medium and larger fishing vessels, both for safety and to support sustainable fisheries. Offshore support vessels, survey ships and wind farm service craft also rely heavily on AIS for collision avoidance and operational coordination. This mix expands the breadth of the Automatic Identification System Market.

Coast guards and navies integrate AIS feeds as one layer in multi sensor maritime domain awareness platforms. While they may not depend on AIS for tactical decision making, they rely on it as a necessary contextual layer. Investment in AIS receivers, coastal base stations and analytics tools is therefore a continuing feature of the Automatic Identification System Market.

Ports and VTS authorities stand out as high value, recurring customers. They deploy coastal infrastructure such as base stations and AtoN units, buy fused terrestial and satellite AIS feeds, and license high end analytics platforms to manage traffic, emissions and resilience. Their long term modernization and digitalization programs make them one of the most predictable sources of growth in the Automatic Identification System Market.

Regional Outlook for the Automatic Identification System Market

North America maintains a high share of the Automatic Identification System Market due to stringent carriage enforcement, extensive coastal networks and a large commercial fleet. The US and Canada have invested heavily in AIS infrastructure and domain awareness, creating steady replacement and upgrade cycles for both hardware and software.

Europe shows balanced growth, blending safety, environmental and security use cases. Northern European states rely on AIS for traffic management in busy seas and for emissions initiatives such as Emission Control Areas. Mediterranean and Atlantic ports use AIS to manage congestion and support digital port initiatives. As a result, Europe drives demand for both base station upgrades and sophisticated analytics in the Automatic Identification System Market.

Asia–Pacific is the fastest growing region. Container hub density, from China and South Korea through Singapore and other ASEAN states, requires robust AIS-backed VTS systems. Fishing fleet equipage in countries like China, India, Indonesia and Vietnam is expanding as safety and traceability pressures rise. Coastal coverage build out in South Asia and archipelagic states reinforces base station and AtoN demand. Satellite AIS complements these networks to cover vast trade routes across the Indian and Pacific Oceans, making Asia–Pacific a central growth engine in the Automatic Identification System Market.

Latin America and the Middle East & Africa are still building out AIS infrastructure. Primary gateways, such as Brazilian, Mexican, Gulf and East African ports, invest in base stations, AtoN and VTS centers. Long coastlines and limited terrestrial infrastructure often make satellite services the most efficient route to broad coverage. As these regions modernize ports and strengthen coastal security, they add incremental demand to the Automatic Identification System Market.

Competitive Landscape in the Automatic Identification System Market

The Automatic Identification System Market combines established marine electronics manufacturers, specialist AIS OEMs and satellite data providers.

Saab TransponderTech is one of the best known names in AIS. The company supplies shipborne Class A equipment, coastal base stations and AtoN systems into both civil and defense programs. Saab’s strength lies in delivering end-to-end solutions for VTS centers and maritime authorities that want integrated hardware and software. Its pedigree in safety critical systems and defense electronics positions it as a premium supplier in the Automatic Identification System Market.

KONGSBERG is another key player, offering shipborne AIS, coastal infrastructure and full maritime domain awareness systems. KONGSBERG’s solutions often integrate AIS with radar, sonar and other sensors, allowing coast guards and navies to treat AIS as one layer in a broader system. Its strong position in both the commercial and defense sectors means KONGSBERG is central to large infrastructure and modernization projects in the Automatic Identification System Market.

SRT Marine Technologies is a specialist AIS OEM with a global presence in transponders and AtoN devices. SRT focuses heavily on flexible, scalable AIS solutions for fishing, workboat and coastal authority markets, often working through local partners. The company’s emphasis on modular hardware and software makes it a visible brand in the Automatic Identification System Market, particularly in emerging regions.

Alltek Marine Electronics (AMEC) is another important OEM, supplying AIS transponders and receivers for commercial and leisure markets. AMEC’s portfolio covers Class A, Class B and AtoN products, and its competitive position is built on cost effective, type approved units that appeal to both professional and recreational segments of the Automatic Identification System Market.

Furuno, a long established marine electronics company, integrates AIS into a broader bridge systems portfolio that includes radar, ECDIS and navigation sensors. For many shipowners, Furuno is a trusted “one stop” supplier for bridge equipment, and its AIS offerings benefit from that brand trust and integration capability in the Automatic Identification System Market.

Jotron, ComNav and McMurdo/Orolia each contribute specialized AIS and safety-of-life equipment. Jotron and ComNav supply AIS transponders and receivers that integrate readily into existing navigation suites. McMurdo/Orolia, with its history in beacons and distress equipment, positions AIS devices as part of a safety-and-rescue ecosystem, linking the Automatic Identification System Market to SAR and GMDSS domains.

Garmin, through its acquisition of Vesper, brings AIS into its broader marine portfolio used by both leisure and professional operators. Garmin–Vesper systems are known for user friendly interfaces and integration with chartplotters and sensors, helping to expand the Automatic Identification System Market into sophisticated yet accessible small vessel solutions.

On the satellite side, ORBCOMM and Spire anchor S-AIS constellations. ORBCOMM offers global satellite AIS feeds combined with other IoT and telematics services, making it a key data provider to ports, maritime authorities and fleet managers. Spire, which absorbed exactEarth, operates a large constellation of small satellites and specializes in data-as-a-service, providing AIS and weather datasets to analytics partners. Their role is critical because satellite data is what turns AIS into a genuinely global Automatic Identification System Market.

Early VDES efforts documented by industry alliances show many of these players preparing upgraded equipment and services. As VDES progresses from trials to operational roll out, companies that can offer VDES ready hardware and two way data services will shape the next competitive phase of the Automatic Identification System Market.

Sustainability and The Automatic Identification System Market

The Automatic Identification System Market has a direct link to maritime sustainability. AIS enabled visibility supports fuel and time saving port calls, optimized anchorage usage and adherence to designated routes, all of which reduce unnecessary loitering and emissions. More accurate ETAs derived from AIS and analytics allow ports to stagger arrivals and limit time at anchor, cutting fuel burn and improving local air quality.

Authorities and NGOs use AIS data to monitor sensitive areas, detect illegal fishing, track tankers that deviate into protected zones and assess compliance with Emission Control Areas and speed reduction schemes. Satellite AIS further enables wide area oversight of behaviors that threaten marine ecosystems. As climate policy tightens, AIS data will increasingly feed into regulatory frameworks such as CII and other decarbonization metrics, ensuring that the Automatic Identification System Market is intertwined with environmental governance.

VDES will enhance this sustainability role by enabling targeted, two way messages such as ice charts, weather advisories and dynamic emissions guidance. When ships receive more precise, timely information over VDES, they can avoid hazardous routes, minimize waiting times and further reduce fuel consumption. This reinforces the long term, mission critical status of the Automatic Identification System Market in a decarbonizing maritime sector.

Outlook for the Automatic Identification System Market (2025–2036)

The Automatic Identification System Market is projected to grow from approximately USD 0.365 billion in 2025 to around USD 0.74 billion by 2036, corresponding to a compound annual growth rate of about 6.6 percent. This growth will be underpinned by several long term trends.

Regulatory requirements will continue to ensure a stable baseline for hardware installations and replacements. Satellite AIS will remain essential for global visibility, particularly as polar and high latitude trade routes develop. The shift to VDES will create new revenue streams for two way data services and e-Navigation applications, expanding the Automatic Identification System Market beyond its current collision avoidance focus.

Software and analytics will capture a growing slice of the value chain. Ports, fleet operators and authorities will increasingly pay for insights rather than raw data, and providers that can combine AIS with weather, port and environmental data will differentiate themselves. Emerging regions will deepen coastal coverage and port call optimization, while mature markets will focus on emissions, security and resilience.

Related Report:

Automatic Identification System Market by Class (Class A, Class B, & AIS Base Stations), Platform (Vessel-Based, and Onshore-Based), Application (Fleet Management, Vessels Tracking, Maritime Security, Other Applications), and Geography – Global Forecasts & Analysis 2025–2036