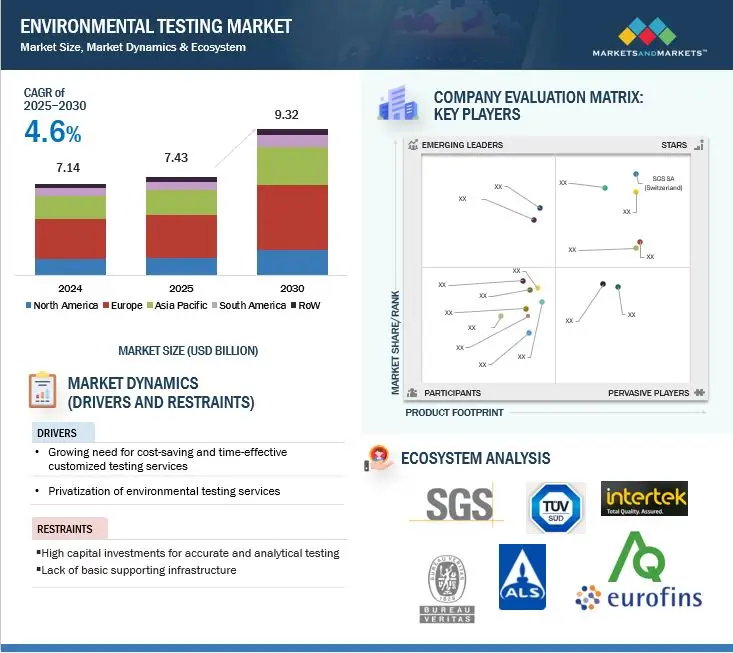

The global environmental testing market is projected to expand from USD 7.43 billion in 2025 to USD 9.32 billion by 2030, at a CAGR of 4.6% during the forecast period. The environmental testing market is expanding at a high rate. This growth is attributed to more stringent pollution control policies, increased emphasis on sustainability, and increasing health concerns for the public. With growing air, water, and land contamination, the demand for precise and effective testing has never been higher. Technological innovations such as automation, analytics powered by artificial intelligence, and high-accuracy sensors are speeding up testing and making it more accurate. Moreover, industrialization, urbanization, and infrastructure development create demand for environmental testing services, particularly in developing markets.

Environmental Testing Market Drivers

- Growing Environmental Concerns: The rise in pollution levels and environmental degradation has led to a global push for more rigorous environmental testing. Government bodies, businesses, and organizations are more focused than ever on reducing their carbon footprint, managing waste, and complying with environmental standards.

- Stringent Regulations and Standards: Governments across the globe are tightening environmental regulations, making environmental testing crucial for industries like manufacturing, construction, and agriculture. For instance, environmental protection agencies like the U.S. EPA and the European Environment Agency (EEA) are enacting policies that mandate regular testing to maintain air and water quality.

- Technological Advancements: The development of more accurate and faster testing methods, such as automated sampling techniques, real-time monitoring, and advanced analytical instruments, is driving the efficiency of environmental testing. This has made it easier for companies to perform tests regularly and on a larger scale.

- Sustainability Initiatives by Companies: Many businesses are implementing sustainability programs and environmental risk assessments to enhance their brand image and comply with consumer demand for greener products and services. This corporate responsibility encourages companies to invest in environmental testing services.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=95098120

Organic Compounds Segment Leading the Environmental Testing Market

The organic compounds segment has emerged as the dominant force in the environmental testing market during the study period. This trend is expected to continue, driven by the widespread presence and hazardous nature of volatile organic compounds (VOCs), pesticides, hydrocarbons, and industrial solvents. These substances contribute significantly to air, water, and soil pollution, posing serious risks to human health and the environment. As a result, regulatory bodies such as the EPA, EEA, and WHO have enforced strict monitoring requirements. The increased use of pesticides in agriculture, petrochemicals in the oil & gas sector, and solvents in manufacturing has further heightened contamination concerns. These factors are fueling demand for advanced and specialized environmental testing services.

Rapid Testing Technologies Gaining Traction

Within the technology segment, rapid testing methods are gaining a larger market share and are projected to grow at the highest compound annual growth rate (CAGR). This surge is driven by the demand for cost-effective, real-time, and highly efficient testing solutions. Traditional laboratory-based methods are often time-consuming and expensive, creating a strong need for quicker, on-site alternatives. Technologies such as biosensors, immunoassays, spectroscopy, and portable analytical instruments enable fast and accurate testing, significantly reducing turnaround times. Strict regulatory frameworks necessitate frequent environmental monitoring, and industries such as oil & gas, manufacturing, agriculture, and wastewater management benefit from rapid testing to ensure timely compliance with evolving standards. Additionally, the growing threat of chemical spills, industrial emissions, and water contamination is accelerating the adoption of real-time monitoring technologies.

North America Maintains a Dominant Regional Position

North America holds a prominent share of the global environmental testing market. This leadership is underpinned by stringent regulatory standards, advanced testing technologies, and a well-established industrial infrastructure. Agencies like the U.S. Environmental Protection Agency (EPA), the Canadian Environmental Protection Act (CEPA), and the Occupational Safety and Health Administration (OSHA) mandate rigorous testing of environmental pollutants across air, water, and soil. Key sectors—such as manufacturing, oil & gas, pharmaceuticals, agriculture, and waste management—must adhere to these standards, driving strong demand for environmental testing services. The region is also home to major players in the market, including SGS North America, Eurofins Scientific, Intertek, and Mérieux NutriSciences Corporation, further reinforcing its market position.

Leading Environmental Testing Companies:

The report profiles key players such as SGS SA (Switzerland), Bureau Veritas (France), Eurofins Scientific (Luxembourg), Intertek Group Plc (UK), TÜV SÜD (Germany), AsureQuality (New Zealand), ALS Limited (Australia), Mérieux NutriSciences Corporation (US), Microbac Laboratories, Inc. (US), Envirolab Services Pty Ltd (Australia), and R J Hill Laboratories Limited (New Zealand).