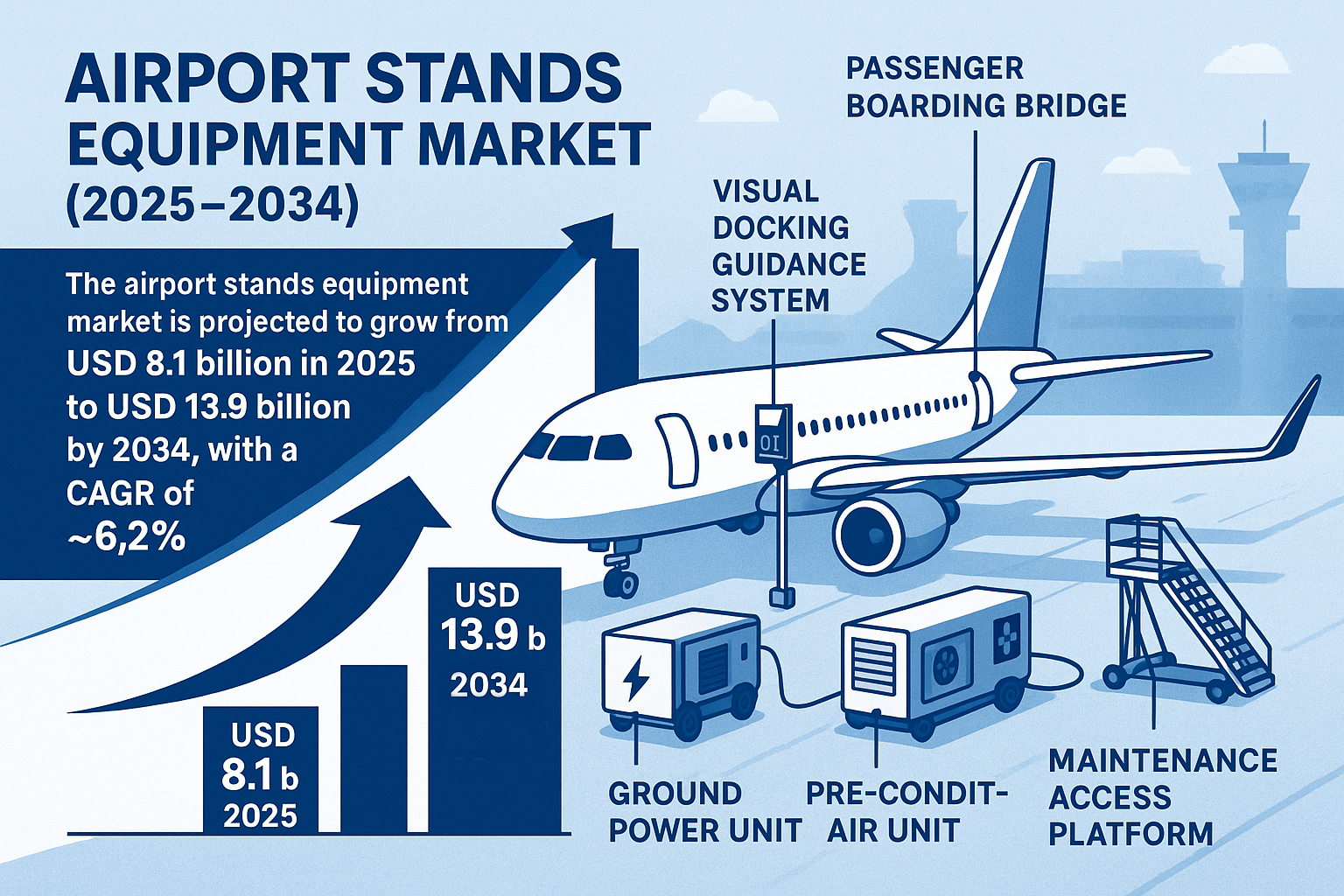

The Airport Stands Equipment Market is entering a decisive decade as passenger volumes rebound, airlines chase faster turns, and airports face mounting pressure to decarbonize apron operations. In 2025, the Airport Stands Equipment Market is valued at around USD 8.1 billion and is projected to reach approximately USD 13.9 billion by 2034. This trajectory implies a CAGR of ~6.2%, underpinned by capacity expansion, smart-stand digitalization, and the global move from diesel to electrified ground-support infrastructure.

Airport stands equipment covers the full suite of systems that service aircraft at parking positions. This includes passenger boarding bridges that connect terminals to aircraft doors, ground power units that keep aircraft powered without burning jet fuel, pre-conditioned air units that cool or heat the cabin during ground time, stand entry and visual docking guidance systems, and maintenance platforms that give safe access to engines and fuselage. Together these assets determine how quickly and safely an aircraft can turn around, how comfortably passengers board and disembark, and how efficiently airports manage their carbon footprint.

As global aircraft movements are expected to exceed pre-pandemic levels by around 2026, the Airport Stands Equipment Market is being reshaped by smart stands, remote docking solutions, IoT monitoring, and new business models such as Equipment-as-a-Service. Airports in both mature and emerging regions are now aligning stand infrastructure with their carbon-neutrality roadmaps and ICAO CORSIA obligations. In this context, the Airport Stands Equipment Market is not just about hardware; it is about digital, sustainable, and operational transformation.

Defining the Airport Stands Equipment Market

To understand the Airport Stands Equipment Market, it is useful to think of the aircraft stand as a miniature ecosystem. When an aircraft arrives at the stand, it needs safe docking, a bridge for passengers, power for onboard systems, conditioned air for cabin comfort, and access platforms for inspection or minor maintenance. Each of these functions is handled by specialized equipment which must be certified, robust, and highly reliable.

Passenger boarding bridges are the most visible elements in the Airport Stands Equipment Market. They allow secure, weather-protected access from terminal to aircraft and are increasingly equipped with advanced control systems and integrated safety sensors. Ground power units supply electrical power, either through fixed 400 Hz systems embedded in the stand or mobile units positioned under the wing. Pre-conditioned air units deliver cooled or heated air to maintain the cabin environment while engines and auxiliary power units remain shut down. Visual docking guidance systems and advanced-VDGS technologies provide precise guidance to pilots, reducing towing time, minimizing risk of collision, and optimizing use of ramp space. Maintenance stands and access platforms complete the picture by giving technicians safe and compliant access to engines, doors, and fuselage sections during quick turns and night stops.

Taken together, these systems form the core of the Airport Stands Equipment Market. They are capital-intensive assets with long service lives, which means that decisions made today will shape apron performance and emissions profiles well into the 2030s.

Market Dynamics: Drivers, Challenges and Opportunities

Several structural forces are propelling the Airport Stands Equipment Market forward.

The first driver is rising air traffic and fleet expansion. As passenger demand recovers and then surpasses pre-pandemic levels, especially in Asia Pacific and the Middle East, airports must add stands or reconfigure existing layouts. Every new contact or remote stand requires a mix of boarding, power, air and guidance systems, and each expansion wave adds volume to the Airport Stands Equipment Market.

The second driver is relentless pressure on operational efficiency. Airlines seek shorter turnaround times to maximize aircraft utilization and maintain on-time performance. This pushes airports to adopt smart docking solutions, automated stand guidance and integrated stand management software that links the stand to the airport operations control center. As a result, the Airport Stands Equipment Market is seeing more demand for connected systems rather than isolated hardware.

The third driver is sustainability. Regulatory bodies, airport operators and investors are putting apron emissions under scrutiny. Replacing diesel ground power units with electric or hybrid alternatives and installing fixed pre-conditioned air units reduces aircraft auxiliary power usage and lowers carbon emissions per turn. Sustainability commitments, including Airport Carbon Accreditation and national green-airport programs, are directly influencing budgets within the Airport Stands Equipment Market.

The fourth driver is technological maturation. IoT sensors, condition monitoring, predictive maintenance algorithms and remote diagnostics are reaching commercial maturity across boarding bridges, GPUs and PCA units. Airports increasingly want assets that can report health data in real time, allowing maintenance teams to intervene before a failure disrupts operations. This trend transforms the Airport Stands Equipment Market into a digital infrastructure play, not just a mechanical one.

Alongside these drivers, the market faces challenges. Heavy infrastructure has long replacement cycles, so airports in constrained financial conditions may defer upgrades. There is also a skills gap for operating and maintaining highly automated, software-rich equipment. Furthermore, stand systems must interoperate with diverse aircraft types and terminal architectures, making standardization slow and complex.

Yet the opportunities are substantial. Integrating stands into centralized airport operations control centers enables holistic decision-making. Semi-autonomous and remote-controlled docking reduces risk and labor demand. Retrofit programs in North America and Europe are unlocking incremental value as older diesel systems are replaced with electric, connected alternatives. Green finance and sustainability-linked loans create additional capital channels for Airports Stands Equipment Market investments that demonstrably cut emissions.

To Know About the Assumptions Considered for the Study Download the PDF Brochure

Segmentation by Equipment Type

The Airport Stands Equipment Market is composed of several core equipment families, each with its own technology path and investment logic.

Passenger boarding bridges remain the flagship category. Fixed and apron-drive bridges are evolving toward lighter structures, smarter controls and better integration with terminal management systems. They now incorporate anti-collision sensors, automation sequences tied to aircraft type, and interface layers to airport digital twins. In the Airport Stands Equipment Market, boarding bridges are often the anchor component that drives associated purchases of power and air systems.

Ground power units are pivoting from diesel to electric. Fixed 400 Hz systems in the stand, mobile battery-powered GPUs and hybrid units are replacing traditional diesel carts. Electric GPUs reduce local emissions and noise, aligning Airport Stands Equipment Market purchases with environmental objectives and, over time, offering lower total cost of ownership thanks to less fuel consumption and fewer mechanical components.

Pre-conditioned air units are similarly moving from diesel-powered mobile units to fixed, grid-connected systems and more efficient refrigerant cycles. Fixed PCA units tied into terminal utility systems help airports cut auxiliary power usage, improving cabin comfort while engines remain off. As airports count emissions per stand, PCA upgrades have become one of the most impactful investments in the Airport Stands Equipment Market.

Stand entry guidance systems, from basic VDGS to advanced radar, lidar or camera-based solutions, support safer and faster docking. They remove the variability of manual marshalling, reduce the risk of nose-gear misalignment and help maximize stand capacity. These smart sensors are the digital vanguard of the Airport Stands Equipment Market, often integrated with A-SMGCS systems and apron safety platforms.

Other supporting systems, such as maintenance stands, engine-access platforms, tow bars and stand lighting, round out the equipment category. While individually smaller in value, they are essential to complete solutions in the Airport Stands Equipment Market and frequently bundled into larger project contracts.

Segmentation by Airport Type

The Airport Stands Equipment Market behaves differently across airport categories.

Commercial airports, particularly large international hubs and regional connectors, account for the majority of the market’s value. These airports manage mixed fleets, including widebodies, single-aisles and regional aircraft. They invest in scalable, standardized stands equipment across multiple terminals and often pursue multi-year modernization programs.

Military airports form a niche but technically demanding segment. Tactical and training bases require robust access platforms, power supplies and sometimes boarding bridges tailored to specific military airframes. Here, reliability and compatibility with military safety protocols are paramount, and decisions influence a specialized slice of the Airport Stands Equipment Market.

Private and business aviation terminals prioritize flexibility, quick repositioning and noise reduction. These facilities may favor compact bridges, quieter ground power and discrete stand guidance systems that match the premium passenger experience. While smaller in volume, this segment drives innovative, space-efficient solutions inside the Airport Stands Equipment Market.

Technology Landscape: Electrified, Connected, Modular

The technology base of the Airport Stands Equipment Market is migrating in three clear directions: electrification, connectivity and modularity.

Electrification is the most visible shift. Electric GPUs, grid-powered PCA units and energy-efficient motors in boarding bridges dramatically cut apron emissions and noise. Airports with aggressive net-zero targets see stand electrification as a quick-win pathway, making it a central theme in the Airport Stands Equipment Market. Solar-assisted and battery-buffered systems are beginning to appear, particularly in regions with high insolation and strong green-financing frameworks.

Connectivity is the second trend. IoT sensors embedded in stand equipment stream data on motor health, voltage levels, refrigerant pressure, bridge position and usage cycles. This telemetry feeds predictive maintenance engines, allowing asset managers to prioritize interventions and reduce unplanned downtime. In the Airport Stands Equipment Market, this connectivity is also used to support Equipment-as-a-Service contracts, where vendors monitor equipment remotely and guarantee performance levels under long-term agreements.

Modularity is the third strategic direction. Airports prefer stand solutions that can be retrofitted to existing foundations and adapted to various aircraft types without major civil works. Modular bridge designs, plug-and-play GPU and PCA units and upgradeable VDGS components help airports manage risk and keep capex in line with traffic cycles. The Airport Stands Equipment Market is responding with systems that can be expanded or enhanced over time, rather than forcing wholesale replacement.

Digital twins and analytics interact with all three trends. By creating a virtual model of stand equipment and integrating live data, airports can simulate traffic flows, energy usage and failure scenarios. This gives the Airport Stands Equipment Market an important software dimension, where simulation and data science are as important as steel and motors.

Regulatory and Sustainability Influences

Regulatory oversight shapes the Airport Stands Equipment Market from multiple angles. Agencies such as the Federal Aviation Administration, the European Union Aviation Safety Agency and ICAO set standards for apron safety, obstacle clearance, equipment reliability and noise levels. National and regional guidelines often specify minimum stand equipment standards for new terminals or expansions.

Sustainability regulations and voluntary programs are particularly influential. Airports participating in Airport Carbon Accreditation or similar schemes must demonstrate concrete reductions in scope-one and scope-two emissions. Stand equipment is a visible target because replacing diesel GPUs and mobile PCA units with grid-connected systems immediately lowers fuel burn and emissions. For this reason, environmental guidelines are increasingly cited in tender documents across the Airport Stands Equipment Market.

Noise regulations also matter. Many airports operate under strict curfew or noise-exposure rules, making quiet electric stand equipment more attractive. As ESG reporting becomes mainstream, investors and regulators will continue to link apron infrastructure choices with broader sustainability disclosures, reinforcing the long-term modernization trend in the Airport Stands Equipment Market.

Regional Outlook for the Airport Stands Equipment Market

North America remains the largest regional market for stand infrastructure. Modernization programs in the United States and Canada, aided by federal infrastructure funding and airside electrification initiatives, are pushing airports to replace aging diesel equipment with smart, electric alternatives. Major hubs such as Atlanta, Dallas/Fort Worth, Chicago and Toronto are investing in connected stands with integrated visual docking guidance and centralized monitoring. This keeps North America a core region within the Airport Stands Equipment Market and a bellwether for retrofit-driven growth.

Europe continues to lead in sustainability and regulatory compliance. Airports such as Amsterdam Schiphol, Frankfurt, Munich, Paris Charles de Gaulle and Heathrow are implementing carbon-neutral stand operations under various EU and national programs. European airports are often early adopters of fully electric GPUs, automated docking guidance and advanced apron safety software. Their ambitious decarbonization targets make Europe an influential trendsetter within the Airport Stands Equipment Market.

Asia Pacific is the fastest-growing region by a clear margin. Capacity expansions in India, China, Indonesia, Thailand and South Korea, along with new greenfield projects such as Noida, Beijing Daxing and the next terminal at Changi, are generating substantial new-build demand. Governments and private operators in the region are specifying energy-efficient boarding bridges, IoT-enabled GPUs and PCA units, and integrated apron control systems right from the design phase. As a result, Asia Pacific is set to capture the highest incremental revenue share in the Airport Stands Equipment Market through 2034.

The Middle East is investing heavily in next-generation hub infrastructure. Airports in Dubai, Abu Dhabi, Doha and Riyadh are adding stands designed for ultra-long-haul operations and high peak-hour densities. Smart-stand automation, remote docking, high-performance VDGS and advanced power and air systems are integral to these mega-hub projects. Africa, led by countries such as Kenya, Morocco, Egypt and South Africa, is progressing through more gradual modernization backed by development finance and PPP models. Together these regions add an important emerging-market dimension to the Airport Stands Equipment Market.

Latin America is advancing at a steadier pace but is clearly on an upward trajectory. Concession-based airport models in Brazil, Mexico, Chile and Colombia are enabling private investment in stand infrastructure. Airports are beginning to adopt electric GPUs, modern boarding bridges and solar-assisted PCA solutions where grid electricity prices and climate conditions make the business case attractive. Retrofitting older terminals with modular systems is a key theme in this part of the Airport Stands Equipment Market.

Competitive Landscape and Key Players

The Airport Stands Equipment Market brings together global OEMs, regional integrators and niche specialists. Competition is increasingly focused on energy efficiency, digital readiness, lifecycle cost and the ability to support long-term service agreements rather than just initial procurement.

ADELTE Group is a prominent supplier of passenger boarding bridges and related stand equipment. With a strong track record in designing and installing PBBs for both cruise terminals and airports, ADELTE brings engineering depth and project-management expertise to complex stand integration projects. In the Airport Stands Equipment Market, ADELTE differentiates itself through customized solutions tailored to terminal architecture, passenger flows and aircraft mix, often bundling bridges with control software and maintenance packages.

Cavotec SA is a key player in the ground power and pre-conditioned air segment. Cavotec offers in-ground utility pits, PCA systems and 400 Hz power solutions that help airports reduce apron emissions and APU usage. The company focuses on integrated, pit-based systems that streamline ramp layouts and minimize hose and cable clutter. Cavotec’s contribution to the Airport Stands Equipment Market lies in its ability to engineer energy-efficient, low-maintenance utility infrastructure that supports long-term decarbonization goals.

JBT Corporation has a broad portfolio of airport services technology, including passenger boarding bridges, ground power units, PCA systems and standalone stands equipment. JBT emphasizes robust engineering, lifecycle support and integration with airport operations software. In the Airport Stands Equipment Market, JBT often acts as a full-scope vendor, integrating multiple equipment types into standardized stand packages supported by global service networks.

ThyssenKrupp Airport Systems is well known for its passenger boarding bridges and related control systems. The company has supplied bridges to many of the world’s busiest airports and continues to innovate in terms of bridge automation, safety interlocks and energy efficiency. In the context of the Airport Stands Equipment Market, ThyssenKrupp’s strength is its ability to deliver large-scale bridge programs with consistent quality and reliable after-sales support.

TLD Group specializes in ground support equipment and provides a wide range of GPUs, PCA units, tow tractors and other ramp systems. TLD’s electric and hybrid products are particularly relevant as airports focus on apron decarbonization. The company’s emphasis on modular, easy-to-service units positions it as a significant contributor to both new-build and retrofit projects in the Airport Stands Equipment Market.

AERO Specialties is a recognized supplier of specialized ground support equipment, including maintenance stands, towbars and belt loaders. While its product scope is broader than stand-specific equipment, AERO Specialties plays an important role in rounding out the functional ecosystem at the stand. Its focus on high-quality, user-friendly GSE supports operational efficiency at smaller terminals and business aviation facilities, adding to the diversity within the Airport Stands Equipment Market.

Textron Ground Support Equipment, through brands such as TUG and other GSE product lines, provides tow tractors, baggage tugs and some power solutions that interact closely with stand operations. Textron GSE’s presence across many airports worldwide gives it valuable insight into apron workflows. In the Airport Stands Equipment Market, this experience translates into equipment designs that integrate smoothly into stand processes and support safer, more efficient aircraft turns.

Across all these players, a common theme is the shift from one-time equipment sales to long-term service partnerships. Many vendors now offer long-term service agreements that bundle installation, preventive maintenance, remote monitoring and performance guarantees. This shift aligns vendor incentives with airport outcomes and gradually transforms the Airport Stands Equipment Market into a lifecycle- and service-centric ecosystem.

Sustainability and Lifecycle Perspective

From a sustainability perspective, the Airport Stands Equipment Market sits at the front line of aviation decarbonization. Replacing diesel GPUs with electric or hybrid units, installing fixed PCA systems and optimizing stand operations can substantially reduce CO₂ emissions per turnaround. Lightweight boarding-bridge designs using recycled materials, energy-efficient motors and regenerative drives further reduce total lifecycle impact.

IoT-enabled predictive maintenance extends the service life of bridges, GPUs and PCA units, cutting down on premature replacements and spare-part waste. Remote diagnostics reduce technician travel and minimize unplanned downtime, which also has an indirect environmental benefit. Airports are increasingly benchmarking carbon footprint per stand and linking investment decisions in the Airport Stands Equipment Market to measurable improvements in ESG metrics.

As investors and regulators scrutinize climate risks and resilience, stand equipment decisions become strategic. Airports that choose future-proof, electrified and digitally enabled stand systems will be better placed to meet tightening environmental targets and to report credibly on their progress.

Market Outlook and Strategic Takeaways

Looking ahead to 2034, the Airport Stands Equipment Market is projected to grow from USD 8.1 billion to roughly USD 13.9 billion, at a CAGR near 6.2 percent. The fastest-growing region will be Asia Pacific, but modernization programs in North America, Europe and the Middle East will provide robust demand for retrofits and expansions.

The core trends that will define the Airport Stands Equipment Market are clear. Electrification will continue to displace diesel as airports commit to long-term decarbonization. Automation and smart docking will become the norm at busy hubs, supported by integrated stand management software and digital twins. Lifecycle-as-a-Service and Equipment-as-a-Service models will spread, especially where capital budgets are constrained but operational performance targets are ambitious.

Airports, airlines and investors evaluating the Airport Stands Equipment Market should prioritize three capabilities in potential partners. The first is sustainability readiness, evidenced by electric and hybrid product portfolios, energy-efficient designs and clear emission-reduction case studies. The second is digital integration capability, including IoT monitoring, predictive maintenance and seamless connection to AOCC and A-SMGCS platforms. The third is modular retrofit expertise, which allows airports to modernize in phases, protecting operations and capital budgets.

Stakeholders that align these three elements will not only benefit from the growth of the Airport Stands Equipment Market but will also help shape a smarter, cleaner and more resilient apron ecosystem for the decade ahead.

Related Report:

Airport Stands Equipment Market by Equipment Type: Air Bridges (Steel, Glass), Preconditioned Air Unit (Fixed, Movable), Electrical Ground Power Unit (Fixed, Movable), Stand Entry Guidance System (VDGS, AVDGS), by Geography – Global Forecasts to 2025-2034