The Internet of Things (IoT) has rapidly transitioned from a futuristic concept to an integral part of the modern digital economy. In the United States IoT technology market is not only thriving—it’s emerging as one of the most attractive areas for strategic investments in both the public and private sectors.

This article explores the forces driving IoT expansion in the U.S., where the most promising investment avenues lie, and why now is the right time to get in.

Key Drivers of IoT Growth in the U.S.

1. 5G and Edge Computing

The nationwide rollout of 5G is unlocking ultra-fast, low-latency communication, essential for real-time IoT applications. Combined with edge computing, it allows devices to process data locally, reducing delays and enhancing responsiveness—crucial for autonomous vehicles, smart factories, and telemedicine.

2. Digital Transformation of Enterprises

Businesses across manufacturing, logistics, retail, and utilities are leveraging IoT to optimize operations, monitor equipment, and enhance customer experiences. Industrial IoT (IIoT) is a particularly hot segment, enabling predictive maintenance, asset tracking, and energy management.

3. Smart City Initiatives

Municipalities are adopting IoT to manage traffic, monitor pollution, streamline utilities, and improve public safety. With federal funding flowing into infrastructure modernization, smart city technologies are accelerating nationwide, creating fertile ground for innovation and investment.

4. Healthcare Innovations

The COVID-19 pandemic accelerated the adoption of IoT-enabled health monitoring devices, such as wearables and remote diagnostics tools. The U.S. healthcare sector is continuing to embrace connected solutions for chronic disease management, elderly care, and hospital efficiency.

5. Consumer Demand for Connected Living

From smart thermostats and voice assistants to connected refrigerators and security systems, the American consumer is increasingly seeking smart home solutions. This trend is driving exponential growth in the home automation segment.

Strategic Partnerships Fueling Innovation

Collaboration is a cornerstone of the U.S. IoT ecosystem. Tech giants, startups, and government bodies are increasingly forming strategic partnerships to accelerate innovation and deployment of IoT solutions.

Big Tech + Startups: Companies like Amazon, Microsoft, and Intel frequently collaborate with smaller IoT startups, either through acquisition or joint ventures. These partnerships help big players innovate faster while giving startups access to resources and markets.

Universities & Research Labs: Academic institutions such as MIT, Stanford, and Georgia Tech are working with private-sector partners to explore edge AI, energy-efficient sensors, and quantum IoT.

Public-Private Collaborations: Federal and state governments are funding smart city initiatives, infrastructure monitoring, and disaster preparedness systems using IoT, offering further investment catalysts.

Investor takeaway: Look for companies with strong alliances and co-innovation models—these firms often scale faster and penetrate markets more deeply.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=258239167

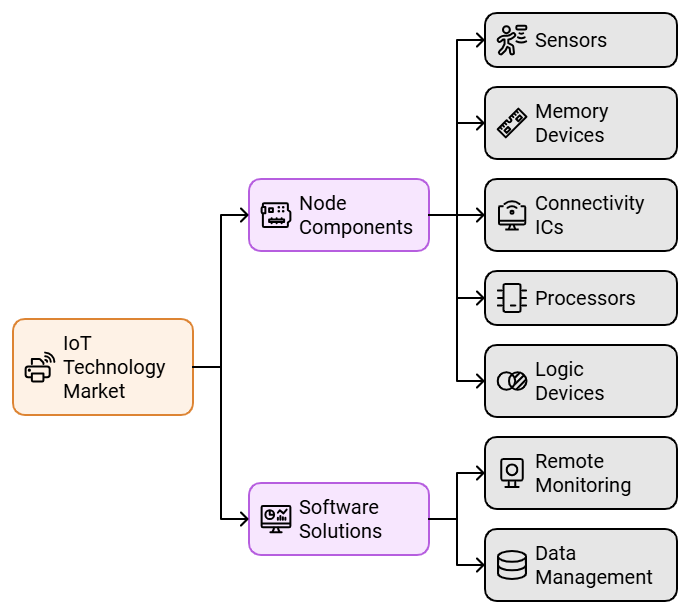

Investment Opportunities by Segment

1. Industrial IoT (IIoT)

Why it matters: Industrial IoT is transforming manufacturing, energy, agriculture, and logistics by enabling real-time monitoring, automation, and predictive analytics.

Investment signals: GE, Honeywell, Siemens, and startups like Samsara and Uptake are gaining traction. There’s growing demand for connected sensors, robotics, and industrial AI.

Outlook: IoT Technology Industry worth $1,377.8 billion by 2029

2. Smart Home & Consumer IoT

Why it matters: The U.S. leads in smart home adoption, driven by convenience, security, and energy efficiency.

Investment signals: Google Nest, Amazon Alexa, and Ring dominate, but there’s room for niche players in energy management, home health, and pet monitoring.

Outlook: Steady growth, especially with millennial and Gen Z homeowners.

3. Healthcare IoT

Why it matters: Remote care, patient tracking, and hospital efficiency are key post-pandemic priorities.

Investment signals: Startups in wearables (e.g., Whoop, Oura), medtech, and health data analytics are drawing investor interest.

Outlook: Strong potential, but regulated—investors should understand FDA requirements and HIPAA compliance.

4. Connected Mobility

Why it matters: IoT is foundational to autonomous driving, fleet management, and smart transportation.

Investment signals: Tesla, Rivian, Waymo, and a slew of mobility startups rely on IoT for telematics, ADAS, and vehicle-to-everything (V2X) communication.

Outlook: High upside but capital-intensive—best suited for strategic or institutional investors.

5. Smart Cities & Infrastructure

Why it matters: IoT solutions are enhancing urban sustainability and operational efficiency.

Investment signals: Companies offering solutions in waste management, traffic control, and energy optimization are gaining traction.

Outlook: Government-funded programs present lower-risk, long-term plays.

6. IoT Cybersecurity

Why it matters: More connected devices mean more vulnerabilities. Security is essential.

Investment signals: Palo Alto Networks, Armis, and startups in identity management, encryption, and anomaly detection are seeing high demand.

Outlook: Expected to be one of the fastest-growing IoT subsegments.

Top States Leading IoT Adoption

California: The Silicon Valley effect—tech innovation and venture capital.

Texas: Industrial IoT in energy and agriculture.

New York: Smart city and fintech applications.

Massachusetts: Healthcare and biotech-focused IoT startups.

Illinois: Manufacturing and logistics hubs adopting connected systems.

These states not only offer robust startup ecosystems but also boast strong university research collaborations and tech incubators.

Funding Trends & M&A Activity

Venture capital: U.S.-based IoT startups raised over $8 billion in 2023, with growing interest in sustainability tech and AI-driven solutions.

M&A: Larger tech firms are acquiring IoT-focused startups to fill capability gaps. In 2023, Cisco, Microsoft, and Honeywell were among the top acquirers.

Private equity: PE firms are entering the space with roll-up strategies, especially in industrial and infrastructure IoT.

Risks & Considerations for Investors

While the outlook is strong, investors should evaluate:

Regulatory compliance (especially in healthcare and mobility)

Cybersecurity risks (ensure robust defenses in place)

Interoperability challenges (fragmented standards can slow adoption)

Hardware vs. software balance (hardware is often capital-intensive)

Scalability and total addressable market (TAM) of specific solutions

Mitigating these risks through proper due diligence and sector expertise is crucial.

Why Now Is the Right Time to Invest

With government support, technological readiness, and rising enterprise and consumer demand, the U.S. IoT technology market is hitting a critical inflection point. Startups and established firms alike are innovating rapidly, creating multiple entry points for investors.

The convergence of AI, 5G, edge computing, and cloud services is amplifying IoT’s potential, while the macroeconomic push for digital transformation makes it a strategic imperative across industries.

The U.S.IoT technology market presents one of the most compelling investment narratives of this decade. From intelligent factories and connected cars to remote health monitoring and smart homes, IoT is embedded in the infrastructure of the future.

Whether you’re a venture capitalist looking for the next breakout startup, a corporate strategist seeking to enter new markets, or a private equity firm pursuing scalable platforms—IoT offers diversified, long-term value across verticals.

Now is the time to invest in the networks, devices, and data that will power tomorrow’s connected world.