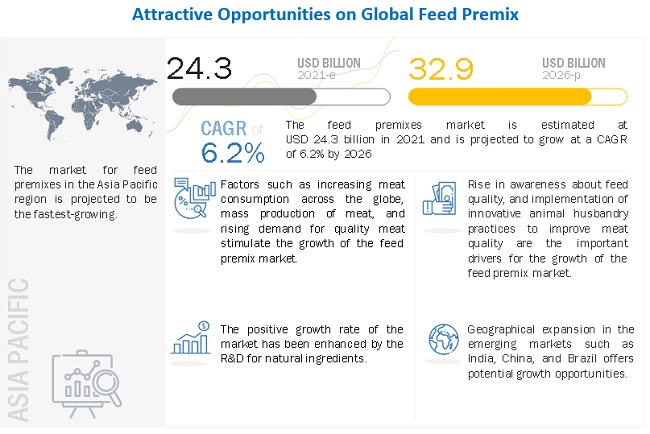

The report “Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants), Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), Form (Dry and Liquid), and Region – Global Forecast to 2026 “, size is estimated to be valued at USD 24.3 billion in 2021 and is projected to reach a value of USD 32.9 billion by 2026, growing at a CAGR of 6.2% during the forecast period. The growth of this market is attributed to increasing awareness about feed quality, and the implementation of innovative animal husbandry practices to improve meat quality are the important drivers for the growth of the feed premix market.

Report Objectives:

- To define, segment, and estimate the size of the feed premix market with respect to its ingredient type, form, livestock, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the Feed premix market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

Challenge: Sustainability of feed and livestock chain

The global feed industry focuses on improving feed efficiency by improving the feed conversion rates for all major livestock and farmed fish species. The feed and livestock industries can achieve sustainability by developing a harmonized environmental footprint methodology based on life cycle analysis involving the entire chain. The development of common metrics can also help to calculate a broader range of resource efficiency indicators. The efficient usage of feed ingredients can support the reduction of the environmental impact of livestock farming through resource-efficient feed production. The use of co-products from other processing industries can reduce the pressure on land-grown crops.

The market for the dry segment is projected to account for the largest share during the forecast period, by form

By form, the dry segment accounted for the highest market share as well as the highest growth rate in the feed premix market due to the factors such as easy handling and storability, usage in a wide range of livestock applications, and lower manufacturing costs. Feed premixes in the dry form are easier to mix with feed and provide a longer shelf life than in the liquid form, due to which they witness high preference among feed manufacturers.

The poultry segment dominated the market for feed premix by livestock.

The poultry industry consists of four main areas of production—broiler, eggs, pullets, and breeders. It is a fast-evolving industry due to the rapid increase in demand for poultry meat, particularly in India and many Islamic countries. In these countries, the consumption of porcine and livestock meat (India) is projected to be low due to religious beliefs, which, in turn, increases the demand for poultry meat. In addition, the global demand for poultry meat is further set to rise in the coming years due to the increased cost and reduced availability due to the rise in demand for beef and pig meat. Poultry, the most traded meat category, accounts for over 40% of the total meat trade. According to the FAO, global poultry meat production was nearly 111.8 million tons in 2015. Furthermore, the demand for poultry meat is projected to remain high in developing economies.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=170749996

Asia pacific is estimated to hold the largest market share during the forecast period

Asia Pacific is projected to be the largest and fastest-growing segment. Increased awareness among consumers about quality meat and increased meat consumption across the region is expected to provide more scope for market expansion. Livestock is an important constituent of agriculture in the Asia Pacific region. The region widely rears and consumes pork and poultry. With the rising demand for animal products, increased livestock productivity is necessary. Quality feed is the primary determinant of the performance and productivity of livestock.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the Feed premix. It consists of the profiles of leading companies such Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK).

Recent Developments:

- In October 2020, DSM completed the acquisition of Erber Group (Austria) for an enterprise value of EUR 980 million (USD 1.16 Billion). The transaction excludes two smaller units in Erber Group. DSM acquired Erber Group’s Biomin and Romer Labs. Erber Group’s specialty animal nutrition and health business Biomin specializes primarily in mycotoxin risk management and gut health performance management, whereas the Romer Labs business focuses on food and feed safety diagnostic solutions. Thus, this would enhance DSM’s animal health & nutrition business in the global market.

- In May 2019, Bayer Animal Health GmbH (Germany) and Nutreco formed an agreement to collaborate for the development of animal health and animal nutrition industries.