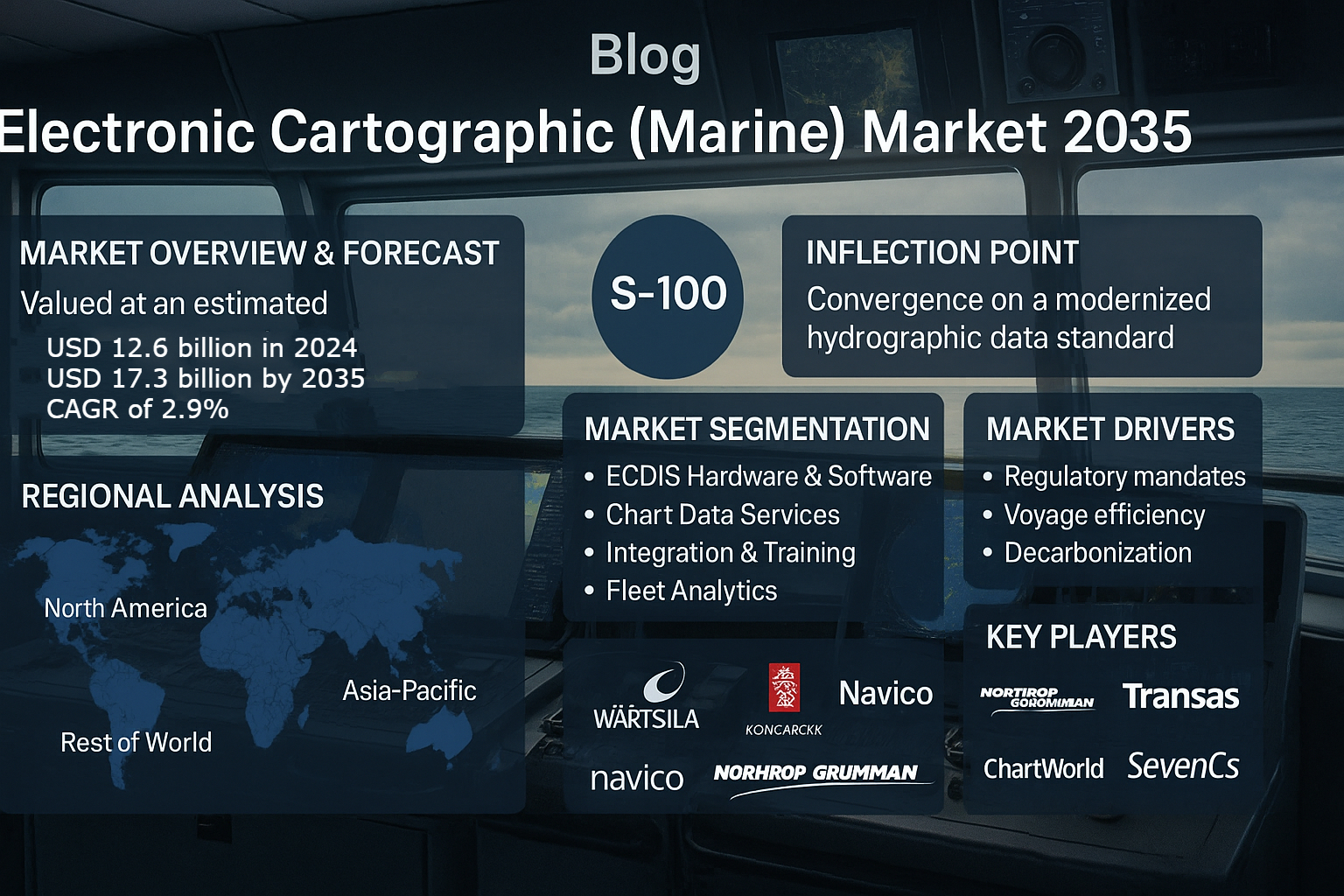

The Electronic Cartographic (Marine) Market is undergoing a prolonged modernization wave as the world’s commercial and defense fleets migrate to next generation chart standards and integrated bridge systems. Valued at an estimated USD 12.6 billion in 2024 and projected to reach USD 17.3 billion by 2035 at a CAGR of approximately 2.9%, the market’s evolution reflects a shift from first time ECDIS fitment to software led modernization, enterprise chart management, and advanced analytics. The convergence of S-100 standardization by the International Hydrographic Organization, mandates around ECDIS carriage, and expanding hydrographic data infrastructures is transforming how navigational data is consumed, updated, and secured. As fleets pursue regulatory compliance, voyage efficiency, and decarbonization goals, demand for Electronic Navigational Charts, S-100 bathymetry products, and interoperable fleet management platforms will define commercial opportunity over the next decade. Adjacent maritime security markets, including the Drone Detection Market, increasingly intersect with cartographic systems as ports and offshore facilities integrate situational awareness layers for safety and resilience.

Market Overview and Forecast

Electronic charting is now fundamental to modern navigation, replacing paper charts and enabling integrated voyage planning, route optimization, and safety alerts. The market grew steadily through the early 2020s as SOLAS Regulation V/19 solidified ECDIS carriage requirements for commercial vessels and as flag administrations and classification societies harmonized implementation timelines. Today the market is characterized by recurring subscription revenue from ENC services, software upgrades for ECDIS units, and an expanding portfolio of value added analytics and fleet management tools. Forecasts indicate that global market value will climb from USD 12.6 billion in 2024 to USD 17.3 billion by 2035. This growth will be driven most strongly by software and data services while hardware growth slows as ECDIS installations mature. Implementation of S-100 data models and related products like S-102 bathymetry and S-104 water levels will create multi year upgrade cycles and new monetizable datasets, supporting steady market expansion.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=227404996

Why S-100 is the Inflection Point

S-100 represents a fundamental rearchitecture of hydrographic data models. It replaces older monolithic standards with a universal, extensible framework that enables richer layers, greater interoperability, and support for new data types such as bathymetric grids, water levels, tides, and metocean products. The S-100 ecosystem unlocks use cases that extend beyond traditional chart display into voyage optimization, digital twins, and autonomous navigation. Shipowners and system integrators view S-100 readiness as a strategic imperative because S-100 capable ECDIS and data services will be the foundation of integrated bridge systems and advanced shore to ship operational platforms. The transition to S-100 will create a replacement and upgrade cycle lasting several years, as legacy ECDIS units are supplanted by type approved, S-100 ready systems and as hydrographic offices migrate datasets to new formats.

Market Segmentation by Solution and Revenue Model

Electronic cartographic solutions now span certified ECDIS hardware and software, ENC production and distribution, integration and training services, and fleet analytics and chart management portals. ECDIS remains the core installed application, but recurring revenue increasingly comes from ENC subscriptions, enterprise licensing, and analytics services that fuse chart data with AIS, weather, and performance metrics. ENC services have evolved from single vessel updates to fleet wide enterprise models that deliver synchronized updates to all vessels under a common contract. Integration and training services are essential to demonstrate compliance and to shorten operational timelines when new standards are introduced. Fleet analytics platforms that leverage cartographic layers for route optimization, carbon accounting, and predictive safety modeling are emerging as high value offerings with measurable ROI for operators seeking to reduce fuel burn and meet emissions targets.

Vessel Types and Application Patterns

Commercial shipping tankers, bulk carriers, container vessels, and passenger ships comprise the largest share of demand, driven by SOLAS regulatory requirements and large fleet sizes. Defense and government segments place a premium on secure, encrypted cartographic services and tailored tactical overlays, while offshore support vessels and specialized survey ships demand high resolution bathymetry layers and integration with dynamic positioning and subsea operations. High end leisure craft, research vessels, and expedition cruise ships adopt advanced ENC layers and visualization tools to support niche operational requirements. Across vessel types, the principal applications center on navigation, voyage planning, and safety compliance, while data analytics and fleet performance applications accrue increasing attention from commercial operators.

Regional Dynamics

Regional adoption patterns for electronic cartographic solutions are shaped by fleet composition, regulatory enforcement, hydrographic coverage, and local supplier ecosystems. North America and Europe remain mature markets with high per vessel spend for advanced ECDIS capabilities and enterprise chart services. OEMs and system integrators in these regions are investing heavily in S-100 readiness and cloud integrated chart management portals. Asia Pacific is the fastest growing region through 2035 due to fleet expansion, shipbuilding activity, and government hydrographic investments in China, India, Japan, and Southeast Asian navies and port authorities. The Middle East’s growing widebody and tanker fleets, together with offshore energy activity, sustain demand for high fidelity charting and integration services. Latin America and Africa show measured but consistent uptake, with naval modernization and port digitization projects acting as catalysts. Regional hydrographic offices’ progression towards S-100 data services will be a key enabler for broader market uptake.

Market Drivers

The electronic cartographic market is propelled by a few intersecting macro and industry drivers. Regulatory certainty and enforcement of ECDIS carriage and performance standards create a stable base demand for compliant units and updated ENCs. The S-100 implementation roadmap and mandates for S-100 readiness in new ECDIS units are stimulating replacement programs and software upgrades. Operational efficiency goals, centered on fuel reduction and voyage optimization, drive investment in integrated charting, predictive routing, and performance analytics. The search for decarbonization solutions under frameworks like CII and EEXI amplifies the value of chart based voyage optimization. Another driver is the increasing availability and quality of hydrographic data as national hydrographic offices, defense organizations, and commercial surveyors expand bathymetric and coastal mapping programs. Finally, technology enablers cloud distribution, AI analytics, and secure update mechanisms make enterprise charting scalable and easier to manage across large fleets.

Market Restraints and Adoption Barriers

Despite clear value propositions, several barriers slow adoption among smaller operators and in less mature regions. High upfront costs for type approved ECDIS hardware and recurring licensing fees for ENCs can be prohibitive for small shipowners. Crew training and human system integration requirements impose both cost and scheduling burdens. Interoperability challenges with legacy bridge systems and proprietary interfaces complicate integration and increase project timelines. Cybersecurity risks and the need for robust protected update flows are paramount as charting systems become more networked. Additionally, uneven global ENC coverage and variability in hydrographic data quality constrain the full realization of advanced S-100 use cases in some coastal regions.

Opportunities and Emerging Monetization Models

Opportunities in the electronic cartographic market are concentrated in data services, analytics, and lifecycle support. Subscription models for enterprise ENC delivery and cloud based chart management reduce per vessel friction and create predictable recurring revenues. Monetization of enriched S-100 products, such as high resolution bathymetry grids, dynamic water level products, and specialized marine service overlays, opens new streams for hydrographic data publishers and integration partners. AI and big data integration enable predictive navigation, anomaly detection, and risk scoring, which can be sold as premium analytics packages. Training, remote diagnostics, and managed compliance services create differentiated offerings for operators seeking turnkey solutions. The integration of cartographic data into carbon accounting systems further positions providers as essential partners in decarbonization strategies.

Technology Trends: AI, Cloud, Cybersecurity, and S-100 Ecosystems

Artificial intelligence and machine learning are being used to fuse chart data with AIS, weather, and vessel performance to produce predictive routing suggestions and detect potential safety risks. Cloud distribution and enterprise chart management portals enable synchronized updates across fleets and simplify audit trails for compliance. Cybersecurity hardening is a critical trend as ECDIS becomes an enterprise node; providers are adopting encrypted ENC delivery, blockchain validation for chart provenance, and secure update channels to meet operational assurance requirements. The S-100 ecosystem has catalyzed a wave of modular data products bathymetric grids, tidal and water level products, marine protected area overlays, and seabed substrate maps that can be combined in flexible service bundles. Integration with voyage optimization and digital twin platforms is accelerating as operators seek tighter coupling between chart data and operational decision systems.

Interoperability With Bridge Systems and Digital Twins

One of the practical challenges and opportunities for electronic cartographic solutions is seamless interoperability with integrated bridge systems, ECDIS units of different vendors, and emerging digital twin platforms. Vendors that provide open APIs, standardized data interfaces, and certified middleware to bridge legacy interfaces gain an advantage. Digital twins that mirror vessel behavior and predicted environmental interactions rely heavily on accurate cartographic and bathymetric layers, making chart providers strategic partners in enterprise digital transformations. Contracts that bundle chart services with digital twin analytics and shore based decision support increasingly appeal to large shipowners and chartering groups.

ENC Production and Quality Assurance

ENC production and quality assurance remain critical. National Hydrographic Offices, defense hydrographic services, and commercial ENC producers now focus on accelerating ENC update cycles, improving positional accuracy, and expanding variable resolution coverage. Quality control processes and validation of S-101 and S-100 conformant products ensure type approved ECDIS units interpret and display data correctly. Subscription models for ENC updates now include automated push notifications for critical chart corrections, enabling faster reaction to navigational hazards and promulgation of safety notices.

Fleet Analytics and Voyage Optimization Value Chain

Cartographic data serves as a foundation for fleet analytics and voyage optimization. By combining ENCs with meteorological forecasts, AIS traffic density layers, and vessel performance models, analytics platforms calculate fuel efficient routes that respect safety constraints and regulatory limits. The resulting route choices can reduce fuel consumption by a measurable percentage per voyage and lower aggregate CO2 emissions across a fleet. Providers that can demonstrate verified fuel savings, integrated carbon accounting dashboards, and compliance reporting will capture the premium end of the market as regulators and charterers prioritize sustainable operations.

Cybersecurity and Resilience

With charting solutions becoming networked and cloud dependent, cybersecurity has emerged as a core operational requirement. Providers are investing in secure key management for chart subscriptions, encrypted ENC delivery, and tamper evident validation of chart provenance. Resilience planning includes offline caching of critical charting datasets and multi source validation routines to ensure continued navigation capability in contested or disconnected environments. For naval and government users, additional layers of classification, secure enclaves, and encrypted tactical overlays become critical product differentiators.

Integration With Maritime Safety and Compliance Ecosystems

Electronic cartographic systems are increasingly linked to broader maritime safety ecosystems, including vessel traffic services, coastal surveillance, and port management systems. Chart providers partner with authorities to deliver standardized overlays for restricted areas, temporary notices to mariners, and real time hazards. Integration with compliance reporting systems automates parts of the audit trail for voyage planning and inspection, reducing administrative burden for operators and improving regulator visibility.

Role of Hydrographic Offices and Public-Private Collaboration

National hydrographic offices and international bodies such as IHO play a pivotal role in enabling data availability and standardization. Public private collaboration is intensifying as governments invest in national hydrographic surveys, crowd sourced bathymetry programs, and capacity building in under charted regions. These collaborations create commercial opportunities for ENC resellers and integrators who can package public datasets with value added analytics and enterprise delivery services.

Environmental and Sustainability Impact

Adoption of electronic cartographic systems supports decarbonization goals by enabling optimized routing, which reduces fuel burn and associated emissions. Digitization reduces paper chart production and logistics, lowering waste and transportation emissions. Vendors that publish lifecycle emission metrics for their cloud services and hardware can help shipowners meet Scope 3 reporting obligations. Integration with carbon accounting tools enables operators to quantify emissions reductions achieved through routing decisions informed by chart analytics.

Competitive Landscape and Key Players

The competitive field blends established navigation OEMs, hydrographic data publishers, and agile technology firms. Competition focuses on S-100 support, user interface design, data integration capabilities, and the ability to deliver enterprise solutions at scale. Key players include Wärtsilä Voyage, Kongsberg Gruppen, Navico Group, Northrop Grumman Corporation, Transas Marine (now part of Wärtsilä), Tokyo Keiki Inc., ChartWorld, SevenCs GmbH, and a roster of regional distributors and ENC service providers. Each of these organizations approaches the market with differentiated strengths and strategic angles.

Wärtsilä Voyage is a major player in navigation and user centric ECDIS ecosystems. The company combines decades of bridge system engineering with recent investments in cloud chart services and S-100 productization. Wärtsilä’s enterprise portals focus on synchronized fleet updates and integrated voyage optimization modules.

Kongsberg Gruppen brings systems integration strength, supplying integrated bridge and automation systems that closely couple ECDIS with radar, DP systems, and dynamic positioning. Kongsberg’s strategy emphasizes S-100 readiness and secure enterprise services for commercial and naval operators.

Navico Group, with brands such as Simrad and Lowrance, addresses both commercial and leisure markets with charting and navigation solutions. Navico’s strength in charting algorithms and broad hardware distribution channels makes it a key supplier for offshore and workboat markets.

Northrop Grumman Corporation, while primarily a defense systems integrator, supplies secure cartographic solutions and tactical ECDIS products to navies and coastguard services. The company’s focus is on secure ENC distribution, encryption, and integration with command and control systems.

Transas Marine, now integrated with Wärtsilä, historically contributed a large installed base of ECDIS units and chart management software. Its product heritage underpins many retrofit and upgrade programs across commercial fleets.

Tokyo Keiki Inc. (also known as Tokyo Keiki or JRC in some contexts) supplies chart plotters, ECDIS units, and marine instrumentation with strong adoption in Asian markets. The company’s local support networks help drive adoption in Japan and neighboring countries.

ChartWorld operates as an ENC distribution and value added reseller, packaging official hydrographic products with management portals and customer support services. ChartWorld’s enterprise focus helps smaller operators migrate to subscription models for ENC updates.

SevenCs GmbH develops chart validation and conversion tools and offers expertise in ENC quality control and S-100 conversion pipelines. SevenCs supports hydrographic offices and commercial publishers in data migration and interoperability.

Beyond these marquee names, regional integrators, classification society affiliates, and specialized data firms provide industry nuance. Smaller firms build niche capabilities in bathymetric processing, tide and current modeling, and training services that complement the core charting offerings of larger vendors.

Key Player Profiles – Deeper Look

Wärtsilä Voyage has repositioned itself as a software and services leader in addition to its hardware offerings. Its solutions focus on distributed chart management, compliance automation, and integration with route optimization platforms. The company’s investments in cloud distribution and shore based management tools make it a primary partner for large operators seeking fleet synchronization and S-100 migration paths.

Kongsberg Gruppen differentiates through systems integration and maritime automation expertise. Kongsberg’s bridge systems and ECDIS portfolio emphasize security, DP integration, and extendability for naval applications. Their strategy includes layered services for lifecycle support and predictive maintenance insights that tie charting into broader vessel performance systems.

Navico Group leverages a strong OEM and aftercare channel to supply charting services across commercial and workboat markets. Their user centric interfaces and hardware compatibility allow for rapid deployment in offshore service vessels and specialized craft.

Northrop Grumman targets secure, mission critical cartography for defense customers. The company provides encrypted charting, offline validation, and ruggedized software stacks suitable for shear environments and tactical use cases. Northrop Grumman’s naval partnerships and classified data handling capabilities position it well for government contracts.

Transas Marine, historically a leading ECDIS supplier, continues to influence retrofit programs and aftermarket upgrades through its software platforms and data services. Integration with Wärtsilä’s broader portfolio enhances the company’s reach into fleet analytics and voyage optimization offerings.

Tokyo Keiki’s regional strength and product support are central to market growth in Asia Pacific. The firm’s hardware lineage and support ecosystem help local operators transition to S-100 ready systems while providing continuity for legacy ECDIS fleets.

ChartWorld focuses on packaging ENC services with enterprise management and compliance reporting. Their reseller model lowers barriers for smaller operators to adopt subscription based ENC delivery and fleet synchronization.

SevenCs provides the technical backbone for S-100 conversion and data quality assurance. Their validation tools and expertise are critical for hydrographic offices and commercial publishers migrating datasets to the S-100 framework.

Use Cases and Implementation Examples

Operators are deploying enterprise chart management systems to deliver synchronized ENC updates across fleets, automating regulatory compliance and reducing human error in update workflows. Offshore operators pair high resolution bathymetry products with DP systems for safer subsea operations and cable laying. Passenger and cruise lines integrate enhanced visual layers, weather overlays, and route optimization to improve passenger comfort and fuel efficiency. Navies deploy encrypted charting and tactical overlays to support littoral operations and secure navigation in contested waters.

Pricing, Procurement, and Total Cost of Ownership

Pricing models have shifted towards subscription and enterprise licensing. Upfront hardware costs for ECDIS remain significant, but enterprise models lower barriers through per vessel subscription fees, fleet licensing, and managed services. Total cost of ownership assessments now account for fuel savings from optimization, compliance cost reduction, training, and the administrative burden of manual update handling. Vendors that can demonstrate verified operational savings and simplified compliance processes command premium contracts.

Training, Human Factors, and Change Management

Crew training and human system integration are essential to realize the value of advanced cartographic systems. Human factors considerations influence interface design, alerting strategies, and operational procedures. Providers that offer comprehensive training, certification support, and simulation environments reduce organizational friction and accelerate time to value.

Regulatory Outlook and Compliance Timelines

Implementation timelines for S-100 readiness and regional mandates will shape procurement cycles. Authorities’ guidance regarding S-100 product acceptance and type approval for ECDIS is crucial for vendors seeking smooth market entry. Compliance automation and audit ready documentation remain high priorities for operators facing tighter inspection regimes.

Intersections With Security Markets: Drone Detection Market and Port Resilience

Electronic cartography plays a role in broader port and maritime security architectures. The integration of situational awareness layers, including AIS, radar overlays, and sensor feeds, creates a unified operational picture. In many major ports, investments in perimeter and low altitude surveillance systems link directly to navigation decision support. Discussions between cartographic providers and stakeholders in the Drone Detection Market have increased as ports seek synchronized situational awareness that fuses chart layers with drone activity feeds. This integration helps port operators manage safety zones, temporary exclusions, and dynamic routing around security incidents. Cartographic systems that can ingest and visualize drone detection inputs alongside conventional navigational layers provide an operational advantage in congested or sensitive waterways.

Risks and Market Inhibitors

Key risks include slower than expected migration to S-100 in some hydrographic offices, delays in regulatory clarity around S-100 type approval, and cybersecurity incidents that undermine operator confidence. Market consolidation or pricing pressure from low cost regional suppliers could compress margins. Additionally, disparities in hydrographic coverage and data quality may limit certain high value S-100 use cases in under surveyed regions.

Future Outlook and Strategic Recommendations

Through 2035 the electronic cartographic market will be defined by incremental technological advances, deeper integration with enterprise operational systems, and the monetization of richer S-100 datasets. Vendors should prioritize modular, API driven platforms, invest in secure distribution mechanisms, and form partnerships with hydrographic offices to accelerate data availability. Shipowners should evaluate subscription models that bundle ENC services with analytics and carbon accounting to realize immediate operational benefits. Governments and hydrographic agencies should continue investing in survey coverage and S-100 transformation to enable a global ecosystem of interoperable, high quality cartographic services. Strategic alignment across industry stakeholders will be essential to capitalize on the safety, efficiency, and sustainability benefits that digital cartography can deliver.

The electronic cartographic (marine) market is shifting from compliance driven spending to value driven services that deliver navigational safety, fuel efficiency, and environmental benefits. With S-100 as the technical pivot and cloud and AI as the delivery mechanisms, the market is poised to grow steadily to an estimated USD 17.3 billion by 2035. Providers that combine high quality hydrographic content, robust cybersecurity, seamless integration with bridge systems, and compelling analytics will capture the most value. Coordination with adjacent security markets, including the Drone Detection Market, and with national hydrographic offices will accelerate the creation of resilient, interoperable navigation ecosystems that support the maritime sector’s operational and sustainability ambitions.

Related Report:

Electronic Cartographic (Marine) Market by Solution (ECDIS, ENC, Integration & Support), by Vessel Type (Commercial, Defense, Offshore, Others), by Application (Navigation, Fleet Management, Safety, Data Analytics), by End User (OEMs, Ship Operators, Naval Forces), and by Region — Global Forecast to 2035