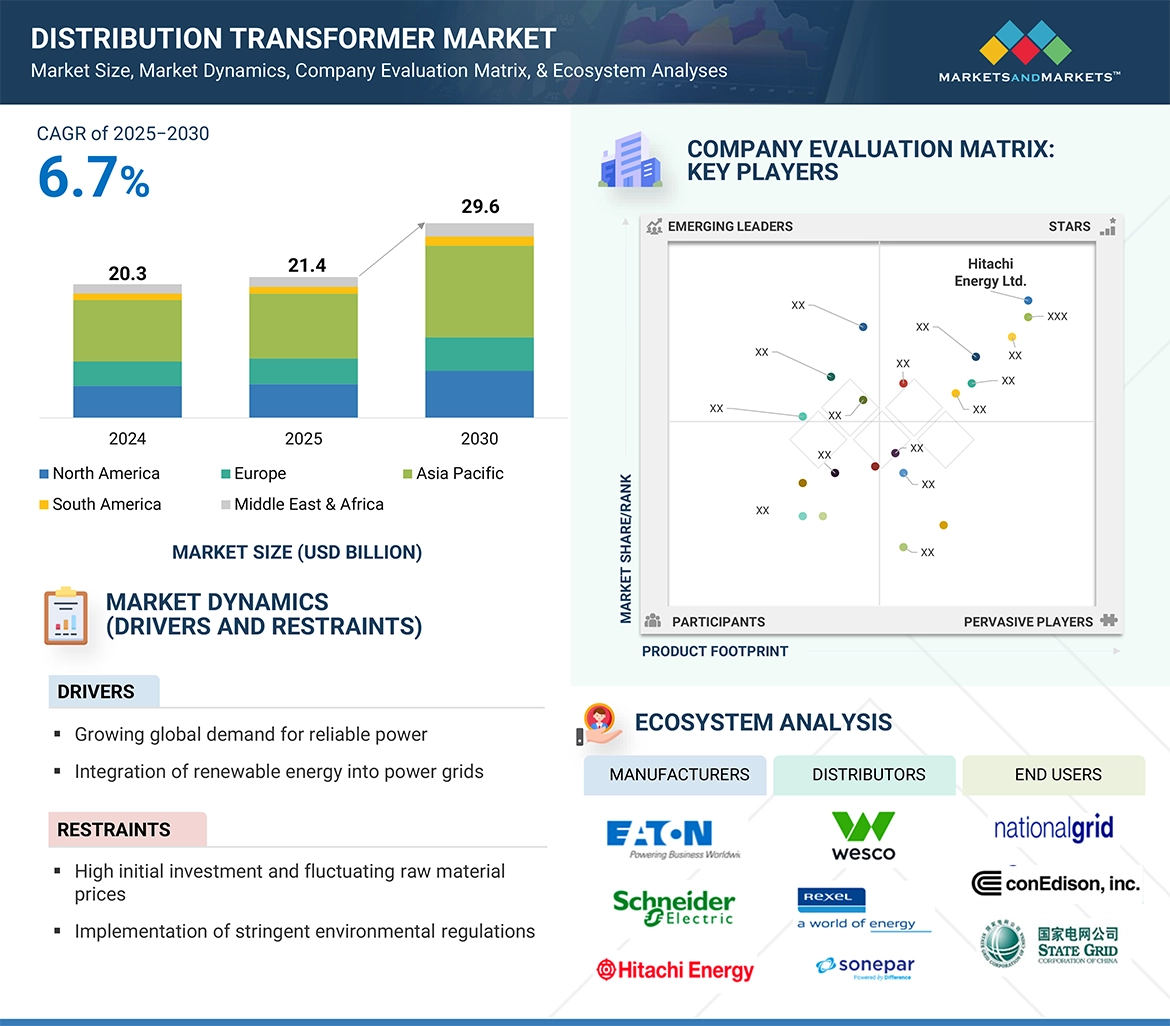

According to a research report “Distribution Transformer Market by Mounting (Pad, Pole, Underground), Phase (Three and Single), Power Rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, above 10 MVA), Insulation (Oil-immersed, Dry), End User, and Region – Global Forecast to 2030″, the distribution transformer market is projected to reach USD 21.4 billion by 2025 to USD 29.6 billion by 2030 with a CAGR of 6.7%.

The global distribution transformer market is expected to experience robust growth from 2025 through 2030, driven by escalating demand for efficient, effective, and cost-saving power distribution infrastructure in urban and rural settings. With the fast pace of industrialization, growing urban populations, and the sped-up electrification of rural and remote areas, especially in emerging markets, utilities and governments are stepping up investment in expanding and upgrading distribution networks. The increasing use of renewable energy sources like wind and solar power also puts more focus on grid stability and distributed power control, hence driving the need for high-performance distribution transformers. These transformers are critical to performing voltage regulation as well as to providing consistent delivery of power from the substations to end consumers. Additionally, the growing use of electric vehicles, smart meters, and smart grid-connected energy systems is driving the roll-out of digital and energy-efficient transformer products. Governments globally are placing higher emphasis on grid reliability and smart grid deployment, compelling utilities to deploy sustainable, high-performance transformer technologies. In regions such as Asia Pacific, where extensive infrastructure growth and urbanization are taking place, the distribution transformer market will rise considerably, providing good opportunities for multinational and regional producers.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85091015

Oil-immersed segment to account for larger market share throughout forecast period.

Oil-immersed distribution transformers are likely to maintain a higher market share during the forecast period because of their established reliability, better cooling efficiency, and economic viability, particularly in high-load as well as outdoor applications. These transformers employ mineral oil or biodegradable substitutes as insulator as well as cooling agents and, therefore, can perform efficiently at higher stress and thermal loads. Their strong construction makes them especially well-suited for utility grids, industrial plants, and regions of varying environmental conditions. In contrast to dry-type transformers, oil-immersed transformers have a longer lifetime, reduced installation expenses, and greater overload capability, rendering them the preferred choice in developing economies where large-scale grid expansion and rural electrification are in progress. Also, new oil purification technologies and environmentally friendly insulating oils have mitigated past issues of environmental concerns and fire risks, thus solidifying their entrenched leadership in both new installations and replacement in medium- and low-voltage grids. Therefore, utilities and transmission operators worldwide prefer the use of oil-immersed transformers for reliable and economical power supply solutions.

Pad-mounted segment to account for largest market share throughout forecast period.

Pad-mounted distribution transformers are expected to hold the lion’s share of the overall distribution transformer market during the forecast period due to their smaller size, safety features, and quick installation in urban and suburban areas. Sealed in tamper-proof steel enclosures and mounted at ground level on concrete pads, such transformers suit residential areas, commercial establishments, and light industry use where an underground power supply is prevalent. Their enclosed design offers improved shielding against environmental conditions like moisture, dust, and vandalism, making them low-maintenance and extremely dependable over long service periods. Utilities prefer pad-mounted transformers for safety purposes as the live parts are not exposed, limiting accidental contact or fire. In addition, as urbanization speeds up, the need for decentralized, space-effective, and visually acceptable power distribution systems continues to grow. These are complemented by increased spending on smart grid infrastructure and underground power systems, which further solidify pad-mounted transformers’ long-term dominance in the global market.

Asia Pacific to lead global distribution transformer market during forecast period.

Asia Pacific will dominate the worldwide distribution transformer market throughout the forecast period owing to high urbanization, strong industrialization, and massive investments in power infrastructure in countries such as China, India, Japan, and Southeast Asian countries. The region is experiencing an unprecedented surge in electricity demand owing to population expansion, growth in residential and commercial sectors, and increasing use of electric vehicles and alternative energy sources. Regional governments are making substantial investments in grid modernization, rural electrification schemes, and renewable integration, all of which entail extensive deployment of high-efficiency distribution transformers. For example, India’s “Power for All” program and China’s efforts to upgrade aging grid infrastructure are driving large-scale deployments of new transformers. In addition, the growth of data centers, manufacturing facilities, and infrastructure development under initiatives such as China’s Belt and Road Initiative also adds to the demand in the region. The availability of a number of local manufacturers with cost-competitive solutions further aids market growth, making Asia Pacific the most dynamic and fastest-growing distribution transformer market.

Ask Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=85091015

Key Players

Some of the major players in the distribution transformer market include Hitachi Energy Ltd. (Switzerland), Eaton (Ireland), Siemens Energy (Germany), Schneider Electric (France), and Toshiba Energy Systems & Solutions Corporation (Japan). Firms in this industry are aggressively engaged in strategic efforts, such as innovation, strategic partnerships, capacity buildups, and geographic expansion, to enhance their market share and meet changing grid requirements. With worldwide momentum gaining pace on grid modernization, rural electrification, and the installation of renewable energy, these players are committed to working on next-generation transformer solutions in the form of dry-type transformers and smart transformers, which are compact, energy efficient, and have digital monitoring features. Industry leaders are partnering with governments, utilities, and OEMs to deliver transformers that are well-equipped to achieve changing performance, safety, and sustainability requirements. The convergence of predictive maintenance, IoT sensors, and condition monitoring is being given a higher level of priority to facilitate smart grid development. Further, investments in local manufacturing facilities, especially in faster-growing areas such as Asia Pacific, and customized solutions for distributed generation and urban infrastructure initiatives are making these players address local regulatory requirements, compress delivery lead times, and address a larger customer base in industrial, commercial, and utility segments.