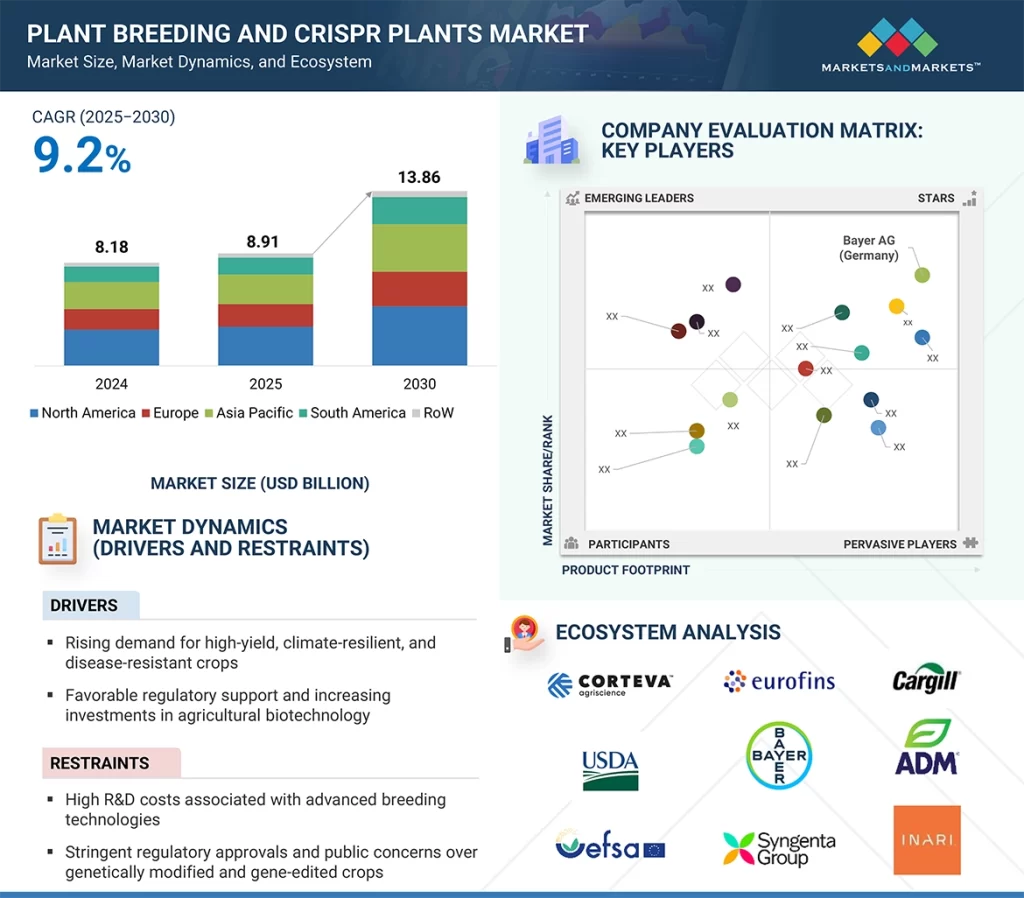

The plant breeding and CRISPR plants market is estimated at USD 8.91 billion in 2025 and is projected to reach USD 13.86 billion by 2030, at a CAGR of 9.2% from 2025 to 2030. Climate change is significantly shaping the plant breeding and CRISPR plants market by increasing the need for resilient crop varieties. Rising temperatures, erratic rainfall, and the spread of pests are already reducing crop yields. According to a NASA study published in Nature Food, maize production could decline by 24% as early as 2030 under high greenhouse gas emissions. Similarly, an April 2024 report from Oxfam America highlights that shifting climate patterns are worsening droughts, leading to more frequent crop failures. Small-scale farmers, who produce a large share of the world’s food, are among the most affected. These challenges are accelerating the adoption of advanced breeding techniques, including genome editing, to develop climate-resilient crops.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

The cereals & grains segment within applications holds the largest share in the plant breeding and CRISPR plants market.

Staple crops such as wheat, rice, and corn are in high demand worldwide, especially in densely populated regions like Asia Pacific and Africa. Food security in these areas depends heavily on these crops. Advances in genome editing and molecular breeding have enabled the development of disease-resistant and nutrient-rich varieties. The active support of governments, especially in North America and the Asia Pacific, for the production of high-yield cereals further strengthens this segment.

The temperature & stress tolerance trait segment is anticipated to witness the fastest growth in the plant breeding and CRISPR plants market during the forecasted period.

Global warming and extreme heat are increasingly affecting crop productivity. Scientists are using conventional breeding and genetic engineering to improve plants’ ability to withstand high temperatures to address this. Scientific advancements in genome editing have enabled precise alterations in plant DNA to improve heat tolerance without compromising yield. Companies and research institutions are focusing on stress-tolerant traits to reduce climate-related losses. It is anticipated that the need for temperature-resilient crops will increase dramatically as heat waves occur more frequently, especially in tropical and subtropical areas, which will spur investments in breeding technologies.

South America is expected to witness significant growth in the plant breeding and CRISPR plants market.

Argentina and Brazil are two of the region’s top producers of genetically modified crops. They benefit from supportive regulations and large-scale commercial farming. The region is extremely vulnerable to extreme weather events, such as heat waves and irregular rainfall, increasing the need for resilient crop varieties. Government policies promoting biotechnological advancements in plant breeding are helping expand the market. The growing use of genome editing in key crops such as soybeans and corn is also driving this growth.

Leading Plant Breeding and CRISPR Plants Companies:

The report profiles key players such as Bayer AG (Germany), KWS SAAT SE & Co. KGaA (Germany), Corteva (US), BASF (Germany), UPL (India), Rijk Zwaan Zaadteelt en Zaadhandel B.V. (Netherlands), Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA. (Switzerland), Sanatech Seed Co., Ltd. (Japan), and Pairwise (US).

Recent Developments in the Plant Breeding and CRISPR Plants Industry:

In February 2025, KWS SAAT SE & Co. KGaA (Germany) introduced new combination varieties that combined the CONVISO SMART system with high Cercospora protection (CR+), solidifying its market position in the sugarbeet seed industry. These varieties were introduced in several European markets, with further expansion planned.

In January 2025, Syngenta Vegetable Seeds, part of Syngenta Group (Switzerland), signed a global licensing partnership deal with Apricus Seeds (US) that gives Syngenta exclusive access to Apricus’ melon, squash, and watermelon germplasm. This partnership enhanced Syngenta’s cucurbits portfolio.

In November 2024, Hazera, a brand by Limagrain (France), opened a high-tech R&D tomato greenhouse in Made, the Netherlands, near its headquarters. The nearly 5-hectare facility, supported by Limagrain, aimed to enhance research on disease-resistant, high-yield tomato varieties. The greenhouse, which was repurposed from a commercial operation, reflected Hazera’s sustainability goals and used innovative breeding techniques to spur innovation in the high-tech tomato market worldwide.