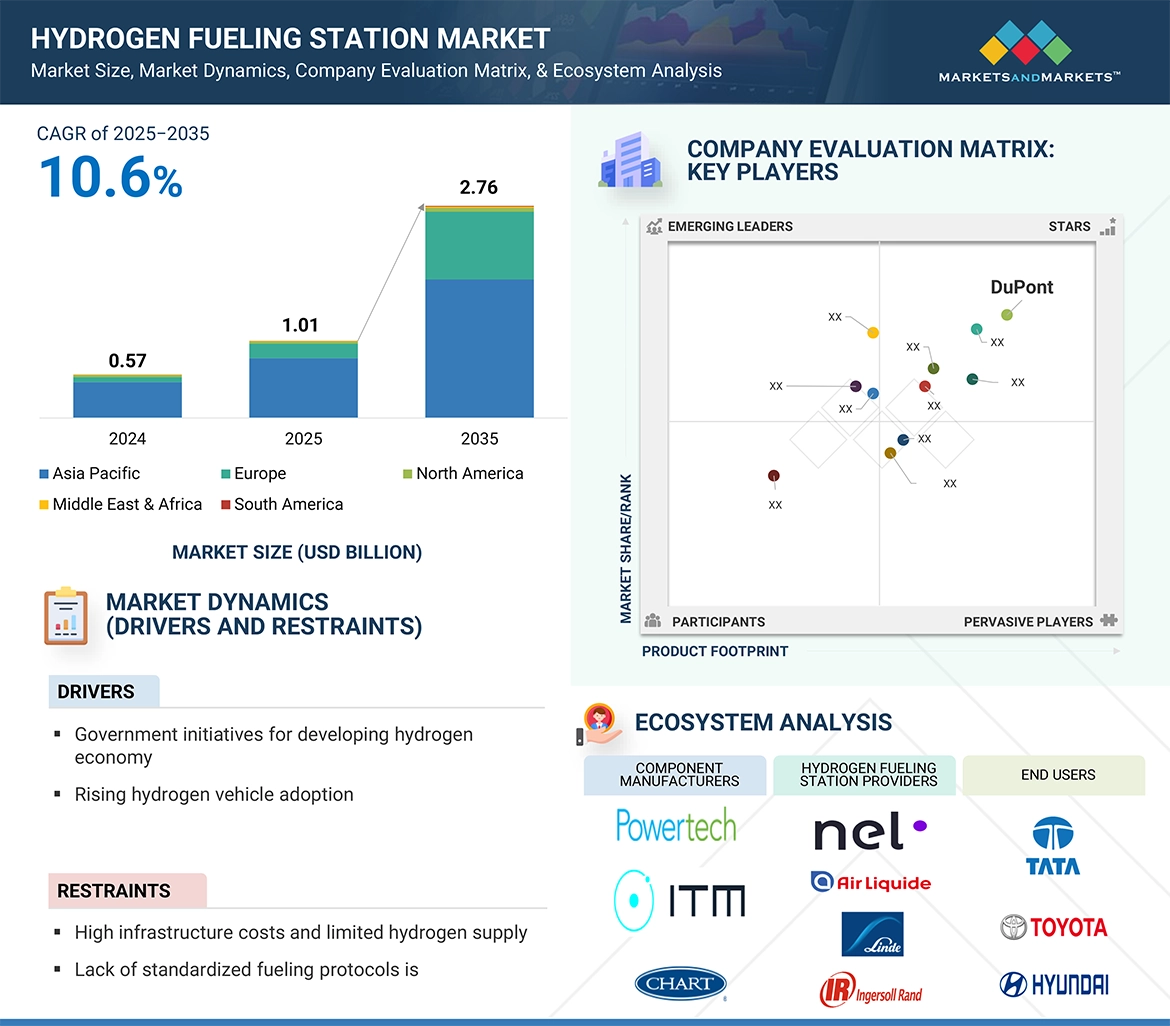

According to a research report “Hydrogen Fueling Station Market by Supply Type (On-site, Off-site (Gas, Liquid)), Station Type (Fixed, Mobile), Station Size (Small, Mid-sized, Large), Pressure (High, Low), Solution (EPC, Components), Region – Global Forecast & Trends to 2035″ published by MarketsandMarkets, the hydrogen fueling stations market is expected to grow from USD 1.01 billion in 2025 to USD 2.76 billion by 2035, at a CAGR of 10.6% during the forecast period. Governments worldwide are implementing stringent environmental regulations and setting ambitious climate goals to reduce carbon emissions. Hydrogen, being a clean and renewable energy source, plays a crucial role in achieving these targets. Policies promoting the use of hydrogen as a fuel, along with incentives and subsidies for hydrogen infrastructure, are driving the growth of hydrogen fueling stations. In addition to this, major automotive manufacturers are increasingly investing in hydrogen fuel cell vehicles (FCVs) as a sustainable alternative to traditional internal combustion engine vehicles and battery electric vehicles (BEVs).

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205206436

The fixed hydrogen stations segment is estimated to be the largest segment during the forecast period.

Based on station size, the hydrogen fueling station market is segmented into fixed hydrogen stations and mobile hydrogen stations. In most cases, fixed hydrogen stations have higher storage and dispensing capacity than their mobile station counterparts, which helps them meet the high demands in busy areas. Fixed stations can be fitted into the existing infrastructure of fueling stations, such as conventional gas stations, thereby making them more accessible and convenient for consumers. Besides, fixed stations offer a stable and reliable supply of hydrogen gas without the logistical complications involved in the transportation of the mobile units from one location to another. Moreover, fixed stations are usually provided with much more support and incentives from the government, including subsidies, grants, and favorable regulations, to motivate them to develop and deploy.

The components segment is estimated to account for the largest market share during the forecast period.

By solution, the hydrogen fueling station market is segmented into EPC and components. The components segment is estimated to account for the larger share during the forecast period. Component technologies are becoming more dependable and efficient due to ongoing advancements, making them more appealing than EPC services. Mass production and economies of scale in component manufacturing have cut down on their costs significantly, making them more affordable and preferable to complete EPC packages. Components offer more flexibility to tune in to the individual needs of projects. Hence, independent station operators are better positioned to have their tailored solutions without having to be locked into one EPC provider. Ordering individual components normally brings shorter lead times compared to arranging comprehensive EPC services, thus shaving off a few weeks or even months from a project timeline and quickening overall deployment. Moreover, components can easily be integrated into existing infrastructure to provide incremental upgrades and expansions, rather than requiring total replacement.

North America accounted for the third-largest market share in 2024.

North America is estimated to be the third-largest hydrogen fueling station market. The market in the region is driven by strong government initiatives, rising adoption of fuel cell electric vehicles (FCEVs), and growing investments from both public and private sectors. The US leads the region’s market growth, driven by California’s well-established hydrogen network and ambitious plans to expand coverage to support light-duty, heavy-duty, and public transit fleets. Federal and state-level incentives, such as the Inflation Reduction Act and funding from the Department of Energy’s Hydrogen Program, are accelerating infrastructure deployment and renewable hydrogen production. Canada is also advancing its hydrogen strategy, with projects focused on integrating HRS into key transportation corridors. Increasing collaborations between automotive manufacturers, energy companies, and technology providers are enabling the roll-out of high-capacity, digitally managed stations, positioning North America as a critical hub for hydrogen mobility expansion.

Request Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=205206436

Key Market Players

The hydrogen fueling stations market is dominated by major players with a wide geographical presence. Some key players in the market are Air Liquide (France), Linde PLC (Ireland), Air Products and Chemicals, Inc. (US), Nel (Norway), MAXIMATOR Hydrogen GmbH (Germany), and HYDROGEN REFUELING SOLUTIONS SA (France).