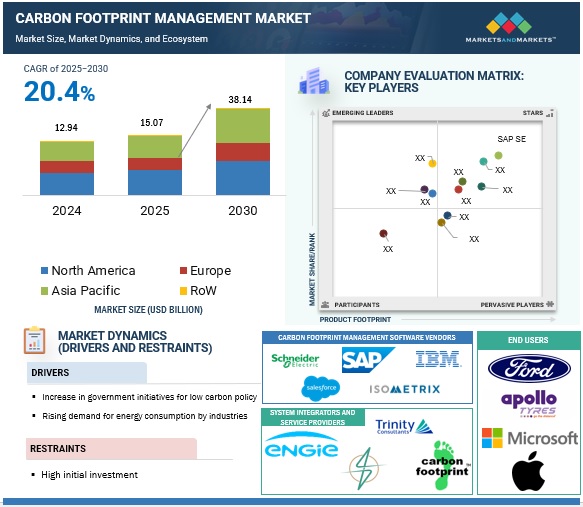

According to a research report “Carbon Footprint Management Market by Component (Solutions, Services), Deployment Mode (On-premises, Cloud), Organization Size (Corporate Enterprises, Mid-Tier Enterprises, Small Businesses), Vertical, and Region – Global Forecast to 2030″, the global carbon footprint management market is anticipated to reach USD 15.07 billion in 2025 and USD 38.14 billion by 2030, growing at a CAGR of 20.4% during the forecast period. The increase in demand for energy consumption from industries and the drive for more sustainable energy solutions propel the global carbon footprint management market. Moreover, an increase in government initiatives and policies for low-carbon policies positively impacts the growth of the carbon footprint management market.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136375712

The corporate enterprises segment is expected to capture the largest share of the carbon footprint management market in 2030

By organization size, the corporate enterprises segment is expected to account for the largest share of the carbon footprint management market in 2030. Large corporate enterprises are among the early adopters of carbon management solutions due to the large size of their facilities and increased focus on sustainability. Governments of various countries and environmental protection bodies closely monitor carbon emissions of these enterprises and their compliance with norms. These factors contribute to the deployment of carbon management systems across enterprises.

By vertical, the financial services segment is expected to record the highest CAGR in the carbon footprint management market between 2025 and 2030

The financial services segment, by vertical, is expected to grow at the highest CAGR from 2025 to 2030. Financial institutions focus on low-carbon transition opportunities and are rapidly engaging in supporting and leading the transition to a low-carbon world. The evolving approaches, technologies, and methods used to quantify the emission intensity of their lending and investment activities are of intense interest. Quantifying financed emissions is a tangible first step toward building trust that financial institutions are integrating climate change into their core business of providing capital.

Europe is expected to be the second-largest carbon footprint management market between 2025 and 2030

Europe is projected to be the second-largest market between 2025 and 2030. This is due to strict regulations, new technology, and active government efforts. This market shows strong momentum compared with global and other regional markets. Key trends underpinning this expansion include the rapid adoption of cloud-based carbon management solutions and the integration of artificial intelligence and blockchain technologies for more accurate emissions tracking and transparency. The stringent climate policies, such as the EU Emissions Trading System (ETS), have also incentivized businesses to adopt advanced carbon accounting and verification frameworks, transforming carbon emissions from a compliance burden into a driver for innovation and efficiency in the region.

Ask Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=136375712

Key Market Players

To enable an in-depth understanding of the competitive landscape, the report includes profiles of some of the leading players, such as Schneider Electric (France), SAP SE (Germany), IBM (US), Salesforce, Inc. (US), and ENGIE (France), along with other prominent manufacturers of carbon footprint management.