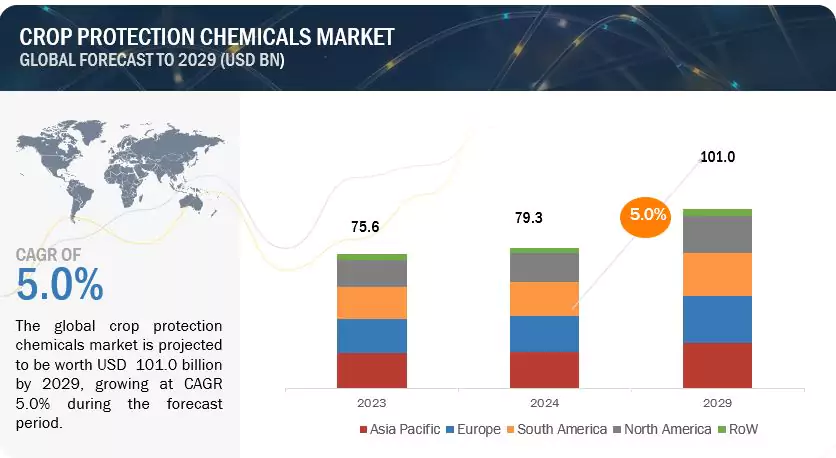

The global crop protection chemicals market continues to strengthen as agriculture faces mounting challenges. Valued at USD 79.3 billion in 2024, the market is projected to reach USD 101.0 billion by 2029, growing at a CAGR of 5.0% during the forecast period.

With rising pest pressures, climate change, and increasing demand for food security, crop protection solutions have never been more crucial to global agriculture.

Why Crop Protection Chemicals Matter More Than Ever

According to the Centre for Agriculture and Bioscience International (CABI), nearly 40% of global crop yields are lost annually to pests, pathogens, and weeds. The rapid spread of destructive pests such as the Fall Armyworm (FAW)—fueled further by climate change—poses serious threats to staple crops like maize, wheat, banana, and coffee.

These losses hurt not only farmers’ incomes but also national economies and the global food system. As a result, demand for effective crop protection solutions is on the rise. Farmers are increasingly adopting advanced chemical and biological formulations to safeguard yields, strengthen resilience, and ensure sustainable production.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Biopesticides: Fastest-Growing Segment by Origin

Among the product categories, biopesticides are expected to register the highest CAGR during the forecast period.

Why Biopesticides Are Rising Quickly

- Growing pest resistance due to chemical pesticide overuse has reduced effectiveness, pushing farmers toward biological alternatives with unique modes of action.

- Biopesticides play a key role in integrated pest management (IPM), helping reduce chemical load and slowing resistance development.

- Increasing consumer awareness of the environmental and health impacts of agrochemicals is driving demand for organic and sustainably produced food.

- Global regulatory bodies—from the EU to the US and India—are creating favorable policies that support sustainable farming and encourage biopesticide adoption.

This blend of regulation, consumer preference, and on-the-ground pest challenges is accelerating the shift toward biological crop protection.

Cereals & Grains: Fastest-Growing Crop Segment

The cereals & grains category is set to grow at the highest CAGR, driven by:

- High vulnerability to pests and diseases such as wheat rust, rice blast, and corn borers, which can cause significant yield losses.

- Government initiatives across India, China, and other regions are being implemented to strengthen food security through better pest management.

- Large-scale cultivation across North America, Europe, and the Asia-Pacific necessitates extensive use of crop protection products.

- Increased usage of fungicides, herbicides, and insecticides in crops such as corn and rice, which depend heavily on chemical treatments to prevent disease outbreaks and pest infestations.

Herbicides: Dominating by Type

Herbicides remain the dominant chemical category due to their essential role in weed management. Weeds compete for nutrients, water, and sunlight and can dramatically reduce crop productivity.

Key Factors Driving Herbicide Dominance

- Widely used herbicides like glyphosate and atrazine continue to see significant global demand.

- Herbicide-resistant crops—such as Roundup Ready soybeans—have enabled farmers to apply herbicides more effectively without damaging crops.

- Countries such as the US, Brazil, and Argentina, where large-scale commercial farming is prevalent, rely heavily on herbicide-based programs to maintain high yields.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=380

South America: A Region of Consistent Growth

South America remains one of the most dynamic markets for crop protection chemicals.

Growth Drivers in the Region

- Vast agricultural land in Brazil, Argentina, and Colombia is dedicated to crops like soybeans, corn, coffee, and sugarcane.

- Favorable tropical and subtropical climates that support high pest and disease pressure, including threats like soybean rust and FAW.

- Strong integration into global export markets requires robust pest management to meet international quality standards.

The combination of large-scale agriculture, climatic challenges, and rising export demand ensures consistent growth for crop protection solutions across South America.

Key Players Shaping the Global Market

Leading companies in the crop protection chemicals industry include:

- BASF SE (Germany)

- Bayer AG (Germany)

- FMC Corporation (US)

- Syngenta Group (Switzerland)

- Corteva (US)

- UPL (India)

- Nufarm (Australia)

- Sumitomo Chemical Co., Ltd (Japan)

- Albaugh LLC (US)

- Koppert (Netherlands)

- Gowan Company (US)

- American Vanguard Corporation (US)

- Kumiai Chemical Industry Co., Ltd (Japan)

- PI Industries (India)

- Chr. Hansen A/S (Denmark)

These companies continue to innovate with next-generation formulas, integrated pest management tools, and sustainable solutions that address emerging global threats.