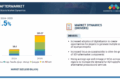

The automotive piston market is projected to grow from USD 2.46 billion in 2025 to USD 2.79 billion by 2035, at a CAGR of 1.3% during the forecast period.

The growth of the automotive piston market is driven by steady global demand for internal combustion engine vehicles, stringent emissions norms, and a focus on fuel efficiency. Asia Pacific holds the largest market share, with rising demand for GDI engines in countries like India, Japan, and China pushing pistons to be designed for higher pressures and temperatures, resulting in a shift toward advanced materials.

“The piston heads segment is estimated to hold the largest share of the OE market during the forecast period”

Piston heads form a significant part of all gasoline, diesel, and alternate fuel passenger and commercial vehicles. They bear the brunt of high pressure and temperature and are, hence, made of special heat-resistant alloys.

With the rise of GDI engines, there is an increasing demand for lighter aluminum alloy piston heads in light-duty vehicles. Conversely, diesel engine pistons are generally heavier, omega-shaped, and made from steel. Manufacturers are focusing on lightweight materials and advanced coatings for piston head production to enhance thermal management and reduce CO2 emissions. Flat-top piston heads are preferred in gasoline vehicles for their efficiency in combustion and air-fuel mixture, which has contributed to their large market share. With growing gasoline vehicle sales in developing countries, the demand for flat-top piston heads and lightweight aluminum alloys is expected to increase due to their high thermal conductivity and favorable strength-to-weight ratio.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=83425882

“Aluminum pistons are estimated to hold the largest share of the automotive piston market in 2025”

Aluminum pistons hold the largest share of the automotive piston market due to their lightweight nature, excellent thermal stability, and favorable strength-to-weight ratio. These features are crucial for regular-use engines, aiding in optimal combustion and performance in both standard and turbocharged vehicles. Their popularity is also rising in heavy commercial vehicles because they can handle high loads and temperatures. Additionally, manufacturers are investing in advanced technologies like hypereutectic aluminum alloys and coatings to boost durability and efficiency. As vehicle production and sales grow, the demand for aluminum pistons is expected to increase.

“The heavy commercial vehicles segment is projected to register the fastest growth during the forecast period”

The heavy commercial vehicles segment, comprising medium & heavy trucks, buses, and coaches, is expected to witness the highest CAGR during the forecast period. Nearly 90% of heavy vehicles are driven by diesel engines (6 & 8 cylinders) worldwide. The demand for heavy commercial vehicles continues to rise due to increasing government spending on infrastructure and growing logistics and transportation industries. Asia Pacific led the production of heavy commercial vehicles with over 75% across the globe in 2024. Heavy commercial vehicle engines require efficient and durable pistons capable of withstanding heavy loads and high temperatures. Currently, aluminum alloy pistons lead in the installation rate. Several European OEMs, including Mercedes-Benz, Scania, and Volvo Trucks, are using high-tech steel pistons to enhance efficiency in their heavy commercial vehicles. Piston manufacturers like Mahle GmbH and Rheinmetall AG are also developing these advanced steel pistons. This trend in the US, Canada, and Europe is expected to boost demand for steel alloy pistons.

“North America is estimated to be the second-largest automotive piston market”

According to OICA, North America produced 11.3 million cars and 4.3 million LCVs in 2024. There is a significant shift towards SUVs and pickup trucks, which typically use more powerful engines requiring durable pistons. The US, the largest market for these vehicles, influences piston demand, with mid-size and full-size models featuring 3 to 8-cylinder engines. As the number of SUVs and pickup trucks increases, so will the demand for pistons.

The US is increasingly focusing on alternative fuel technologies like ethanol-mix gasoline and biodiesel to reduce CO2 emissions instead of solely relying on vehicle electrification. This emphasis, along with the rising production of heavy commercial vehicles, is expected to boost demand for advanced piston technologies in alternate fuel vehicles.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=83425882