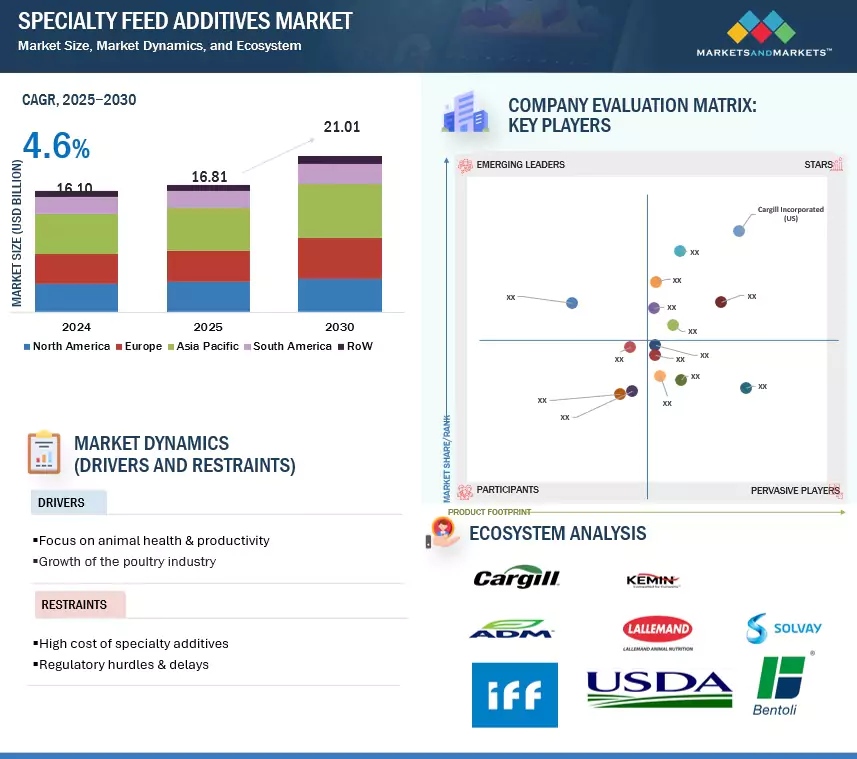

The global specialty feed additives market is on a steady growth path. According to MarketsandMarkets, the market is projected to reach USD 16.81 billion by 2025 and expand further to USD 21.01 billion by 2030, recording a CAGR of 4.6%. This growth is powered by innovations in animal nutrition, with new feed technologies reshaping how livestock health and productivity are managed.

Innovations Fueling Market Growth

The specialty feed additive industry is witnessing rapid advancements in precision feed formulation and nutrient extraction from novel sources such as seaweed, algae, and microbial cultures. These breakthroughs are creating high-quality nutritional solutions that are both efficient and sustainable.

Notably, global giants such as Evonik (Germany) and Nutreco (Netherlands) are investing heavily in research and development. Their efforts are ensuring that specialty feed additives evolve to meet the needs of both large-scale commercial farms and organic producers. This innovation-driven growth is accelerating the shift toward optimized and sustainable livestock production.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72590192

Asia Pacific: The Dominant Market

The Asia Pacific region is set to lead the specialty feed additives market during the forecast period. Several factors drive this dominance:

- Rising livestock production to meet growing protein demand.

- Increasing consumer preference for safe, high-quality animal-derived food.

- Greater emphasis on feed efficiency and animal health.

A major challenge in the region is mycotoxin contamination, which has fueled demand for advanced additives like toxin binders. To address this, Clariant (Switzerland) inaugurated a new toxin binder production line in Cileungsi, West Java, Indonesia, in April 2025. This facility leverages local clay, adheres to Good Manufacturing Practices, and is pursuing FAMI-QS certification. By shifting production closer to its customer base, Clariant aims to ensure faster distribution and tailored support for livestock producers in the region.

Synthetic Sources: Leading the Market Share

Among feed additive sources, the synthetic segment is expected to dominate. Its growth is attributed to:

- Consistency and cost-effectiveness.

- Scalable production and precise formulation.

- Stability and predictable performance are critical for intensive farming systems.

Synthetic additives like probiotics and water disinfectants are widely used across poultry, swine, and ruminants. Furthermore, advancements in chemical synthesis and fermentation are enhancing bioavailability, making synthetic solutions even more effective. As demand for cost-efficient, high-quality feed rises, especially in the Asia Pacific and North America, synthetic sources are expected to maintain their strong position.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=72590192

Liquid Segment: Poised for Faster Growth

The liquid form of specialty feed additives market is projected to grow at the fastest pace. Its popularity stems from:

- Ease of integration into feeding systems.

- Superior dispersion and absorption.

This trend is particularly strong in swine production, where liquid feeding is gaining traction. A notable milestone was the December 2024 approval by Great Britain’s Food Standards Agency (FSA) of Pediococcus acidilactici CNCM I-4622 (BACTOCELL), developed by Lallemand Animal Nutrition. As the first microbial approved to enhance liquid feed hygiene, BACTOCELL reduces pH levels, prevents harmful bacterial growth, and improves gut health—underscoring the rising demand for liquid-format solutions.

Leading Specialty Feed Additives Companies:

Several global leaders are driving the evolution of specialty feed additives. These include:

- Cargill (US)

- ADM (US)

- International Flavors & Fragrances Inc. (US)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Novonesis Group (Denmark)

- Adisseo (France)

- Nutreco (Netherlands)

- Kemin Industries (US)

- Lallemand Inc. (Canada)

- Alltech (US)

- Bentoli (US)

- Neospark Drugs & Chemicals (India)

- Volac International Ltd. (UK)

- Global Nutrition International (France)

- Novus International (US)

These companies are leveraging technological innovation, R&D, partnerships, and acquisitions to strengthen their market presence. Their strategies ensure that they continue to deliver advanced solutions aligned with emerging industry needs.