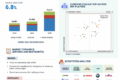

The global Self-Driving Cars Market Size (covering semi-autonomous and autonomous passenger vehicles) is projected to rise from approximately 37,090 thousand units in 2024 to 76,217 thousand units in 2035, representing a CAGR of 6.8% over the period.

This growth is powered by increasing adoption of ADAS features, regulatory pressure for vehicle safety, improved sensor and AI technologies, and the rise of mobility-as-a-service (MaaS) models.

Market Overview: Size & Share Insights

- 2024 estimated volume: 37,090 thousand units.

- 2035 forecast volume: 76,217 thousand units.

- CAGR (2024-2035): 6.8%.

- Regionally, the Asia Pacific region is expected to account for the largest share, supported by strong OEM activity, regulatory support and consumer adoption.

These numbers highlight the long-term scale and gradual nature of mainstream self-driving vehicle adoption — moving beyond pilots into broader volume production.

Key Growth Drivers

- Regulatory mandates & safety standards – Governments are introducing requirements for advanced safety features and autonomous capabilities, pushing manufacturers to integrate semi-autonomous and autonomous functions.

- Advancements in sensor, AI & compute stack – Improved vision systems, LiDAR, radar and AI/edge-compute capabilities are enabling more capable self-driving systems.

- Mobility-as-a-Service (MaaS) growth – Shared autonomous fleets, robotaxis and shuttle services are becoming viable, creating demand beyond personal vehicle ownership.

- Consumer demand for convenience & safety – Drivers and riders increasingly favour vehicles with autonomous features for ease of use, lower fatigue and higher safety.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1220

Trends & Market Opportunities

- Semi-autonomous to autonomous transition (L2 → L3+): The market shows strong momentum in L2/L3 vehicles equipped with more advanced features.

- Shared mobility & fleet deployment: Beyond personal ownership, growth lies in shared fleets, urban mobility services and commercialised autonomous transport.

- Regional leadership by Asia Pacific: Especially China, Japan and South Korea are aggressively advancing testing, deployment and regulation of self-driving cars.

- Sensor & compute value chain growth: As more vehicles deploy self-driving features, sensor, mapping, compute and software providers become key value-chain participants.

- Feature-upgrade & subscription models: OEMs may monetise autonomous feature upgrades via software subscriptions — an emerging business model.

Challenges & Restraints

- High development costs & complexity: Achieving safe, reliable autonomous driving at scale requires significant R&D, sensors, compute, testing and validation.

- Regulatory and infrastructure readiness: Many regions still lack full regulatory frameworks, high-definition mapping, V2X infrastructure and public acceptance.

- Consumer trust & safety concerns: Public trust in autonomous capabilities is evolving; incidents or regulatory setbacks can slow adoption.

- Hardware cost & vehicle economics: Adding autonomous systems increases vehicle cost; making them economical at scale remains a challenge.

Why It Matters to Stakeholders

- For OEMs & Tier-1 suppliers: Self-driving capability is increasingly a product differentiator and future revenue axis (vehicle + feature + service).

- For software/hardware providers: The anticipated growth underlines demand for sensors, AI algorithms, mapping, compute, and validation tools.

- For mobility operators & fleet owners: Autonomous vehicles open pathways to new mobility business models (robotaxi, shuttle services), lower operating costs and increased safety.

- For investors & strategists: Understanding the volume forecast (~76 million units by 2035) helps size the opportunity and identify winners in the ecosystem.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1220

FAQ

Q: How many self-driving cars will be on the road by 2035?

A: The market is projected to reach around 76,217 thousand units by 2035.

Q: What is the expected CAGR of the self-driving cars market from 2024 to 2035?

A: The CAGR is estimated at 6.8%.

Q: Which region leads the self-driving cars market?

A: Asia Pacific is expected to be the largest region by volume and growth.

Q: What are the major drivers for the self-driving cars market?

A: Key drivers include regulatory mandates, sensor/AI improvements, mobility-as-a-service growth and consumer safety/convenience demand.