The EMI shielding market in 2025 is marked by rapid technological innovation, growing demand across sectors such as telecommunications, automotive, aerospace, and consumer electronics, and the strategic expansion of key players. Several global companies have emerged as dominant forces in this landscape, leading the charge with cutting-edge shielding materials, advanced manufacturing capabilities, and robust customer bases.

Laird Performance Materials, now part of DuPont, continues to be one of the most influential players in the EMI shielding space. The company offers a broad portfolio of EMI shielding products, including conductive foams, gaskets, tapes, and integrated shielding solutions tailored for high-performance electronics. DuPont’s acquisition of Laird has strengthened its position in advanced material solutions, especially for the growing electric vehicle and 5G infrastructure markets.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=105681800

3M Company remains a global powerhouse in the EMI shielding industry with its diverse range of high-performance shielding tapes, laminates, and films. Its long-standing reputation for innovation and quality has made it a trusted partner across various industries. In 2025, 3M continues to leverage its deep R&D expertise and global reach to provide shielding solutions that are lighter, more efficient, and compatible with next-gen electronics.

Parker Hannifin Corporation, through its Chomerics Division, has maintained a strong market presence by offering high-conductivity EMI shielding materials, thermal interface products, and conductive adhesives. Its ability to cater to high-end applications in aerospace, defense, and automotive industries positions the company as a go-to supplier for mission-critical EMI management.

Henkel AG & Co. KGaA is another key contender, particularly in the adhesive and coating segment of EMI shielding. The company’s LOCTITE and BERGQUIST brands are widely recognized for delivering effective EMI and thermal management in compact electronic assemblies. Henkel’s commitment to sustainability and miniaturization makes it a favored partner in medical and wearable electronics markets.

PPG Industries, a global leader in specialty coatings, has made significant strides in the EMI shielding domain by providing conductive paints and coatings for military, automotive, and industrial equipment. In 2025, PPG is capitalizing on the increasing demand for lightweight and corrosion-resistant shielding materials in harsh environments.

Additionally, companies like RTP Company, Tech-Etch, and KITAGAWA INDUSTRIES Co., Ltd. have carved out strong positions through their niche focus, customized product offerings, and ability to meet specific regional or industry demands. Their innovative material science and flexible manufacturing capabilities help address the diverse and evolving EMI shielding challenges of modern electronics.

In conclusion, the EMI shielding market in 2025 is dominated by a blend of multinational corporations and specialized players who are driving product innovation, expanding global footprints, and responding dynamically to the shifting requirements of high-frequency and high-density electronic applications. As the world becomes increasingly reliant on connected and autonomous systems, these top companies are leading the charge to ensure electromagnetic compatibility and signal integrity across devices and industries.

Frequently Asked Questions (FAQ) on the EMI Shielding Market

Q1: What is EMI shielding in the context of the market?

EMI shielding, in the market context, refers to the industry involved in manufacturing and supplying materials and components designed to block or reduce electromagnetic interference (EMI). This prevents electronic devices from malfunctioning dueifying each other and ensures their reliable operation in various applications.

Q2: Why is EMI shielding becoming increasingly important in modern electronics? EMI shielding is increasingly crucial due to the proliferation of electronic devices, particularly in sectors like automotive (EVs, ADAS), consumer electronics (5G devices), and healthcare. More electronics mean more potential for interference, making shielding essential for performance, safety, and regulatory compliance.

Q3: What are the primary types of EMI shielding components available in the market?

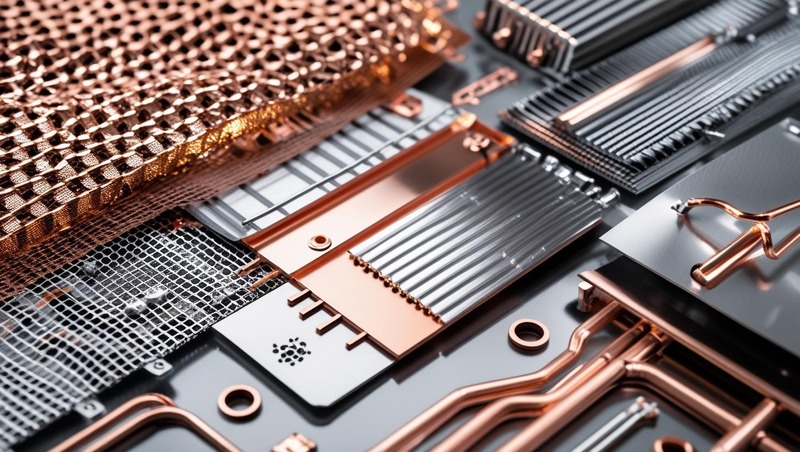

The market offers various EMI shielding components, including conductive coatings (paints, platings), EMI gaskets (conductive elastomers, knitted wire mesh), shielded cables and connectors, and EMI absorbers (ferrites). Each type addresses specific shielding requirements and applications.

Q4: Which industries are the major consumers in the EMI shielding market?

Key consuming industries include automotive (electric vehicles, autonomous systems), consumer electronics (smartphones, IoT devices), telecommunications (5G infrastructure, network equipment), healthcare (medical devices), aerospace & defense, and industrial electronics.

Q5: How do regulatory standards influence the EMI shielding market?

Regulatory standards, such as the EU’s EMC Directive, FCC regulations (USA), and automotive-specific standards (e.g., CISPR 25), are a major driver. They mandate specific limits for electromagnetic emissions and immunity, compelling manufacturers to integrate effective EMI shielding solutions to achieve compliance and market access.

Q6: What role does 5G technology play in the demand for EMI shielding?

5G technology, operating at higher frequencies and with greater data density, generates more complex electromagnetic environments. This significantly boosts the demand for advanced EMI shielding solutions capable of effectively attenuating high-frequency interference to ensure reliable 5G device and infrastructure performance.