De-oiled lecithin is a dry form of lecithin and has multi-functional properties across various industries, food, feed, pharma and personal care. The increasing prevalence of health concerns has affected industries far beyond healthcare. The food & beverage industry plays a key role in the dietary aspect of a healthy lifestyle. Functional and natural ingredients have been witnessing an increase in demand, as a result of this trend. Also, it is this same trend that has provided the industry with the innovation of various forms of de-oiled lecithin.

De-oiled lecithin is enriched in phospholipids for enhanced dispersion in water. Acetone is widely used for the de-oiling of lecithin, as it extracts about 40% of the inactive vegetable oil from the crude lecithin. In the processing method, acetone is added to the crude lecithin, and de-oiled lecithin is obtained after the evaporation of the added acetone leading to increase in the phospholipid content by about 40% after the de-oiling process.

De-oiled lecithin is available in the form of granules or powders. Dry lecithin has advantages such as convenient handling and a neutral flavor and color. It is an essentially ready nutraceutical, offering nutritional benefits to consumers. It is used in dietary foods such as tablets & capsules; in bakery products; and convenience foods such as instant soups and sauces; this highlights the multifunctionality of de-oiled lecithin.

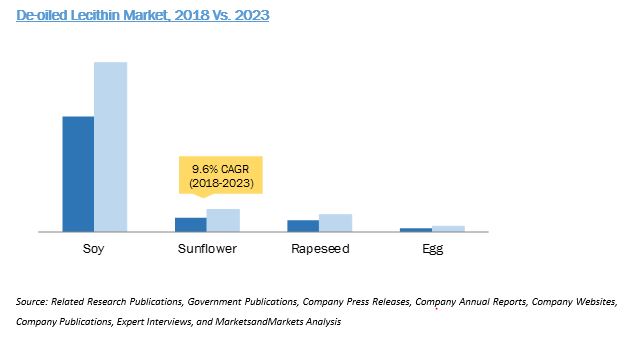

This ingredient is mainly derived from soy, sunflower, rapeseed, and eggs. Although de-oiled lecithin is mainly extracted from soybean oil by the addition of water and centrifugation, it has been witnessing a decline in demand, owing to concerns related to allergens and GMO foods. According to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), in 2016, soybean was the largest genetically modified crop at a global level. This has augmented the demand for alternate sources such as sunflower and rapeseed. However, the supply of sunflower lecithin is not sufficient to fulfill the required demand.

Download PDF brochure @ https://www.marketsandmarkets.com/pdfdownload.asp?id=89222733

Countries such as Ukraine, Russia, and Argentina are expected to present opportunities for domestic manufacturers. As per U.S.-UKRAINE BUSINESS COUNCIL (USUBC), Ukraine, Russia, and Argentina are the leading producers of sunflower oil. Genetic modification found in the soy crop has become a prime concern for manufacturers in the EU. Countries such as the US and Brazil are the leading producers of GM soybean. European as well as Asian countries majorly rely on the import of de-oiled lecithin from these leading producers. However, the growing demand for non-GMO de-oiled lecithin among customers in Europe along with stringent regulations towards the usage of non-GMO ingredients is expected to create opportunities for various oil processors and de-oiled lecithin manufacturers.

This industry is gaining momentum globally, due to increasing demand for green or natural cosmetic products that contain medicinal and nutritional ingredients such as vitamins, are gaining popularity in several Asian countries. In developed countries such as the US and Canada, calorie concerns and trends involving weight loss are expected to drive the demand for de-oiled lecithin in the dietary supplements space. Similarly, in Europe, the growing popularity of Asian personal care products is expected to drive the de-oiled lecithin market for cosmetics applications.

According to a recent study by MarketsandMarkets, the global de-oiled lecithin market is projected to grow at a CAGR of 8.2%, during the forecast period (2018–2023), to reach USD 232.1 million by 2023 from USD 156.5 million in 2018.

Leading driving force of the de-oiled lecithin market: Growth in demand for natural food additives and increasingly label-conscious consumers

Increase in consumer awareness about the ill-effects of the consumption of chemical ingredients and presence of natural or organic ingredients as alternatives in the market are driving the demand for natural food ingredients. “Additive-free” and “natural” labels have become part of consumers’ checklist while buying food & beverage products. Ingredient labeling has become mandatory in developed economies such as the US and EU countries, due to increase in consumer awareness. Consumers look for natural ingredients, along with acceptable (if not appealing) taste and fewer calories. Though artificial or non-organic ingredients have found approval among consumers and have gained a significant market presence, there is a need to replace these artificial ingredients with natural alternatives such as de-oiled lecithin. The demand for natural and nutritious ingredients is increasing, owing to which manufacturers are launching various products with natural ingredients that can provide an advantage to drive the consumption. As de-oiled lecithin, a type of food emulsifier, is of a natural origin, it is poised to witness an increase in adoption by the industry, thereby driving its market growth.

Request Sample of the report @ https://www.marketsandmarkets.com/requestsample.asp?id=89222733

Furthermore, the demand for non-GMO food ingredients has mounted due to the increasing instances of allergen in GMO food. Also, several countries have banned the manufacturing of GMO food. For instance, European countries, along with Japan and Korea, have completely stopped manufacturing GMO food, therefore providing huge opportunities for de-oiled lecithin manufacturers to fulfill this demand.

Another interesting factor driving this market is the consumer buying behavior; for food and grocery products, the buying behavior has always been influenced by several economic, cultural, psychological, and lifestyle factors. They want detailed, precise, and reliable information regarding the foods they consume. Food labeling is a medium through which consumers can acquire knowledge about the food they consider buying. However, to be useful, the information must deal with those aspects that are of greatest concern to the consumers, and it should be formulated in such a way that they can understand and use it. As mentioned before, consumers are showing greater interest in “natural” and “green” labels. De-oiled lecithin manufacturers are focusing on the quality and safety of the products, which are mandated by several governments to be clinically tested and approved to be utilized to produce end-use products.

Cargill (US), a leading manufacturer of de-oiled lecithin, recently launched a new range of rapeseed de-oiled lecithin products in response to growing consumer demand for label-friendly ingredients. This introduction completed its portfolio of GMO and non-GMO lecithin products in Europe for bakery and snacks manufacturers. With this introduction, Cargill’s European customers will benefit from a full (GMO and non-GMO) lecithin product portfolio ranging from soy and sunflower to de-oiled rapeseed solutions.

Leading companies in the de-oiled lecithin industry

The major players in the de-oiled lecithin market are as follows:

- Cargill (US)

- ADM (US)

- DowDuPont (US)

- Bunge (US)

- Stern-Wywiol Gruppe (Germany)

To achieve growth, retain their market share, and meet the global demand in the de-oiled lecithin market, major key players focused on strategies such as agreements, acquisitions, new product launches, and expansions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst