The lithium-ion battery market has long been a cornerstone of the global clean energy transition, powering everything from electric vehicles to consumer electronics. However, the imposition of tariffs on imported battery components and raw materials—especially during the Trump administration—reshaped the competitive landscape in ways few anticipated. Initially causing disruption and uncertainty, the tariffs also served as a catalyst for innovation, localization, and strategic realignment within the industry.

As we look toward 2025 and beyond, the lithium-ion battery market is re-emerging stronger, more diversified, and filled with new opportunities. The ripple effects of tariff policies have prompted both governments and businesses to rethink supply chains, domestic production, and next-generation battery technology development. Here’s how the post-tariff environment is unlocking a new chapter for lithium-ion batteries globally.

Request US Tariff Impact on Lithium-ion Battery Market @ https://www.marketsandmarkets.com/forms/ctaTariffImpact.asp?id=49714593

A Market Resilient by Design

The tariffs introduced during the Trump administration, particularly those targeting China—the world’s leading supplier of lithium, cobalt, and battery-grade materials—created bottlenecks and inflated costs across the lithium-ion value chain. Automakers and battery manufacturers responded swiftly. U.S.-based and allied firms began accelerating plans to establish domestic gigafactories, partner with North American and European raw material suppliers, and develop alternative chemistries that reduce reliance on high-risk geopolitical regions.

This market recalibration has now matured. By 2025, companies that embraced vertical integration and built diversified supply networks are in a strong position to capitalize on growing demand across sectors.

Repatriation of Manufacturing

One of the most tangible opportunities emerging post-tariffs is the repatriation of battery manufacturing. Governments have incentivized local production through subsidies, tax credits, and infrastructure investments. In the U.S., legislation such as the Inflation Reduction Act has driven funding toward domestic gigafactories, opening the door for job creation and regional growth.

This shift has created vast opportunities not just for battery cell manufacturers, but for component producers—such as anode/cathode material suppliers, electrolyte providers, and battery pack assemblers—who can now plug into localized supply chains. It’s a prime moment for small and medium-sized enterprises to carve out niches in a newly forming domestic ecosystem.

Innovation in Battery Chemistries

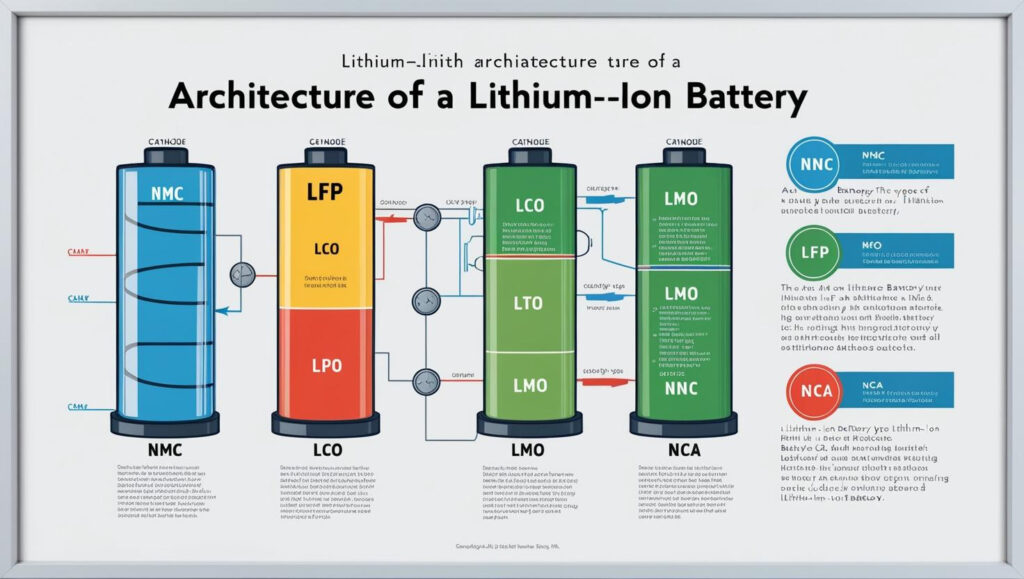

Post-tariff pressure also led to greater R&D investment in alternative chemistries. Manufacturers are now exploring options like lithium iron phosphate (LFP) and solid-state batteries that rely less on nickel and cobalt—metals most affected by tariffs and geopolitical risk.

Startups and established players alike are pouring resources into these next-generation solutions, offering lighter, safer, and cheaper batteries. As EV makers expand their portfolios to include affordable, mid-range electric cars, these innovations will play a key role—and offer market entrants a clear runway to success.

Strategic Alliances and Vertical Integration

Tariff-era challenges highlighted the vulnerability of disjointed global supply chains. In response, key players are forming strategic alliances to secure raw materials, streamline logistics, and integrate upstream and downstream operations. These joint ventures and M&A activities present opportunities for smaller tech firms to become acquisition targets or strategic partners in the evolving value chain.

Companies that offer smart battery management systems, lifecycle analytics, and energy storage software are especially attractive, as the industry seeks end-to-end solutions that go beyond just hardware.

Energy Storage Systems for Renewables

As the world races toward renewable energy adoption, grid-scale energy storage has emerged as a massive opportunity—and lithium-ion batteries remain the dominant technology. In the post-tariff era, utilities and governments are doubling down on domestic battery storage initiatives, fueling demand for lithium-ion solutions in stationary storage applications.

This trend is especially potent in regions with intermittent solar and wind power generation, where batteries are essential to maintaining energy stability. For battery manufacturers, system integrators, and energy software providers, this opens up multi-billion-dollar prospects in clean energy infrastructure projects.

Circular Economy and Battery Recycling

Rising material costs and restricted imports have also thrust battery recycling into the spotlight. Companies are now incentivized to recover valuable metals like lithium, nickel, and cobalt from spent batteries instead of relying solely on mined sources. The circular economy is no longer a fringe concept—it’s a commercial necessity.

This evolution presents growth opportunities for recycling startups, reverse logistics providers, and innovators in extraction technologies. Post-tariff economics support a closed-loop system, where material recovery and reuse can significantly reduce dependence on foreign suppliers and cut costs.

Government Incentives and Policy Support

In a move to future-proof domestic industries, governments around the world are creating favorable policy environments for lithium-ion production. These incentives—ranging from capital grants to R&D funding—are opening doors for new market entrants and expanding the runway for existing players to scale operations. Startups and SMEs with unique IP or localized manufacturing capabilities stand to benefit immensely.