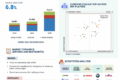

The global hybrid train market is projected to grow from 412 units in 2023 to 446 units by 2030, registering a CAGR of 1.1%. Due to the rising demand for sustainable transportation solutions, the industry of railway systems is experiencing a transformative shift towards hybrid trains. These innovative locomotives seamlessly blend the power of battery-electric, hydroelectric, and diesel-electric propulsion systems, offering a multifaceted approach to addressing the growing need for efficient, eco-friendly, and versatile rail transport. As environmental concerns gain prominence and energy efficiency becomes paramount, the convergence of these propulsion technologies is paving the way for a sustainable mode of transportation, one that is characterized by reduced emissions, enhanced performance, and the promise of a greener future for rail travel.

Demand for energy-efficient and less polluting train operations

Increasing stringency of emission norms by governments in several countries has compelled train manufacturers to adopt less pollution-causing trains. Thus, companies like Alstom, Bombardier, Siemens, and Wabtec Corporation are investing in alternative fuel-powered trains. For instance, Alstom was one of the first companies to unveil a hydrogen-powered train. In April 2022, Alstom and ENGIE signed a partnership agreement to offer the rail freight sector a solution for decarbonizing mainline operations by replacing diesel-powered locomotives with hydrogen versions. Various freight companies have started investing in hybrid trains to cut operating costs by eliminating fuel and maintenance costs. The total cost of ownership (TCO) plays a key role in the freight industry and affects profit margins. Fuel expenses are high while covering long distances using conventional diesel trains. However, the use of electrified, fuel cell, CNG, and LNG hybrid trains reduces these expenses by almost 50%. Increasing the modal share of railways is considered a cost-effective method of increasing the use of renewable energy in transport, thereby reducing greenhouse gas (GHG) emissions. These factors are expected to drive the growth of the hybrid train market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=238438631

Retrofitting of diesel-electric trains

According to Worldwiderail (website), diesel locomotives cost around USD 0.5-USD 2 million, and an electric locomotive costs more than USD 6 million. Hence, it is more viable to retrofit a diesel locomotive with battery systems than to buy a new one. For example, in the US, a large number of General Electric locomotives, currently owned by several North American railroads, are being rebuilt with cab upgrades, along with electrical and safety systems. Re-manufacturing locomotives cost about 40% less than purchasing a new locomotive. Indian Railways, for instance, has been able to reduce the cost incurred in diesel to electric conversion to as low as USD 0.3 million. The growing market for diesel retrofitting is driving the demand for energy storage systems, such as backups and power supply units. In addition to the above, replacing the diesel motor with an electric drive will also reduce the onboard weight and further improve the efficiency of railways. For instance, In 2022, the German railway company Deutsche Bahn (DB) announced that it would be retrofitting 100 diesel-electric trains with hybrid technology. The retrofitting is expected to be completed by 2025. The retrofitting will involve installing a battery pack and a hybrid control system on the trains. The battery pack will allow the trains to operate on electric power for short distances, while the hybrid control system will automatically switch between electric and diesel power depending on the operating conditions.

Europe is the largest market for Hybrid trains during the forecast period

Europe is home to many leading railway manufacturers such as Alstom (France), Siemens (Germany), Hitachi Rail (Italy), and CAF (Spain). The railway industry is one of the key contributors to the European economy. The region for this study is segmented into Germany, France, Spain, Austria, and the UK. Europe has stringent environmental regulations and ambitious sustainability targets. Hybrid trains, which combine electric and alternative power sources, help rail operators reduce greenhouse gas emissions, meet emissions standards, and contribute to a cleaner environment. Many European governments offer incentives, subsidies, and grants to promote the adoption of hybrid and electric trains. These financial incentives encourage rail operators to invest in greener transportation options. For instance, the UK government has announced that it will be phasing out all the trains running solely on diesel by 2040. Many of the top train manufacturers from the region, such as Alstom, Siemens, Hitachi Rail STS, and CAF, have incorporated hybrid technologies in their trains.

Key Market Players

The hybrid train market is dominated by CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland), among others.

Inquire Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=238438631