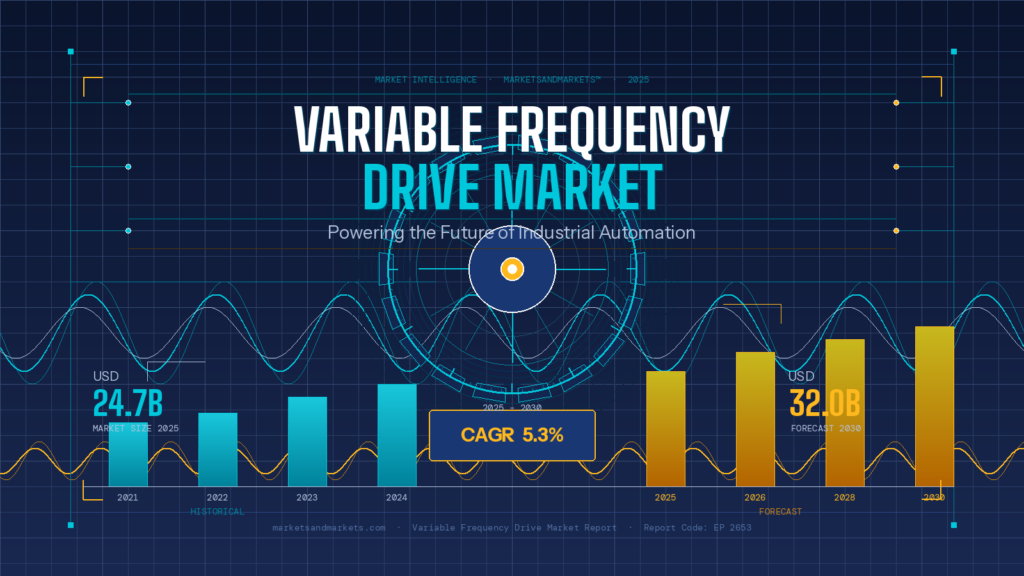

Variable Frequency Drive Market Size and Forecast

The Variable Frequency Drive market is projected to grow from USD 24.7 billion in 2025 to USD 32.0 billion by 2030, registering a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period. This expansion is underpinned by two converging forces: the increasing industrialization of emerging economies and the urgent need to reduce energy consumption across manufacturing, oil and gas, water treatment, and power generation sectors.

Market Size (2025): USD 24.7 Billion

Market Forecast (2030): USD 32.0 Billion

CAGR (2025–2030): 5.3%

These numbers tell a story of quiet but consistent growth — a market that is not chasing hype but is instead anchored in fundamental industrial necessity. Industries worldwide are under mounting regulatory and competitive pressure to maximize motor performance while reducing operating costs, and VFDs are the most proven technology for achieving both simultaneously.

Download PDF Brochure – http://www.marketsandmarkets.com/pdfdownloadNew.asp?id=878

The Variable Frequency Drive market is characterized by intense competition among established industrial giants and innovative challengers, each bringing unique technological capabilities and strategic advantages to the global stage. According to MarketsandMarkets™ research, the competitive landscape features a mix of market leaders executing aggressive product innovation strategies, emerging players expanding manufacturing footprints, and specialized firms carving out niches in high-growth applications. Here is a closer look at the companies defining the future of the VFD industry.

Siemens: Setting the Standard with SINAMICS and Strategic Acquisitions

Siemens stands as one of the most formidable players in the global VFD market, leveraging decades of engineering excellence and a comprehensive portfolio of SINAMICS drives that span low-voltage, medium-voltage, and servo applications across virtually every industrial sector. The company’s drives are renowned for their integration with the Siemens Xcelerator digital business platform, enabling seamless connectivity between motor control systems and enterprise-level automation and analytics infrastructure. This integration positions Siemens drives as critical enablers of Industry 4.0 and smart manufacturing transformations.

In March 2024, Siemens announced a strategic agreement to acquire the industrial drive technology (IDT) business of ebm-papst, a move that significantly strengthens its capabilities in intelligent, integrated mechatronic systems in the protective extra-low voltage range and advanced motion control systems. This acquisition is not merely about expanding product lines—it is about deepening Siemens’ technology stack in areas where precision, compactness, and intelligence are paramount. The ebm-papst IDT business brings expertise in highly efficient motor-integrated drives and innovative control architectures that complement Siemens’ existing SINAMICS portfolio. For industrial customers, this means access to a broader range of solutions that can address increasingly complex motion control requirements in applications ranging from robotics and material handling to process automation and building systems.

Siemens’ strategic focus extends beyond product development to ecosystem building. The company actively collaborates with system integrators, OEMs, and end users to co-develop application-specific solutions that maximize energy efficiency and operational performance. Siemens drives are deployed in some of the world’s most demanding industrial environments—from the steel mills of Asia to the automotive assembly lines of Europe and the oil and gas infrastructure of the Middle East. The company’s ability to deliver reliable, high-performance VFDs at scale, backed by comprehensive service and support networks, makes it a trusted partner for enterprises pursuing long-term operational excellence.

ABB: Innovation in Extreme Environments and Outdoor Applications

ABB is another dominant force in the VFD market, distinguished by its focus on creating drive solutions that perform reliably in the harshest operating conditions. In April 2024, ABB launched a groundbreaking product specifically engineered for outdoor installation and extreme environments in the HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) industry. This drive is certified to UL Type 4X standards, ensuring robust protection against rain, snow, salt spray, dust, corrosion from caustic chemicals and gases, exterior ice formation, high humidity levels, and UV radiation. For industries operating in coastal, desert, or industrial environments where equipment is exposed to aggressive elements, this represents a significant leap forward in reliability and total cost of ownership.

Schneider Electric: Expanding Medium-Voltage Capabilities

Schneider Electric has positioned itself as a leader in energy management and automation, with its Altivar variable frequency drive family serving as a cornerstone of its industrial solutions portfolio. In November 2024, Schneider Electric expanded its Altivar Medium Voltage Drives portfolio with the launch of the Altivar Process ATV6100. This new drive features a significantly more compact design and versatile functionality specifically engineered to improve energy efficiency, optimize industrial processes, and reduce total cost of ownership for end users in sectors such as water treatment, oil and gas, mining, and chemicals.

Danfoss: Recognized for Energy-Efficient Innovation and Strategic Partnerships

Danfoss has earned recognition as a ‘Star’ in the MarketsandMarkets™ Company Evaluation Matrix, reflecting its consistent track record of launching innovative, energy-efficient drive technologies and cultivating strategic partnerships that enhance product competitiveness and customer satisfaction. In June 2024, Danfoss launched its highly anticipated iC2 and iC7 VFD series in India, marking a significant milestone in the company’s strategy to capture growth in one of the world’s fastest-expanding industrial markets. These drives are engineered to operate motors at optimal speeds, delivering substantial energy savings and operational efficiency gains.

Rockwell Automation: Driving Regenerative Energy Innovation

Rockwell Automation is a key player in the VFD market, particularly in North America, where its PowerFlex drive family has become synonymous with reliable, high-performance motor control in industrial and infrastructure applications. A standout example of Rockwell’s technological leadership is the PowerFlex® 755TR regenerative drive, which enabled DSI Inc., an oil and gas operator, to achieve projected energy savings of USD 3 million per month, 17% energy regeneration with 95% reuse efficiency, eligibility for carbon credits, and enhanced reporting on pump performance.

WEG: Emerging Leader with AI-Driven Digital Transformation

WEG has been classified as an ‘Emerging Leader’ in the MarketsandMarkets™ Company Evaluation Matrix, reflecting its rapid ascent in the global VFD market through strategic investments in digital transformation, manufacturing expansion, and technological innovation. WEG’s acquisition of BirminD, a specialist in industrial analytics, sensor diagnostics, and AI-driven process control, has significantly strengthened the company’s capabilities in predictive maintenance, real-time optimization, and intelligent motor management.

Make an Inquiry – https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=878

Key Market Segments: Where the Action Is

By Type: AC Drives Dominate, Servo Drives Surge

The VFD market segments by type into AC Drives, DC Drives, and Servo Drives. AC drives command the largest share because of their superior adaptability, cost-effectiveness, and compatibility with the widest range of industrial applications — from HVAC and pumping systems to conveyor lines and compressors. Their ability to adjust motor frequency based on real operational need makes them the backbone of energy-saving strategies across virtually every sector.

By Voltage: Medium Voltage is the Fastest-Growing Segment

Medium-voltage VFDs — typically deployed for motors operating above 690 V — are experiencing the fastest growth in the market. They are essential for large-scale operations in oil and gas, mining, water treatment, power generation, cement, steel, and chemicals. Their ability to provide precise speed control, extend motor lifespan, lower mechanical stress, and reduce maintenance costs makes them an irresistible investment for industries where operational reliability is non-negotiable.

By Application: Pumps Lead, Compressors are the Growth Star

Pumps represent the largest application segment, owing to their critical role across oil and gas, water and wastewater, mining, chemicals, and pulp and paper industries. However, compressors are the fastest-growing application. VFDs allow compressors to match output to demand dynamically, cutting energy use by up to 50% and extending equipment lifespan — an extraordinary value proposition in industries where compressors operate 24/7.

By Power Rating: Low Power Drives Rule, High Power Drives Rise Fast

Low-power drives (under 6 kW) hold the largest share, driven by massive demand from HVAC, agriculture, water treatment, food and beverage, and light manufacturing. High-power drives, however, are the fastest-growing segment, fueled by modernization and energy-efficiency initiatives in the steel and mining industries, where large-scale equipment demands precise control and maximum efficiency.

By End User: Power Sector Leads; Oil and Gas Surges Back

The power generation sector is the largest end-user of VFDs globally. Utilities and power generators rely on VFDs in draft fans, cooling tower pumps, feedwater pumps, and compressors to optimize internal power consumption. Oil and gas is the second-fastest-growing segment, driven by record capital expenditures in 2024 — particularly in North and Latin America — that are accelerating VFD adoption for drilling operations, pipeline fluid transport, and compressor management.

Request sample pages of the report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=878

Trends and Disruptions Reshaping the VFD Industry

AI and Generative AI Integration

Artificial intelligence is moving from the periphery to the core of VFD technology. AI-driven predictive maintenance algorithms are being embedded directly into drive platforms, enabling systems to anticipate failures before they occur, schedule maintenance proactively, and continuously optimize energy consumption without human intervention. Companies like WEG are already leading this charge — their acquisition of BirminD has strengthened capabilities in industrial analytics, sensor diagnostics, and AI-driven process control.

IoT-Enabled Smart Drives

Connected VFDs that communicate with plant-wide IoT platforms are transforming how industrial facilities manage their energy and maintenance profiles. Real-time data from thousands of drive units can be aggregated, analyzed, and acted upon at a system level — a capability that is redefining what operational efficiency means in a smart manufacturing context.

Renewable Energy Integration and Decentralized Power

As industries integrate renewable energy sources into their operations, VFDs play a critical role in managing the variability and intermittency of solar and wind power. Decentralized power generation models, where facilities generate and manage their own electricity, require sophisticated motor control solutions that only modern VFD platforms can provide.

Gray Market Challenge: Quality and Innovation at Risk

Not all growth trends are positive. The VFD market faces a persistent challenge from gray market players offering low-cost alternatives that undercut pricing but fail to deliver advanced features, after-sales support, or adherence to industrial standards. This dynamic suppresses innovation adoption and creates reliability risks in critical industrial applications. Leading manufacturers are responding through customer education, product authentication programs, and cost-competitive solutions that don’t sacrifice quality.