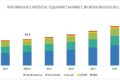

The global Refurbished Medical Equipment Market is projected to reach USD 24.41 billion by 2029, rising from USD 16.93 billion in 2024, at a CAGR of 7.6% during the forecast period. This growth is fueled by the rising need for affordable healthcare solutions, limited access to newly manufactured medical devices in low-income regions, and the increasing demand for high-quality, cost-effective refurbished systems. Government funding initiatives and supportive policies are further boosting market expansion.

Download PDF Brochure (MarketsandMarkets):

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=770

Why Refurbished Medical Equipment Is Gaining Momentum

Refurbished medical devices are becoming a lifeline for hospitals and clinics aiming to balance quality healthcare delivery with cost efficiency. Modern refurbishment processes—often involving upgraded components and advanced software—have significantly improved device durability and performance.

Key Benefits Driving Adoption

- Cost Efficiency: Hospitals can optimize budgets, especially in low-resource healthcare systems.

- Enhanced Durability: Companies like Avante Health Solutions use durable components in refurbished ventilators to extend product life.

- Regulatory Assurance: Leading refurbishers, including Siemens and Philips, ensure devices comply with FDA and EU MDR standards.

- Improved Safety Features: Upgrades such as better alarms, user interfaces, and monitoring systems—seen in brands like Soma Tech and Meridian Medical—enhance safety and functionality.

- Simplified Regulatory Pathways: Recent regulatory shifts have enabled smoother refurbished product approvals.

Market Segmentation Insights

By Product

The market includes:

- Medical imaging equipment

- Operating room & surgical equipment

- Patient monitors

- Cardiology, urology, neurology, and intensive care equipment

- Endoscopy equipment

- Intravenous therapy systems

- Other medical devices

Medical imaging equipment holds the largest market share. Refurbished MRI, CT, and other imaging systems provide advanced diagnostics at significantly lower costs—particularly crucial for developing countries upgrading their healthcare infrastructure without large capital investments.

By Application

- Diagnostic applications (largest segment in 2023)

- Therapeutic applications

- Others

Refurbished diagnostic systems—such as updated MRI units—offer performance comparable to new devices, thanks to modern imaging techniques and software enhancements. They help meet the increasing demand for accessible, affordable diagnostic care in emerging markets. Regulatory bodies like the FDA also support refurbished device usage through clear guidelines.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=770

Competitive Landscape

Prominent players include:

- GE Healthcare (US)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- Block Imaging (US)

- Soma Technology (US)

- Avante Health Solutions (US)

- Canon Medical Systems (Japan)

- Mindray (China)

- Dräger (Germany)

- Stryker (US)

- DirectMed Parts & Services (US)

- Medline Industries (US)

- Nihon Kohden (Japan)

- Others

These companies operate across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa—offering broad portfolios and strong service networks.

Strategic Focus Areas

- R&D investments to integrate AI and advanced software into refurbished systems

- Sustainability initiatives, reducing e-waste and environmental impact

- Growth via acquisitions, partnerships, and collaborations

Company Highlights

GE Healthcare (US)

GE’s refurbished systems are part of a full-scope healthcare solution aimed at delivering cost efficiency without quality compromise. Devices like the Optima CT660 undergo rigorous inspection and testing to meet high clinical standards. Their approach supports global sustainability by reducing equipment waste.

Philips Healthcare (Netherlands)

Philips’ Circular Edition leads the market in sustainable refurbishment. Their CT, MRI, ultrasound, and C-arm systems offer up to 25% cost savings compared to new devices. Each system undergoes a seven-step restoration process, including replacing components with original Philips parts and updating software to the latest versions.

Siemens Healthineers (Germany)

Siemens continues to expand its refurbished portfolio across imaging and patient monitoring. With demand rising in North America, APAC, and Latin America, Siemens delivers high-quality, cost-effective solutions tailored for hospitals seeking premium performance without the high price of new equipment.