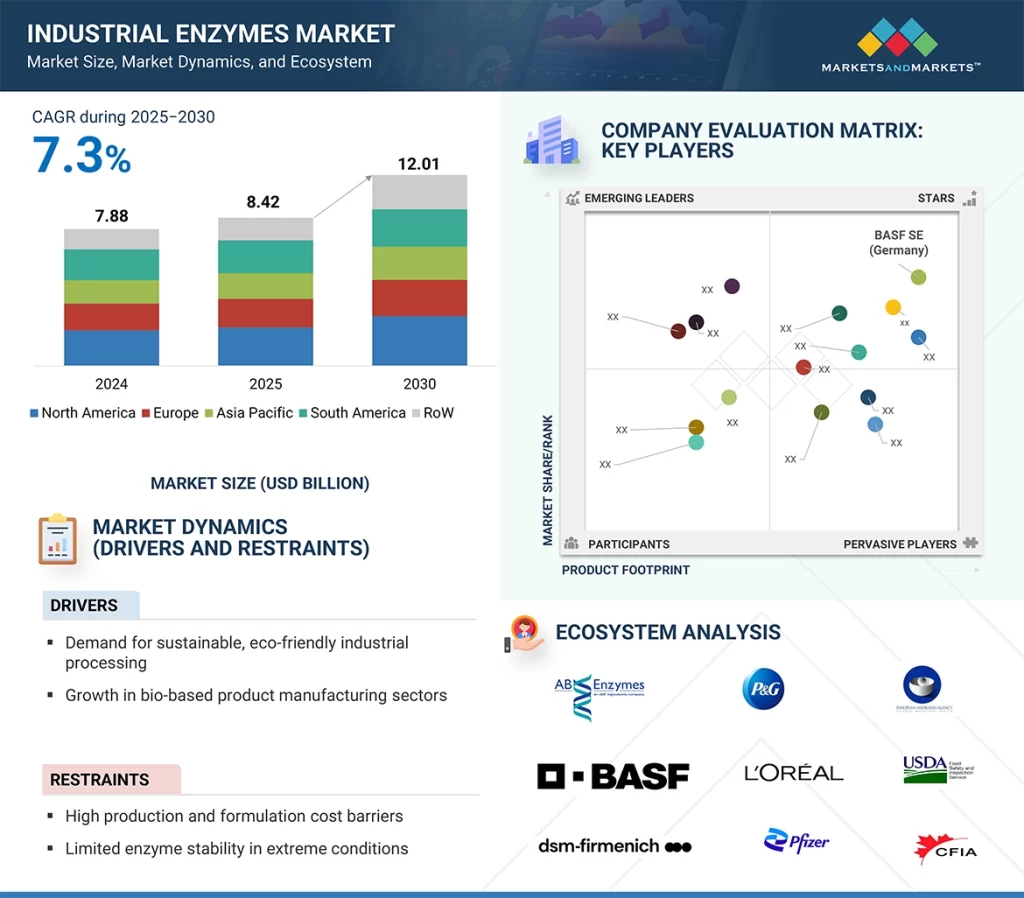

The global industrial enzymes market is projected to grow from USD 8.42 billion in 2025 to USD 12.01 billion by 2030, at a CAGR of 7.3% during this period. This growth is driven by rising demand for sustainable, efficient, and cost-effective processing solutions across core manufacturing sectors. As industries face increasing pressure to reduce environmental impact, enzymes offer a bio-based alternative to traditional chemical processes, operating under mild conditions while lowering energy and water consumption. Industries such as food & beverage, textiles, bioethanol, detergents, and wastewater treatment are increasingly adopting enzyme-based processes to improve product quality, enhance yields, and comply with stricter regulations. Advances in enzyme engineering, fermentation technology, and immobilization methods are expanding their performance and applicability even under challenging industrial conditions.

Additionally, the global shift toward circular economy models and bio-based production—supported by government initiatives in regions like Europe, India, and Southeast Asia—is further accelerating enzyme adoption. With demand for cleaner and more efficient manufacturing rising, industrial enzymes are becoming central to future industrial value chains worldwide.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237327836

Microorganisms Lead the Source Segment

Microorganism-derived enzymes hold the largest share of the industrial enzymes market due to their high efficiency, scalability, and versatility across diverse applications. Enzymes from bacteria and fungi—particularly Bacillus and Aspergillus species—perform effectively across a broad range of temperatures and pH levels, making them suitable for food processing, bioethanol, detergents, and textiles. Microbial fermentation allows for large-scale, cost-efficient production with consistent quality and high yield. Genetic modifications can further enhance enzyme specificity, stability, and activity, enabling tailored solutions for specific industrial needs. Continuous innovations in strain development and fermentation technology strengthen the commercial viability of microbial enzymes. Compared to plant- or animal-derived enzymes, microbial enzymes face fewer supply chain constraints and are easier to standardize, aligning closely with sustainability, efficiency, and regulatory compliance requirements.

Wastewater Treatment Emerges as the Fastest-Growing Application

The wastewater treatment segment is experiencing rapid growth, fueled by stringent environmental regulations and the global demand for sustainable water management. Enzymes provide an eco-friendly alternative to traditional chemical treatments, efficiently breaking down organic pollutants, fats, oils, and complex compounds in municipal and industrial effluents. This reduces chemical usage, minimizes sludge production, lowers disposal costs, and improves treatment efficiency. Growing industrialization and urbanization have increased wastewater volume and complexity, driving the need for advanced enzymatic solutions. Innovations in enzyme engineering have produced robust enzymes capable of operating under diverse environmental conditions, enhancing their applicability across multiple treatment scenarios.

A notable development in May 2025 saw researchers at the National Institute of Technology, Rourkela (NIT-R), introduce a sustainable wastewater treatment system using sunlight and reusable spherical concrete beads as photocatalysts. This approach achieved over 82% reduction in Chemical Oxygen Demand (COD) under sunlight and maintained over 90% efficiency after 15 reuse cycles, eliminating the need for artificial UV light and offering an energy-efficient solution suitable for rural or resource-constrained regions. The findings were published in the Journal of Water Processing Engineering, with two patents filed.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=237327836

Asia Pacific Dominates the Market

Asia Pacific is the leading region in the industrial enzymes market, driven by rapid industrialization, growing manufacturing sectors, and stricter sustainability regulations. Countries including China, India, and Southeast Asian nations are witnessing strong growth across food & beverage, textiles, biofuels, and wastewater treatment. Rising urbanization and consumer demand for processed foods are boosting food-grade enzyme consumption, while environmental concerns are driving the adoption of enzyme-based water treatment solutions. Government support for biotechnology and bioeconomy initiatives, such as India’s BioE3 policy launched in August 2024, has accelerated local enzyme production and innovation. Additionally, low-cost raw materials, skilled labor, and favorable investment environments are attracting global players to establish production and R&D facilities in the region.

In a significant industry development, Novus International, Inc. acquired U.S.-based BioResource International, Inc. in March 2024, gaining its products, intellectual property, and facilities. This acquisition enhances Novus’ innovation pipeline and expands its offerings in feed additives for animal health and profitability.

Leading Industrial Enzymes Companies:

Prominent players in the industrial enzymes market include BASF SE (Germany), International Flavors & Fragrances Inc. (US), DSM-Firmenich (Switzerland), Kerry Group plc (Ireland), Dyadic International Inc. (US), Advanced Enzyme Technologies (India), Aumgene Biosciences (India), Amano Enzyme Inc. (Japan), Associated British Foods plc (UK), Novozymes A/S (Denmark), F. Hoffmann-La Roche Ltd (Switzerland), Codexis, Inc. (US), Sanofi (France), Merck KGaA (Germany), and Adisseo (China).