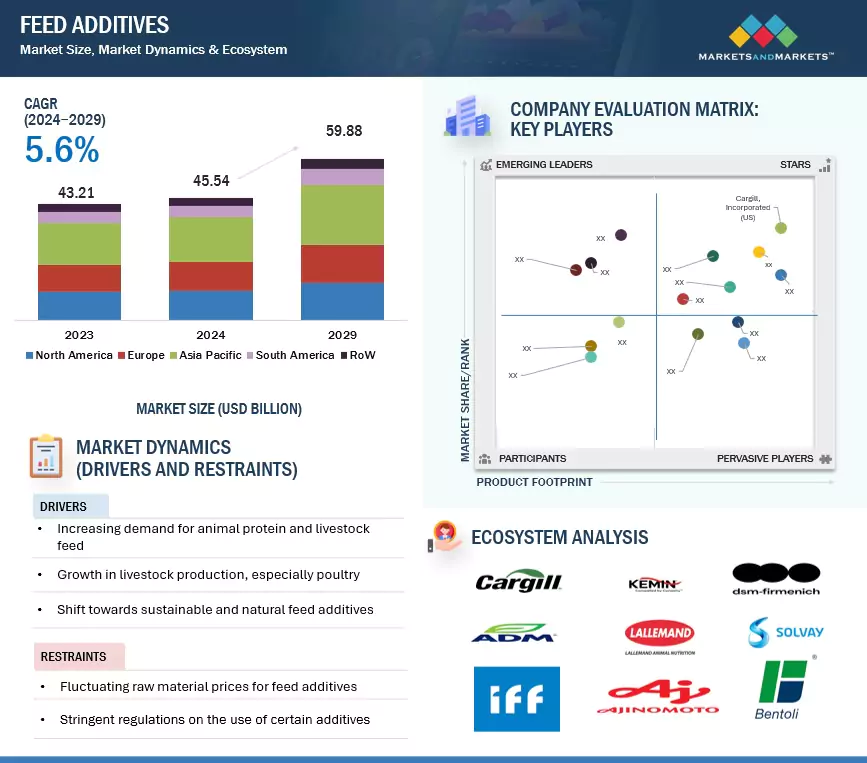

The global feed additives market is valued at USD 45.54 billion in 2024 and is projected to reach USD 59.88 billion by 2029, growing at a CAGR of 5.6%. This growth is primarily driven by the rising global demand for high-quality animal protein. The expansion of livestock production, along with an increased focus on animal health and performance, continues to support the growth of this market.

As populations rise and dietary patterns shift, particularly in emerging economies, the need for efficient and sustainable livestock farming has become essential to achieving food security. This has brought challenges such as disease outbreaks and reduced feed efficiency, creating opportunities for feed additives like amino acids, enzymes, probiotics, and vitamins. These additives enhance feed quality and improve animal nutrition and health. Additionally, stricter regulations surrounding sustainable livestock practices and antibiotic reduction have accelerated the adoption of natural and organic feed additives.

Biotechnology is expected to play a pivotal role in the sector, with innovations in feed formulation providing tailored solutions for the specific nutritional and health needs of livestock.

Feed Additives Market Driver: Growing Demand for Livestock-Based Products

The growing global consumption of animal-derived products—meat, dairy, and eggs—is a major factor accelerating the use of feed additives. Poultry meat, in particular, stands out due to its affordability, low production costs, and widespread demand across both developed and developing countries.

Feed additives help enhance feed quality and improve animal productivity to meet this rising demand. According to the OECD-FAO Agricultural Outlook 2023–2032, global livestock and fish production is expected to increase by 10% over the next decade, driven largely by middle- and low-income countries. Poultry meat alone is projected to grow by 14%, accounting for nearly half of the overall meat production increase. This growth will be especially pronounced in regions such as Asia Pacific and Sub-Saharan Africa.

To support this growth, improvements in breeding efficiency and feeding practices are essential, underscoring the crucial role feed additives play in increasing productivity and sustaining future supply.

Market Segment: Dry Form Feed Additives

Dry feed additives dominate the market due to their ease of storage, longer shelf life, and cost-effectiveness. Unlike liquid forms, dry additives are more stable and less prone to spoilage, making them easier to handle and transport. They also save on shipping costs by reducing water content and minimizing storage space.

Common dry additives include amino acids, vitamins, probiotics, acidifiers, minerals, and antioxidants. These are typically incorporated into pellet or crumble feed to improve digestibility, palatability, and feed conversion rates.

Recent innovations have further strengthened this segment. For example:

- DSM-Firmenich (Switzerland) launched HiPhorius, a fourth-generation phytase in dry powder form that enhances phosphorus digestibility.

- Nuqo (Canada) introduced NUQO NEX, a dry additive combining plant and marine algae metabolites to support gut health and feed efficiency.

Such products reflect the industry’s shift toward sustainable, high-performance nutrition solutions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=870

Market Segment: Synthetic Feed Additives

Synthetic feed additives continue to dominate the market due to their scalability, affordability, and high bioavailability. These chemically manufactured compounds can be produced in large volumes at lower costs than their natural counterparts and offer consistent quality and effectiveness.

Their superior absorption by animals ensures enhanced growth and health outcomes, meeting the needs of a growing livestock industry while maintaining cost-efficiency for producers.

Regional Insight: Europe’s Evolving Feed Additives Market

Europe holds a significant share of the global feed additives market, although feed production trends vary by segment. According to Alltech’s 2024 Agri-Food Outlook, overall feed production in Europe is trending downward, particularly for beef and pig feed:

- Pig feed declined by 3.37% from 2022 to 2023, a reduction of 2.61 million metric tons.

- Aquaculture feed in Norway also saw a 2.58% drop (0.12 MMT).

- However, poultry feed showed a marginal increase, and pet feed grew by 3.2% (approximately 354,600 metric tons).

These shifts highlight emerging opportunities for feed additive manufacturers to develop solutions that improve feed efficiency and meet evolving sustainability standards. Sustainable, high-quality additives are increasingly vital to supporting the health and productivity of both livestock and companion animals in this transitioning market.

Leading Feed Additives Companies:

The report profiles key players such as Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), Evonik Industries AG (Germany), BASF SE (Germany), dsm-firmenich (Switzerland), Ajinomoto Co., Inc. (Japan), Novonesis Group (Denmark), Adisseo (France), Jubilant Ingrevia Limited (India), Nutreco (Netherlands), Kemin Industries, Inc. (US), Lallemand Inc. (Canada), BRF Global (Brazil), and Alltech (US).