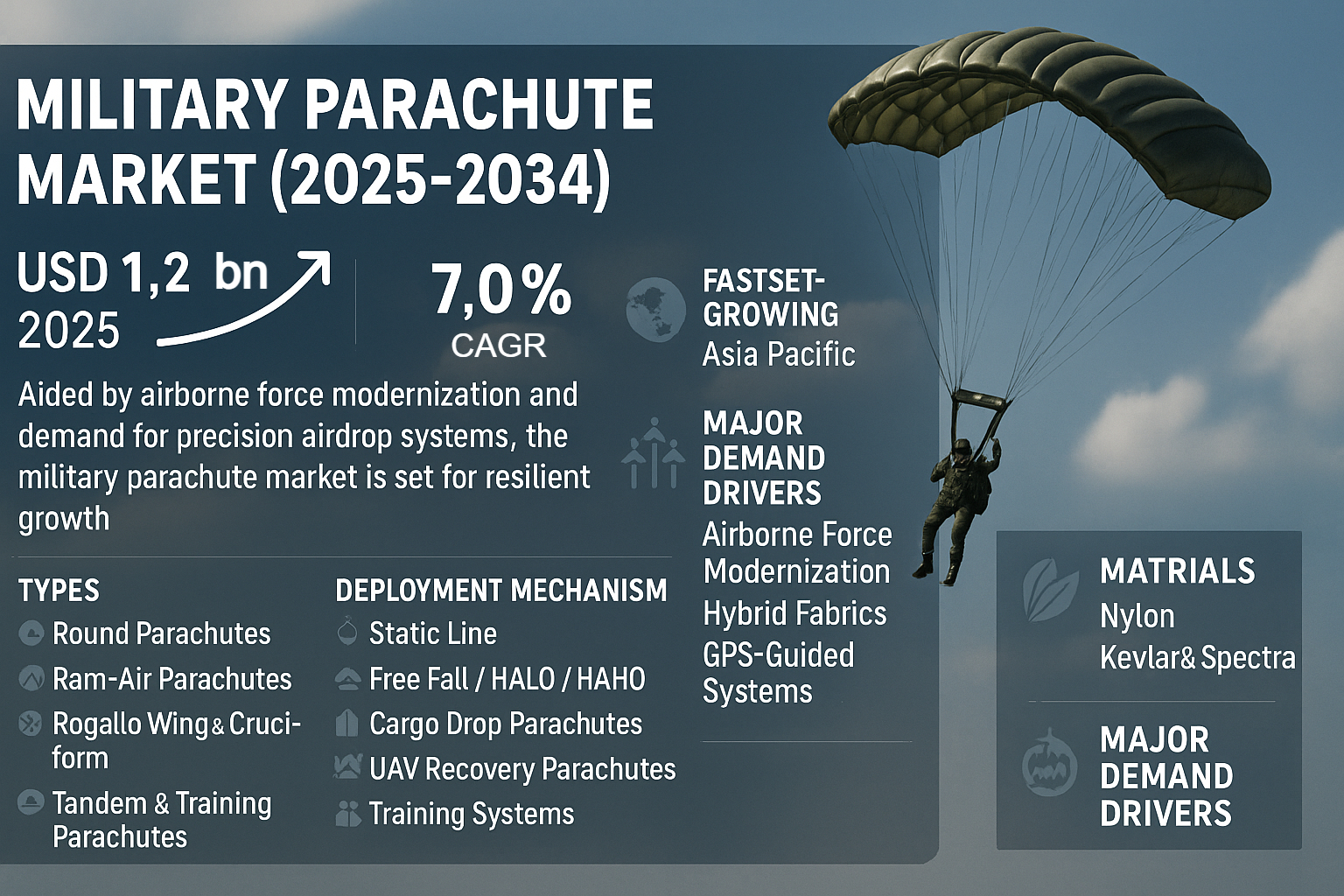

The Military Parachute Market is entering a decade of accelerated transformation as armed forces modernize airborne brigades, expand special operations capabilities, and push for more precise, survivable airdrop solutions. Valued at around USD 1.2 billion in 2025 and projected to reach approximately USD 2.4 billion by 2034, the Military Parachute Market is expected to grow at close to a CAGR of ~7.0%. This growth reflects a shift from legacy round canopies to agile ram air systems, from simple fabric-and-lines to intelligent, sensor enabled platforms that can support complex operational concepts such as high altitude, long range infiltration and autonomous cargo resupply.

At its core, the Military Parachute Market provides one of the few capabilities that can insert troops, vehicles, ammunition, humanitarian supplies and unmanned systems without any dependence on airfields, ports or friendly infrastructure. In an era of contested logistics and anti access/area denial threats, that flexibility is strategically priceless. Parachutes are evolving from simple descent devices into guided, data rich delivery systems, tightly integrated with aircraft avionics, mission planning tools and soldier worn equipment.

Market Overview and Strategic Context

The Military Parachute Market sits at the intersection of several long term defense trends. First, many countries are revitalizing airborne and rapid reaction formations after decades of focus on counter insurgency. Second, high end conflict scenarios and grey zone operations have increased demand for stealthy, dispersed insertion techniques such as HALO and HAHO, which rely on advanced ram air parafoils and integrated oxygen and navigation systems. Third, military logisticians are increasingly using precision airdrop and parachute recovery techniques to support forward units, recover high value UAVs or sensor pods, and deliver relief supplies in disaster zones where fixed infrastructure is damaged or absent.

The Military Parachute Market therefore spans more than personnel parachutes. It includes cargo airdrop systems, extraction parachutes, emergency and ejection seat parachutes, UAV and loitering munitions recovery chutes, and training and tandem systems used by instructors. Underpinning all of these are innovations in fabric technology, canopy aerodynamics, barometric sensors, automatic activation devices and digital manufacturing techniques.

Key Growth Drivers in the Military Parachute Market

One of the strongest growth drivers is the expanding scope of airborne and air mobility operations. Major powers and regional players alike are investing in airborne brigades and special operations forces that can deploy across theaters on short notice. Every new airborne battalion or company translates into recurring demand for main and reserve parachutes, training canopies, emergency parachutes and associated harness and container systems. This recurring demand anchors the Military Parachute Market in long term modernization roadmaps.

Precision and steerability form another critical driver. Traditional round parachutes are robust and simple but offer limited control over landing point and descent profile. Modern ram air parafoils, by contrast, give jumpers the ability to glide considerable distances from the release point, choose landing zones with greater precision and reduce the risk of injury. When enhanced with GPS guided systems, these parafoils become even more capable, turning the Military Parachute Market into a key enabler of precision insertion and precision resupply.

Material innovation is reshaping performance envelopes across the Military Parachute Market. Lightweight synthetic fibers such as Kevlar, Spectra and Dyneema offer higher strength-to-weight ratios, lower bulk and improved resistance to abrasion and UV damage compared with traditional nylon. These materials allow designers to shrink pack volumes, reduce all up soldier load and increase payload capability for cargo systems. Hybrid fabrics blending carbon and advanced polyamides are emerging to further improve durability, thermal resistance and signature management.

Modernization initiatives within established airborne forces also drive significant replacement cycles. Armies and air forces in the United States, France, India, China, the United Kingdom and many other countries are retiring aging round canopy fleets and procuring high performance tactical parachutes, often with modular harness systems and integrated AADs. Each modernization wave sustains steady growth in the Military Parachute Market across multiple segments, from personnel to cargo and emergency systems.

Finally, the emergence of UAV and payload recovery applications is opening fresh demand. As militaries rely on unmanned aircraft for surveillance, strike and electronic warfare, they increasingly want non destructive recovery options for valuable platforms and sensor payloads. Recovery parachutes for UAVs, loitering munitions and expendable sensors are becoming a small but fast growing niche within the Military Parachute Market.

To Know About the Assumptions Considered for the Study Download the PDF Brochure

Challenges and Restraints

The Military Parachute Market faces significant certification and safety testing hurdles. Every new fabric, line material, harness design or deployment mechanism must withstand extensive environmental, fatigue and live jump testing before being cleared for operational use. This process is expensive and time consuming, and it can slow the introduction of promising technologies.

Maintenance and recertification impose another constraint. Parachute systems must be inspected, dried, packed and tested on strict cycles. Large military users handling tens of thousands of canopies bear ongoing costs for rigging facilities, specialist manpower and quality assurance. This recurring burden shapes how procurement authorities structure contracts in the Military Parachute Market, often favoring systems that reduce inspection time, extend service intervals or support condition based maintenance.

Emerging markets also struggle with a shortage of experienced riggers and maintainers. Introducing sophisticated HALO/HAHO and ram air systems requires training pipelines, doctrine updates and safety culture development. Without sufficient rigging personnel, even the best systems in the Military Parachute Market cannot deliver their full capability.

Opportunities in Next-Generation Systems

Despite these challenges, the Military Parachute Market presents substantial opportunities for innovation. Autonomous airdrop systems, where sensor based units and AI controlled release logic optimize opening altitude and glide profile, are an active area of development. These systems can increase survivability of both personnel and cargo by minimizing exposure to ground fire or adverse wind conditions.

Lifecycle extension and recertification services are also attracting interest. As budgets come under pressure, many forces want to extend the life of existing parachute fleets without compromising safety. OEMs and specialized service providers can offer inspection, repair, fabric treatment and recertification programs that reduce the need for full replacement, creating service driven revenue streams within the Military Parachute Market.

Hybrid fabric development represents another opportunity. By combining carbon fiber elements, advanced nylons and ultra high molecular weight polyethylene fibers, manufacturers aim to create canopies that tolerate higher dynamic loads, resist heat and reduce radar and infrared signatures. These characteristics are particularly attractive for special operations and high threat environments.

Localization and offset production programs such as Make in India and NATO driven industrial cooperation are opening doors for domestic assembly and joint ventures. Partnering with global specialists, local firms can build manufacturing capability, support export ambitions and create resilient supply chains, deepening the domestic footprint of the Military Parachute Market.

Detailed Segmentation of the Military Parachute Market

Segmentation by type begins with round parachutes. These classic domed canopies are still widely used for large scale troop drops and basic cargo delivery. Their advantages include robustness, relatively low cost and straightforward training. However, the Military Parachute Market is gradually shifting away from relying solely on round canopies because they offer limited maneuverability and higher impact speeds on landing.

Ram air or parafoil parachutes represent the high performance end of the spectrum. These rectangular or elliptical wings are used in HALO and HAHO operations, as well as for precision cargo airdrop. They generate lift and allow controlled glide, letting jumpers travel many kilometers from the release point and land with lower vertical speed. The ram air segment is one of the fastest growing segments in the Military Parachute Market due to its central role in special operations and stealth insertion.

Rogallo wing and cruciform systems bridge some capabilities between round and ram air designs. They offer improved directional control and stability compared with traditional round canopies, especially at low altitude, making them suitable for specific tactical and cargo applications.

Tandem and training parachutes form another important segment. These systems allow an instructor and trainee to jump together, or carry an additional passenger in specialized missions. They feature reinforced harnesses, extended control toggles and enhanced safety mechanisms, and they play a critical role in building and sustaining airborne competencies across the Military Parachute Market.

Segmentation by deployment mechanism reveals the operational diversity of the market. Static line systems dominate mass airborne drops, where paratroopers exit in quick succession and have their parachutes deployed automatically by a line attached to the aircraft. This method maximizes the number of jumpers in a short time window and remains a cornerstone of the Military Parachute Market for large scale operations.

Free fall deployment in HALO and HAHO profiles involves either manual activation by the jumper or automatic activation at pre set altitudes through AADs. These methods support stealthy infiltrations from high altitude, often beyond the reach of many air defenses, and require advanced training and equipment.

Cargo drop and extraction systems form yet another critical category. Heavy equipment, pallets, vehicles and humanitarian supplies rely on multi canopy clusters, reefing mechanisms and load distribution systems to land safely. Innovations in this segment of the Military Parachute Market focus on increasing load capacity, improving payload stability and integrating GPS guidance to reduce drift.

UAV recovery systems complete the deployment segmentation. These small but sophisticated parachute systems are designed to deploy reliably at high speed and sometimes at low altitude, allowing controlled recovery of unmanned platforms or loitering munitions. As unmanned operations proliferate, this niche is becoming a recognizable segment in the Military Parachute Market.

Application segmentation extends from personnel and cargo to emergency, extraction and training systems. Personnel parachutes equip airborne infantry, commandos and special operations units. Cargo systems support logistics, disaster relief and theater level sustainment. Extraction parachutes help pull loads out of aircraft cargo bays in flight. Emergency parachutes, including those integrated into ejection seats, provide last resort escape options for aircrew. Training systems ensure that both new recruits and experienced operators can maintain proficiency safely.

Material and fabric segmentation runs from traditional nylon and polyamide fabrics to advanced Kevlar and Spectra UHMWPE materials and emergent carbon hybrid weaves. Nylon remains prevalent due to its elasticity, cost and proven performance. High end systems in the Military Parachute Market increasingly incorporate high strength, low stretch fibers in canopy panels, suspension lines and risers to reduce bulk and improve performance under demanding conditions.

Component segmentation includes canopy systems, harness and container assemblies, suspension lines and risers, and electronic automatic activation devices. Modern AADs are microprocessor based units that monitor altitude and descent rate, deploying reserves if the main canopy has not opened by a safe threshold. These devices have become standard in many advanced systems, reinforcing the safety profile of the Military Parachute Market.

End user segmentation splits demand among army airborne units, air force special operations wings, naval commandos and marine corps elements, and joint logistics commands. Each user community has distinct requirements for canopy performance, load carriage, environmental resilience and compatibility with other gear, which shapes procurement and development roadmaps across the Military Parachute Market.

Technology and Innovation Landscape

Technology development in the Military Parachute Market is led by advances in materials, aerodynamics and digital integration. Nanocoated low drag fabrics reduce air resistance and improve canopy glide efficiency. Barometric and inertial sensors feed real time data into guidance units on precision cargo systems, enabling parafoils to follow pre planned routes and land within tight circular error probabilities around designated points.

Digital design tools and computational fluid dynamics enable engineers to model airflow and structural loads across the entire canopy and line set before a single prototype is cut. This reduces the number of physical iterations, shortens development cycles and helps identify stress concentrations that could limit service life. It also supports tailor made solutions within the Military Parachute Market for specific altitudes, temperatures and wind regimes.

RFID and similar tagging technologies are being embedded into harnesses and deployment bags. These tags allow logistics and maintenance teams to track each canopy’s jump count, packing history and repair record in real time. By linking this data to predictive maintenance models, forces can safely extend the service life of parachutes and optimize replacement schedules. This kind of smart lifecycle management is a significant value add in the Military Parachute Market.

Multi role parachute systems are also attracting investment. Modular designs that can be reconfigured from personnel to cargo use through different harness kits or connection points reduce the number of distinct systems that must be purchased, stored and maintained. This flexibility is especially appealing to smaller forces and expeditionary units working with limited space and budgets, and it is becoming a differentiating feature for suppliers in the Military Parachute Market.

Regional Outlook for the Military Parachute Market

North America is the single largest regional market, led by the United States. The size of its airborne and special operations communities, combined with modernization initiatives and regular training requirements, ensures a substantial and recurring demand for personnel and cargo systems. Programs to improve Arctic and high altitude deployment capabilities further support investment in specialized parachute solutions. Canada, while smaller in volume, also contributes to regional demand as it upgrades training and low velocity systems suitable for cold and remote environments.

Europe presents a diverse landscape. Western European nations such as France, Germany and the United Kingdom maintain experienced airborne and commando units, investing in HALO/HAHO equipment, tandem systems and UAV recovery parachutes. Eastern European countries, responding to heightened security concerns, are reinforcing airborne and rapid reaction elements and exploring industrial collaboration for indigenous manufacturing. This blending of modernization and local production ensures that Europe remains a strategic region for the Military Parachute Market.

Asia Pacific is the fastest growing region. Rising defense budgets in China, India, Japan and South Korea, combined with territorial and maritime security concerns, are driving significant expansion and modernization of airborne forces. India is emphasizing self reliance through institutions such as DRDO and companies such as BEL and Paras Defense, which are working to develop and manufacture parachute systems domestically. China’s PLA continues to scale up large airdrop capabilities, often with indigenous ram air designs. All of these trends make Asia Pacific a critical growth engine for the Military Parachute Market over the next decade.

The Middle East features strong demand from countries such as the UAE, Saudi Arabia and Israel, where special operations and rapid reaction forces are central to national defense strategies. Investment focuses on tactical ram air systems, night vision compatible equipment and specialized harnesses that integrate with modern soldier systems. In Africa, demand is more modest but important, often driven by peacekeeping, humanitarian missions and training, with procurement sometimes supported by multinational and UN frameworks. Together these regions add diversity and new use cases to the Military Parachute Market.

Latin America, led by Brazil and Colombia, has a strong tradition of airborne and jungle operations forces. These countries require reliable troop and cargo parachute systems that perform in hot, humid conditions and rugged terrain. Disaster relief operations, particularly in response to floods and earthquakes, further reinforce the value of airborne delivery capabilities. Technology transfer partnerships with Western OEMs are gradually expanding local production and integration capacity, supporting long term participation in the Military Parachute Market.

Competitive Landscape and Key Players

The Military Parachute Market is served by a mix of global defense primes, specialized parachute manufacturers and regional integrators. Competition revolves around canopy performance, safety record, certification pedigree, lifecycle support and the ability to support local industrial participation.

Safran, through its airborne systems businesses, is one of the most recognized names in the Military Parachute Market. The company offers a broad portfolio ranging from personnel and cargo parachutes to emergency and ejection systems. Safran’s strengths include extensive experience in high altitude systems, integrated oxygen and navigation equipment, and long standing relationships with major airborne forces. Its global footprint and certification track record make it a preferred supplier in many large programs.

BAE Systems participates in the Military Parachute Market through broader aircrew survivability and escape system solutions. The company’s focus on ejection seat parachutes, emergency systems and integrated life support equipment positions it well for air force programs that bundle parachutes with seats, helmets and survival gear. BAE Systems leverages its systems integration capabilities to offer complete escape and recovery packages rather than standalone canopies.

Specialist manufacturers such as Airborne Systems, Mills Manufacturing, SPEKON and others provide dedicated parachute design and fabrication expertise. These firms focus on personnel and cargo systems and often lead in niche innovations such as precision guided parafoils, low velocity training canopies and multi role systems. Their deep technical know how and ability to customize designs for specific national requirements make them important pillars of the Military Parachute Market.

Regional players and state linked companies, including organizations in India and Eastern Europe, are increasingly active. Entities such as DRDO and associated industrial partners in India are pushing indigenous personnel and cargo parachute programs, often under Make in India and export promotion frameworks. Similar dynamics appear in other regions where governments seek sovereign capability and export potential. This localization trend is reshaping supply chains and adding new competitors to the Military Parachute Market.

Across the competitive landscape, companies are differentiating themselves through integrated training support, digital lifecycle management tools, configurable harness systems and the ability to co produce systems in customer countries. Long term support agreements, covering inspection, repair, recertification and training for riggers and jumpmasters, are increasingly influential in procurement decisions, reinforcing the service dimension of the Military Parachute Market.

Outlook for the Military Parachute Market to 2034

Looking toward 2034, the Military Parachute Market is expected to maintain steady, technology driven growth as it doubles in value from about USD 1.2 billion to around USD 2.4 billion. Airborne doctrine is unlikely to shrink; if anything, the need for agile, infrastructure independent deployment options will increase as militaries confront contested logistics, long range operations and limited access to fixed bases.

Technological advances will continue to emphasize precision, modularity and survivability. GPS guided parafoils, intelligent deployment devices, hybrid fabrics and digitally managed maintenance will become standard features rather than cutting edge options. The integration of parachute systems with mission planning software, soldier borne electronics and aircraft avionics will deepen, turning the Military Parachute Market into a tightly coupled element of broader network centric warfare architectures.

Industrial strategies will play a larger role as governments push for local manufacturing, offset agreements and exportable designs. Suppliers that embrace partnership models, support co production and transfer know how responsibly will gain competitive advantage. Those that can combine superior technical performance with compelling lifecycle economics and robust training and service offerings will be best positioned to win the next generation of tenders.

In summary, the Military Parachute Market is far from static. It is a dynamic, innovation rich segment that underwrites the mobility, reach and resilience of modern armed forces. Stakeholders who understand its evolving technologies, regional dynamics and industrial landscape will be best placed to capture the growth and strategic value it offers between 2025 and 2034.

Related Report:

Military Parachute Market by Application (Military, Cargo, Sports, Rescue, Recovery, Break Chutes), Type (Round, Ram-air, Square, Ring & Ribbon), Component (Canopy, Cords, Tapes, Webbings, Metal), Region (North America, Europe, Asia-Pacific, The Middle East, Latin America, Africa) – Global Forecasts to 2025-2034