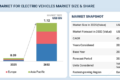

The electric 3 wheeler market is projected to grow from USD 2.68 billion in 2025 to USD 3.85 billion by 2032, registering a CAGR of 5.3%.

The electric 3 wheeler market is accelerating rapidly because operators are chasing dramatically lower operating costs per kilometer. In India, commercial 3-wheelers running on electricity now cost around INR 1.28 per kilometer, versus about INR 3.21 per kilometer for petrol models, making the cost savings clear. This economic advantage, combined with increased fuel prices and high utilization of fleet vehicles, is prompting vehicle owners to shift to electric models when government subsidies and financing support make the upfront cost more affordable. For instance, the central scheme PM E-DRIVE offers demand incentives on electric 3-wheelers, making their acquisition more viable. Furthermore, the domestic supply base is expanding; a wide range of electric 3-wheeler models, from low-cost domestic makers to more standard platforms from established manufacturers, is now available, making fleet conversion more feasible across both passenger and cargo segments. There is also a shift from lead-acid batteries to lithium-ion batteries due to their longer battery life, higher reliability, and faster charging, which together enable a greater range, reduced downtime, and higher operational efficiency for commercial users.

The mid motors segment is expected to be prevalent during the forecast period.

The mid motors segment is expected to lead the electric 3 wheeler market during the forecast period, with a market share of over 93%. Mid motors, situated centrally within the vehicle chassis, optimize weight distribution and enhance handling dynamics, and are the default motor options in electric 3-wheelers. Their mechanical linkage enables precise torque delivery and wheel traction control, thereby enhancing stability and maneuverability, particularly in challenging terrains. The flexibility of mid motors to accommodate modular battery configurations enables scalability and customization according to operational needs and regulatory requirements, further fueling their adoption in the electric mobility market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=59408226

The 5–8 kWh segment is expected to hold the highest share during the forecast period.

The 5–8 kWh segment is expected to lead the electric 3 wheeler market during the forecast period. There is a growing demand for vehicles with higher battery capacity that can travel longer distances without depleting the battery’s energy. Passenger carrier models, such as Piaggio Ape E City FX, Omega Seiki Stream, Bajaj RE TEC, and Lohia Auto Comfort E Auto, come with this range. Similarly, load carrier models such as AtulAuto Elite Cargo XL, Citylife Loader, Dilli Electric E Loader, and Lohia Auto Humsafar IB Loader fall within this range. Manufacturers are focusing on launching models with high battery capacity to address the drawbacks of electric 3-wheelers. For instance, the Mahindra Treo Zor electric 3-wheeler features a 6.0 kWh battery, providing a range of ~80–90 km per charge. This capacity is sufficient for typical urban routes while keeping the vehicle affordable for fleet operators.

Asia Pacific is expected to be the leading market for electric 3-wheelers during the forecast period.

Asia Pacific is expected to be the largest market for electric 3-wheelers during the forecast period. The region has established markets such as China and India. Notably, India holds the largest share in the electric 3-wheeler segment, driven by the rapid expansion of last-mile delivery and shared mobility services, which are increasingly adopting electric 3-wheelers to cut operating costs. These vehicles are well-suited for India’s congested urban areas due to their compact design and low running cost. Major logistics and e-commerce companies are leading this adoption as part of their fleet electrification goals. Meanwhile, Sri Lanka is expected to be the fastest-growing country in Asia Pacific. There is an increasing demand for green technology vehicles in the country. SL Mobility and Ideal Motors are the prominent manufacturers of electric 3-wheelers in the country. Due to the growth in sales of overall alternative fuel vehicles, the Sri Lankan electric 3 wheeler market is expected to grow. Similarly, the Thai government is rolling out policies to promote EVs as part of its plans to create an EV manufacturing hub. The country is committed to improving air quality, developing smart cities, and achieving carbon neutrality by 2050, as well as net-zero greenhouse gas emissions by 2065.

Key Players

The major players in the electric 3 wheeler market include Mahindra & Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Bajaj Auto Ltd. (India), among others. Mahindra & Mahindra is working on higher profitability through best-in-class load carriers. YC Electric and Seara Electric Auto Pvt. Ltd. are working on affordable e-rickshaws, aiming to diversify their product portfolios. Bajaj Auto Ltd. and Piaggio Group are focusing more on high-end passenger carriers. These companies are collaborating with regional auto component suppliers to enhance localization and lower costs.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=59408226