The global carbon credit trading platform market is expected to reach USD 317 million by 2027 from an estimated USD 106 million in 2022, at a CAGR of 24.4% from 2022 to 2027. The global carbon credit trading platform market is expected to witness significant growth during the forecast period due to the surge in demand for carbon credits resulting from the increased investments in the carbon capture technologies as well as renewable energy adoption.

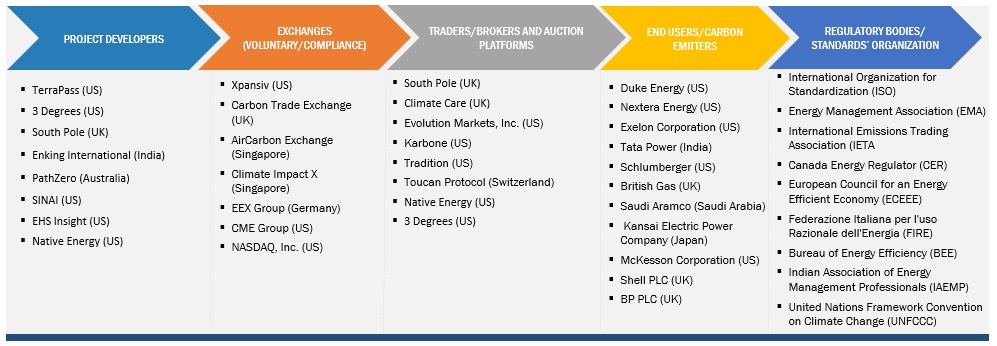

The carbon markets are differentiated into two segments as voluntary carbon markets and regulatory/ compliance carbon markets. There is a difference between these in terms of regulations, impact and the share in the market, among other factors. The funding into projects for reduction of carbon emissions is helping to drive the market for voluntary carbon market. A few major players have a wide regional presence and dominate the switchgear market. The leading players in the carbon credit trading platform market include Nasdaq, Inc. (US), EEX Group (Germany), AirCarbon Exchange (ACX) (Singapore), Intercontinental Exchange, Inc. (US) and Xpansiv (US).

This research report categorizes the carbon credit trading platform market based on type, system type, end-use, and region.

Based on type:

- Voluntary Carbon Market

- Regulated Carbon Market

Based on system type:

- Cap and Trade

- Baseline and Credit

Based on end use:

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

Based on the region:

- North America

- Asia Pacific

- Europe

- Rest of the World

Europe likely to emerge as the largest Carbon Credit Trading Platform Market

Europe accounted for the largest share in the global Carbon Credit Trading Platform Market during the forecast period. European countries have been operating a cap and trade program since 2005. EU ETS is the largest Emission Trading Scheme (ETS) globally. Germany successfully launched its national Emissions Trading System (ETS) in 2021. It covers upstream fuel from the transport and building sectors and complements the EU Emissions Trading System (ETS). In 2021, regulated entities opened registry compliance accounts, started monitoring their emissions, and bought the first allowances from the exchange or authorized intermediaries. Multiple Emissions Trading Systems (ETS) are in force in Germany, where some emissions are covered by the EU ETS and others by the German National ETS. As part of its commitment to implementing a coherent international policy, France has developed effective tools to incorporate its climate ambitions into its development strategy.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=93146916

Recent Developments

- In July 2022, Aircarbon exchange (ACX), signed a collaboration agreement with the Nairobi international financial center (NIFC) and the Nairobi Securities Exchange (NSE) to develop a Kenya carbon exchange during the official launch of the Nairobi international financial center (NIFC). The partnership will establish a carbon ecosystem in Kenya connected to ACX’s international client order book, allowing buyers and sellers, international and domestic, to transact efficiently and transparently.

- In March 2022, CarbonX, a carbon asset developer, has signed a memorandum of understanding (MOU) with the AirCarbon exchange (ACX) to develop a carbon marketplace in Indonesia jointly. The partnership will provide Indonesian carbon project developers with a domestic carbon market linked to ACX’s international client order book. Also, the carbon marketplace will allow the growing Indonesian carbon market to rapidly scale up.

- In September 2021, CTX & IBAC –Partnership to support Business Aviation Voluntary Commitments on Climate Change. The International Business Aviation Council (IBAC) represents over 18,000 operators worldwide on Aviation emissions reductions.