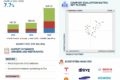

The global electric bus market is estimated to grow from USD 17.0 billion in 2024 to USD 37.5 billion by 2030 with a CAGR of 14.2% over the forecast period.

The growth of the electric bus market is driven by countries prioritizing the electrification of their public transportation fleets through subsidies and favorable regulations, prompted by emission concerns. Governments of the UK, Hungary, Japan, China, India, the US, and other countries, are planning to replace their existing gas engine-based transport buses and coaches, including intercity and intracity transport solutions, with battery-powered ones. The European Commission and private companies are pushing for initiatives to transition corporate fleets to ZEVs by 2030. Asia Pacific is expected to be the largest market during the forecast period. Governments of several Asia Pacific countries are offering incentives for the promotion of electric buses.

Electric buses will find traction across major regions, driven by emission regulations, battery price drops, the emergence of low-emission zones, purchase subsidies, and tax exemptions. Also, significant investments and funding initiatives are supporting the deployment of EV charging infrastructure globally. For instance, the European Union, comprising 27 nations, intends to allocate approximately USD 10.08 billion for initiatives throughout Latin America and the Caribbean which drives the electric bus market in this region.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38730372

DRIVER: Growing demand for zero-emission vehicles

The transportation industry is currently the quickest growing contributor to greenhouse gas emissions, expected to surpass 30%. One of the leading causes of future GHG emissions, and a significant source of air pollution. With the worldwide collection of vehicles anticipated to increase by 100% by 2050, particularly in low and middle-income nations, thorough actions are necessary. The UNEP (United Nations Environment Program) and other international organizations have developed a global program to support this shift. Governments worldwide are adopting electric buses to make urban transport systems more sustainable and fuel-efficient. Initiatives by the government further promote the adoption of electric buses. The transition is being driven by initiatives such as the Electric Transport Green Deal in the Netherlands and the funding for zero emission projects from the US Federal Transit Administration. The goal of the ZEBRA (Zero Emission Bus Rapid-deployment Accelerator) project is to transition new bus purchases in major Latin American cities to low-emission technologies. Metropolitan areas such as Santiago de Chile and Medellin are leading this shift towards emission free public transportation, with Santiago striving to possess the world’s second largest electric bus fleet. European Commission is imposing strict CO2 emission goals for new heavy-duty vehicles from 2030 onwards. Newly manufactured urban buses are required to have zero emissions, while emissions from heavy-duty commercial vehicles must be decreased by 45% by 2030, 65% by 2035, and 90% by 2040. In Africa, Asia, Latin America, and the Caribbean, UNEP helps cities develop plans and test projects for eco-friendly public transportation, like electric buses, through its clean bus fleet initiative. These actions aims to change public transportation for better air quality, decrease in noise, and improve fuel efficiency on a global scale. The electric buses market will be driven by all these advancements and projects undertaken by government bodies in various locations.

OPPORTUNITY:Transition towards hydrogen fuel cell electric mobility

The fuel-cell electric technology offers major opportunities for the electric bus industry. Many regions worldwide are establishing lofty objectives to incorporate fuel-cell electric buses into their public transportation fleets. According to the assessment carried out by SunLine Transit Agency (US), hydrogen fuel cell electric buses have the capability to provide better fuel efficiency than CNG buses, even though their initial fuel and maintenance costs are higher. Due to its better fuel efficiency and 300–400 mile range on a single tank, FCEVs are widely used in transportation industry. There are potential opportunities for companies operating in this market. For instance, in 2021 Toyota integrated the necessary fuel cell components to create a small fuel cell system module. Many players and public entities are directing funds towards the advancement of fuel cell buses. For instance, Intercity Transit in US is intended to invest USD 89.6 million for operational costs and USD 65.3 million for capital investments in 2024.

North America region holds the largest share of the Electric Bus Market.

North America is estimated to be the fastest-growing market during the forecast period. In North America, government incentives, the presence of individual investors, and technological edge are driving the electric bus market. The US has been leading the market in this region. The market is expanding due to government incentives, tax breaks, and private investments. The Federal Transit Administration set aside USD 1.7 billion in 2023 for buses, with an emphasis on zero-emission vehicles, even though European acceptance lags lag. This shift is further supported by the USD 5.6 billion set up in the Bipartisan Infrastructure Law for cleaner buses. make at least one-third of its 70,000 public transit buses electric by 2045. Government incentives and public-private partnership (PPP) schemes and policies like Toronto’s plan to convert 50% of its fleet to electric by 2050 show the region’s commitment to sustainable transport solutions. For instance, in Canada, public-private partnership initiatives and government incentives are being used to introduce electric buses in the market. Canada is rapidly implementing electric buses, with tax breaks and provincial subsidies making the purchase easier. Growth is driven by public-private partnerships and government incentives with the goal of incorporating electric buses into public fleets. Moreover, manufacturers with advance technology that dominate the industry includes NFI Group and Blue Bird Corporation. Due to environmental concerns, public transit has been more popular over time, and this has improved infrastructure, which has contributed to fostering the market’s rapid growth in this area.

The report profiles key players such as BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden) and CAF (Solaris Bus & Coach sp. z o.o.) (Spain). These companies adopted new product development, and supply contract strategies to gain traction in the terminal tractor market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=38730372