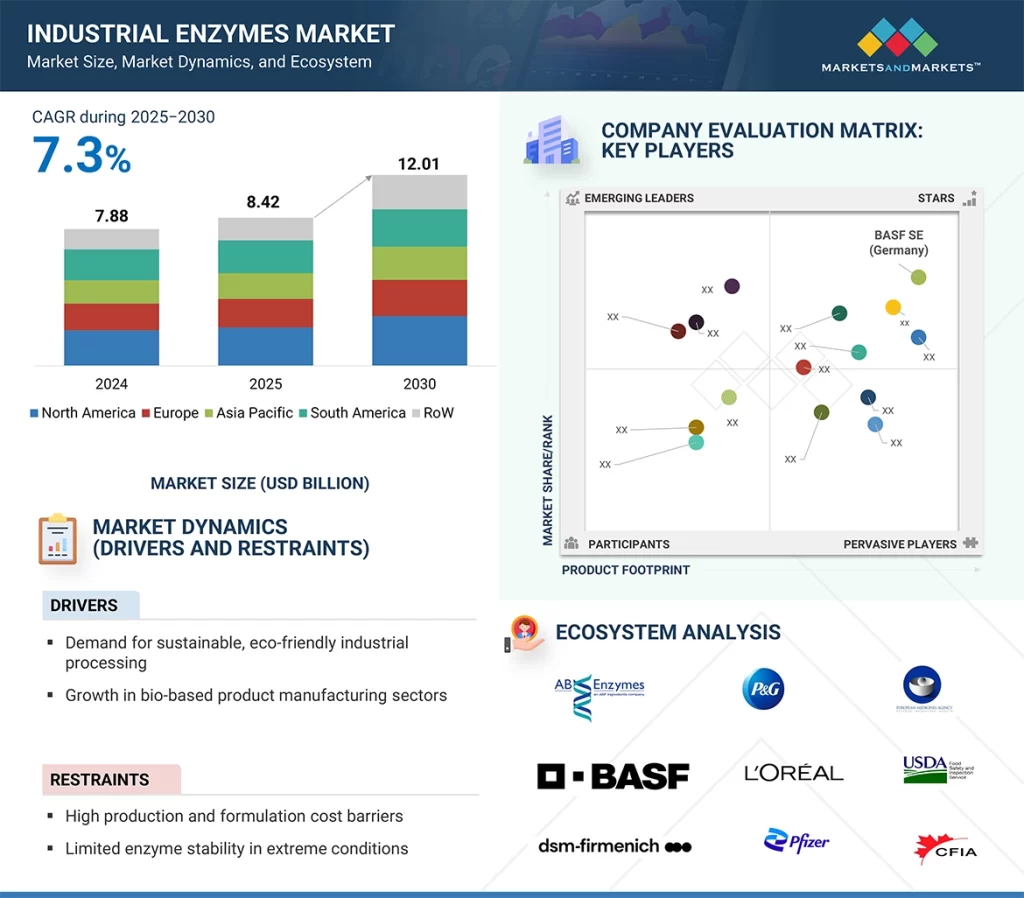

The global industrial enzymes market is estimated at USD 8.42 billion in 2025 and is projected to reach USD 12.01 billion by 2030, at a CAGR of 7.3% from 2025 to 2030.

The industrial enzymes market is poised for steady growth in the coming years, driven by the rising demand for sustainable, efficient, and cost-effective processing solutions across key manufacturing sectors. As industries increasingly aim to reduce their environmental footprint, enzymes are emerging as a bio-based alternative to traditional chemical methods. They operate under milder conditions, helping lower both energy and water usage.

Industries such as food and beverages, textiles, bioethanol production, detergents, and wastewater treatment are adopting enzyme-based technologies to enhance product quality, boost yields, and comply with stringent regulatory standards. Innovations in enzyme engineering, fermentation processes, and immobilization techniques are broadening the usability and resilience of enzymes in challenging industrial settings.

Moreover, the global transition toward circular economy practices and bio-based production—supported by strong government initiatives in regions like Europe, India, and Southeast Asia—is propelling enzyme integration across industrial value chains. As demand grows for cleaner and more efficient manufacturing solutions, industrial enzymes are set to play a critical role in shaping the future of global industry.

Industrial Enzymes Market Growth Drivers

- Sustainability Goals: Governments and corporations worldwide are actively seeking green technologies to meet carbon reduction targets. Industrial enzymes offer a sustainable alternative to harsh chemicals, reducing energy consumption and environmental impact.

- Rising Demand in Food & Beverages: Enzymes are extensively used to enhance texture, flavor, and shelf-life in processed foods. With rising health consciousness, the preference for clean-label and enzyme-assisted food production is accelerating.

- Boom in Biofuel Production: Enzymes play a vital role in converting biomass into bioethanol. As countries aim to reduce reliance on fossil fuels, enzymatic biofuel processing is gaining traction.

- Pharmaceutical & Healthcare Innovations: Enzymes are increasingly used in drug formulation, diagnostics, and disease treatment. The precision and efficiency they offer are pushing the boundaries of biomedical advancements.

- Textile and Detergent Applications: Enzymes such as cellulases and proteases are now standard in eco-friendly laundry detergents and textile processing, contributing to energy and water savings.

Microorganisms Lead the Industrial Enzymes Market

Microorganism-based enzymes account for the largest share of the industrial enzymes market, driven by their exceptional efficiency, scalability, and versatility. Enzymes produced by bacteria and fungi—especially Bacillus and Aspergillus species—perform well across wide temperature and pH ranges, making them ideal for applications in food processing, bioethanol, detergents, and textiles.

The use of microbial fermentation enables consistent, large-scale, and cost-effective enzyme production. Additionally, microorganisms can be genetically modified to enhance enzyme activity, stability, and specificity, offering customized solutions for diverse industries.

Compared to plant- or animal-derived enzymes, microbial enzymes offer better standardization, fewer supply chain challenges, and greater sustainability. Ongoing innovations in strain development and fermentation technology continue to boost their commercial appeal, reinforcing microorganisms as the dominant source in the industrial enzymes sector.

Asia Pacific to Remain the Largest Contributor to Industrial Enzymes Market Share

Asia Pacific is expected to retain its position as the largest market for industrial enzymes, driven by rapid industrialization, population expansion, and the growth of key manufacturing sectors. Countries such as China, India, Japan, and those across Southeast Asia are witnessing strong demand in enzyme-intensive industries, including food and beverages, textiles, animal feed, bioethanol, and wastewater treatment.

The rising appetite for processed foods, dairy products, and functional beverages is propelling enzyme adoption in food applications. At the same time, heightened environmental awareness is encouraging the use of enzyme-based solutions for eco-friendly wastewater and effluent management.

Additionally, supportive government policies are bolstering the region’s biotechnology landscape. For example, India’s BioE3 policy (introduced in August 2024) and China’s strategic industrial biotechnology initiatives are boosting enzyme production and research capabilities. With advantages such as low-cost labor, abundant raw materials, and growing foreign investments, Asia Pacific continues to strengthen its role as both a leading producer and consumer in the global industrial enzymes market.

Leading Industrial Enzymes Companies:

The report profiles key players such as BASF SE (Germany), International Flavors & Fragrances Inc. (US), DSM-Firmenich (Switzerland), Kerry Group plc. (Ireland), Dyadic International Inc. (US), Advanced Enzyme Technologies (India), Aumgene Biosciences (India), Amano Enzyme Inc. (Japan), Associated British Foods plc. (England), Novozymes A/S (Denmark), F. Hoffmann-La Roche Ltd. (Switzerland), Codexis, Inc. (US), Sanofi (France), Merck KGaA (Germany), and Adisseo (China).