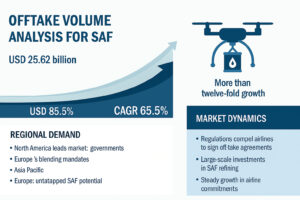

The Aviation Industry stands at a turning point, where sustainable solutions are no longer optional but essential to ensure long-term viability. At the heart of this transformation lies the Sustainable Aviation Fuel Market, which is experiencing extraordinary growth as global carriers, governments, and energy companies pursue ambitious decarbonization goals. Sustainable aviation fuel, widely known as SAF, is projected to scale from a market value of USD 2.06 billion in 2025 to USD 25.62 billion by 2030, reflecting a staggering compound annual growth rate of 65.5%. In terms of volume, global SAF consumption is expected to increase from 0.30 billion gallons in 2025 to 3.68 billion gallons by 2030.

Offtake agreements, long-term contracts where airlines commit to purchasing SAF volumes from producers, play a critical role in this market expansion. They provide financial security to producers while ensuring airlines meet regulatory mandates and corporate sustainability goals. Analyzing the offtake volumes offers valuable insight into the pace of adoption, the regions driving demand, and the strategies of major market players. This blog presents a comprehensive offtake volume analysis for SAF, exploring drivers, restraints, opportunities, and challenges, while highlighting the contributions of leading companies shaping the future of sustainable aviation fuel.

Market Dynamics Driving Offtake Volumes

The Sustainable Aviation Fuel Industry is fueled by a combination of regulatory push, technological advancement, and rising airline commitments. With aviation responsible for around 2–3% of global CO₂ emissions, decarbonizing this sector has become imperative. SAF offers a renewable and cleaner substitute to conventional jet fuel, reducing lifecycle greenhouse gas emissions by as much as 80%.

One of the most significant drivers of offtake volumes is the rapid advancement in feedstock processing and refining technologies. Processes such as Hydroprocessed Esters and Fatty Acids (HEFA), Fischer-Tropsch synthesis, and Alcohol-to-Jet (AtJ) have broadened the pool of raw materials, including used cooking oil, agricultural residues, municipal waste, and algae. These methods not only improve efficiency but also bring SAF closer to commercial competitiveness.

At the same time, challenges remain, particularly high production costs and limited infrastructure. SAF is still significantly more expensive than fossil-based jet fuel, presenting an obstacle for airlines already operating on thin margins. However, growing climate regulations, public demand for greener travel, and long-term carbon neutrality commitments are compelling airlines to sign large-scale offtake agreements, which in turn stimulate investment in SAF production capacity.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70301163

Regional Outlook for SAF Offtake

North America

North America dominates the Sustainable Aviation Fuel Market in terms of offtake volumes, supported by leading SAF producers and robust airline commitments. The United States, with its extensive commercial aviation network, has seen long-term offtake deals between major carriers like United Airlines, Delta Air Lines, and American Airlines and SAF producers such as World Energy and Neste. Government incentives, including the US Sustainable Aviation Fuel Grand Challenge, have further spurred production capacity growth. By 2030, North America’s SAF market is projected to reach USD 10.66 billion, growing at a CAGR of 50.1%.

Canada is also advancing SAF adoption under its Clean Fuel Regulations. With regional feedstock availability and supportive government policies, the region will continue to secure a large share of global SAF offtake agreements.

Europe

Europe’s offtake volumes are driven by stringent regulations such as the EU’s ReFuelEU Aviation mandate, requiring airlines to gradually increase SAF blending percentages in jet fuel. European carriers including Lufthansa, Air France-KLM, and British Airways have already signed extensive offtake deals with SAF suppliers. Finland-based Neste remains the largest SAF producer in the region, while TotalEnergies and BP also expand production capacities.

Given Europe’s strong regulatory framework, growing consumer demand for sustainable travel, and airline alliances focused on decarbonization, the region is expected to be one of the top markets for SAF offtake.

Asia Pacific

The Asia Pacific region presents untapped opportunities for SAF offtake, particularly as air travel in China, India, and Southeast Asia continues to rise. Japan has committed to SAF blending targets by 2030, while China is investing in large-scale production using agricultural and municipal waste feedstocks. Australia is also emerging as a player with government and airline initiatives to support SAF adoption.

As Asia Pacific airlines grow their fleets, long-term offtake agreements will play a central role in securing sustainable fuel supply and meeting international aviation emission reduction standards.

Middle East

The Middle East, home to major global carriers such as Emirates, Qatar Airways, and Etihad Airways, is increasingly entering the SAF offtake landscape. Governments in the UAE and Saudi Arabia are investing in domestic production facilities to ensure energy independence and sustainability. With the region’s heavy reliance on aviation as an economic driver, SAF offtake volumes are expected to accelerate, especially as flagship airlines commit to net-zero strategies.

Latin America

Latin America, led by Brazil, is gradually entering the SAF offtake market, leveraging its strong biofuel industry. Brazil’s abundance of sugarcane and ethanol feedstock positions it as a regional leader. Airlines in Mexico, Chile, and Colombia are also beginning to explore SAF adoption. While volumes remain modest compared to North America and Europe, increasing investment and partnerships will boost SAF offtake in this region.

Key Market Drivers for SAF Offtake

The offtake volume in the Sustainable Aviation Fuel Market is supported by factors such as the rapid expansion of commercial aviation, growing environmental regulations, and government-led initiatives promoting SAF blending mandates. Airline commitments to net-zero targets by 2050 ensure continued growth in long-term offtake agreements.

Restraints Affecting SAF Offtake

High production costs remain the primary restraint limiting offtake growth. SAF production requires advanced biochemical and thermochemical processes, which are not yet scaled to match the cost efficiency of petroleum refining. This cost disparity creates hesitation among airlines to commit to higher volumes without subsidies, tax incentives, or favorable regulations.

Opportunities in SAF Offtake

Global focus on reducing greenhouse gas emissions represents a major opportunity for SAF offtake. Governments and airlines are increasingly setting binding targets, and SAF is one of the few viable solutions to decarbonize aviation without replacing existing fleets. This growing momentum is leading to more offtake agreements and stimulating greater investment in SAF production capacity.

Challenges in Scaling SAF Offtake

The lack of adequate infrastructure, including production facilities, blending sites, and airport fueling systems, poses a challenge to scaling SAF offtake. Without sufficient infrastructure, producers cannot meet rising demand, and airlines face limited access. Developing these systems will be crucial to ensuring sustainable growth in offtake volumes.

Key Players Shaping SAF Offtake

Neste (Finland)

Neste leads the Sustainable Aviation Fuel Market with its flagship product, Neste MY Sustainable Aviation Fuel. It has signed numerous offtake agreements with global airlines including Lufthansa, American Airlines, and Air New Zealand. Neste’s ability to scale production capacity and its global distribution network make it a central figure in SAF offtake growth.

Shell (UK)

Shell has made large investments in SAF production, leveraging its refining expertise and global infrastructure. By partnering with airlines and airports, Shell is positioning itself as a major supplier of SAF and increasing offtake agreements across Europe and Asia.

TotalEnergies (France)

TotalEnergies is scaling its SAF production in Europe, focusing on supplying SAF to major carriers through long-term contracts. Its refineries in France are already converting waste oils into SAF, supporting growing offtake demand.

OMV Aktiengesellschaft (Austria)

OMV is expanding its SAF refining operations and entering long-term offtake deals with airlines across Europe. Its emphasis on HEFA-based SAF ensures high-quality and scalable production.

World Energy, LLC (US)

World Energy operates one of the first commercial SAF production facilities in North America. It has signed offtake agreements with major US carriers and is investing in expanding production to meet growing demand.

Lanzatech (US)

Lanzatech uses innovative gas fermentation technology to produce SAF from industrial emissions. Its partnerships with airlines and refiners make it a unique contributor to the offtake landscape.

Velocys Plc (US)

Velocys specializes in Fischer-Tropsch technology for SAF production. Its projects in the US and UK are backed by offtake commitments from airlines aiming to meet long-term sustainability goals.

Skynrg (Netherlands)

Skynrg focuses on building SAF supply chains and ensuring reliable distribution to airlines. It plays a key role in linking producers with carriers through offtake agreements.

Topsoe (Denmark)

Topsoe provides the refining technologies powering SAF production worldwide. By supplying technology to producers, it indirectly drives offtake volumes by enabling scalable production.

Aemetis, Inc (US)

Aemetis focuses on renewable fuels, including SAF. Its facilities in California are designed to produce significant volumes of SAF, with long-term offtake agreements supporting expansion.

BP Plc (UK)

BP is investing in SAF as part of its broader decarbonization strategy. Its airline partnerships and global refining operations ensure steady growth in offtake volumes.

Repsol (Spain)

Repsol has committed to SAF production using a range of feedstocks, with offtake agreements in Spain and broader Europe. It aims to increase SAF availability in line with EU mandates.

Eni (Italy)

Eni is expanding its bio-refineries to produce SAF and has already supplied SAF to Italian and European carriers through offtake contracts.

Philips66 (US)

Philips66 is developing SAF capacity in the US with partnerships aimed at ensuring long-term supply for major airlines.

World Kinect Corporation (US)

World Kinect focuses on aviation fuel logistics and distribution, supporting airlines with SAF offtake agreements globally.

Future Outlook for SAF Offtake

The Sustainable Aviation Fuel Market is poised for exponential growth in offtake volumes as regulatory mandates tighten and airlines intensify sustainability commitments. With global SAF consumption expected to increase more than twelve-fold by 2030, offtake agreements will remain central to ensuring a reliable and scalable supply chain.

Visit our company page on LinkedIn: https://www.linkedin.com/showcase/marketsandmarkets%E2%84%A2-aerospace-defense-research/posts/