LiDAR (Light Detection and Ranging) technology has emerged as a transformative tool across a range of sectors—automotive, aerospace, agriculture, urban planning, and more. It enables high-resolution, three-dimensional perception by measuring the time it takes for laser pulses to reflect off surfaces. As LiDAR adoption surges globally, especially in North America, Europe, and Asia-Pacific, understanding the LiDAR market structure by component is essential for stakeholders to identify opportunities and align with technological trends.

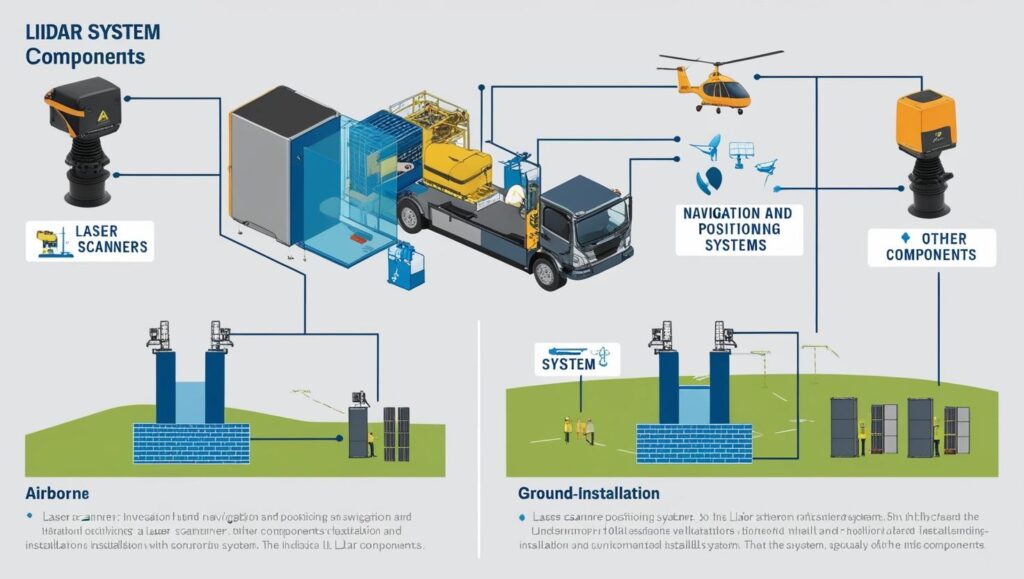

The LiDAR system is a composite of several components working in tandem—laser scanners, navigation and positioning systems, and supporting components such as optics, photodetectors, and processors. Each plays a critical role in defining the performance, accuracy, and reliability of a LiDAR solution.

Laser Scanners: The Core of Distance Measurement

Role and Functionality

The laser scanner is the central component of any LiDAR system. It emits pulses of laser light that bounce back after hitting an object. By calculating the time-of-flight (ToF), the scanner determines distance, enabling the creation of 3D maps or point clouds. These are essential for spatial understanding and object recognition in autonomous systems.

Market Position and Advancements

Laser scanners hold the largest market share among LiDAR components, driven by their indispensable role in data collection. Innovations in this segment are leading to:

Solid-state laser scanners, with no moving parts, ideal for automotive and mobile applications due to their compactness and durability.

MEMS-based scanners (Microelectromechanical Systems), which are highly miniaturized and suitable for consumer electronics and small drones.

High-power, multi-wavelength lasers, offering greater penetration in dense vegetation and more accurate classification in geospatial surveys.

With the proliferation of autonomous vehicles and drones, demand for high-performance, cost-effective scanners continues to grow, pushing manufacturers to prioritize scalability and precision.

Navigation and Positioning Systems: Anchoring Spatial Accuracy

Purpose and Components

Navigation and positioning systems in LiDAR include Global Navigation Satellite Systems (GNSS), Inertial Measurement Units (IMUs), and sensor fusion modules. These ensure that every laser data point is accurately georeferenced with time, location, and orientation information—especially important in mobile, aerial, and vehicle-mounted LiDAR systems.

Industry Trends

This component segment is growing rapidly due to:

- High-accuracy IMUs that improve location precision even when GPS signals are lost, such as in tunnels or dense urban areas.

- Sensor fusion technologies that combine IMU, GPS, and wheel odometry for robust positional tracking.

- Lightweight and power-efficient modules, essential for drone-based LiDAR where payload and battery are critical constraints.

- Accurate navigation is crucial for aligning point cloud data to real-world coordinates, making this component particularly vital in surveying, mapping, and autonomous navigation.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1261

Supporting Components: Enabling Performance and Versatility

Overview and Types

Other critical components in a LiDAR system include photodetectors, optical systems, beam steering mechanisms, signal processors, and power management circuits. While these may not receive as much attention as scanners or GNSS units, they are key to ensuring overall performance, reliability, and adaptability.

Notable Innovations

Photodetectors like Avalanche Photodiodes (APDs) and Silicon Photomultipliers (SiPMs) are improving sensitivity, enabling better detection of weak signals over long distances.

Optical phased arrays (OPAs) and electro-optic beam steering are emerging as cutting-edge technologies for solid-state beam steering, crucial for eliminating mechanical parts.

Custom ASICs (Application-Specific Integrated Circuits) are enhancing onboard processing capabilities, allowing real-time data analysis at the sensor level (edge computing).

These innovations are enabling LiDAR systems to become smaller, faster, and more power-efficient—opening new doors for consumer electronics, wearable technology, and IoT applications.

Component-Wise Market Dynamics

Each component plays a unique role in shaping the broader LiDAR market:

Laser Scanners are expected to continue dominating due to their foundational function and evolving use in automation and safety applications.

Navigation Systems are seeing significant demand growth in automotive and drone-based solutions, where real-time location tracking is non-negotiable.

Supporting Components are gaining momentum as systems evolve to prioritize compact, lightweight, and integrated designs for next-generation devices.

The overall LiDAR Industry worth $3.7 billion by 2029, with a compound annual growth rate (CAGR) of 18.2% , driven by increased adoption in transportation, smart infrastructure, defense, and environmental monitoring.

Application-Specific Component Trends

Automotive

The push toward autonomous vehicles has made LiDAR a core technology in the automotive space. Solid-state laser scanners and compact navigation modules are critical for ADAS (Advanced Driver Assistance Systems) and full self-driving functionalities.

Aerial Mapping and Surveying

For drone and aircraft-mounted LiDAR systems, lightweight yet high-accuracy laser and navigation components are crucial. Surveyors also benefit from real-time kinematic (RTK) GPS modules and gyroscopically stabilized platforms.

Industrial and Robotics

Factory automation, warehouse robotics, and perimeter security systems rely on rugged, fast-response LiDAR systems. Low-latency sensors and real-time processing units are essential for these high-speed environments.

Consumer Devices

Emerging applications in smartphones (e.g., Apple’s LiDAR-equipped iPhones), AR/VR, and home automation require ultra-compact sensors with low power requirements and seamless integration with other onboard technologies.

Breaking down the LiDAR market by component offers deep insights into where the industry is headed and where innovation is concentrated. While laser scanners form the core of data acquisition, navigation systems ensure precision, and supporting components enhance performance and integration. Together, they are driving LiDAR into new sectors and scaling its adoption across both professional and consumer markets.

As the technology continues to mature, component-level advancements will be key to unlocking more scalable, accessible, and versatile LiDAR solutions. For investors, developers, and adopters alike, understanding this component ecosystem is essential for staying competitive in a rapidly evolving landscape.