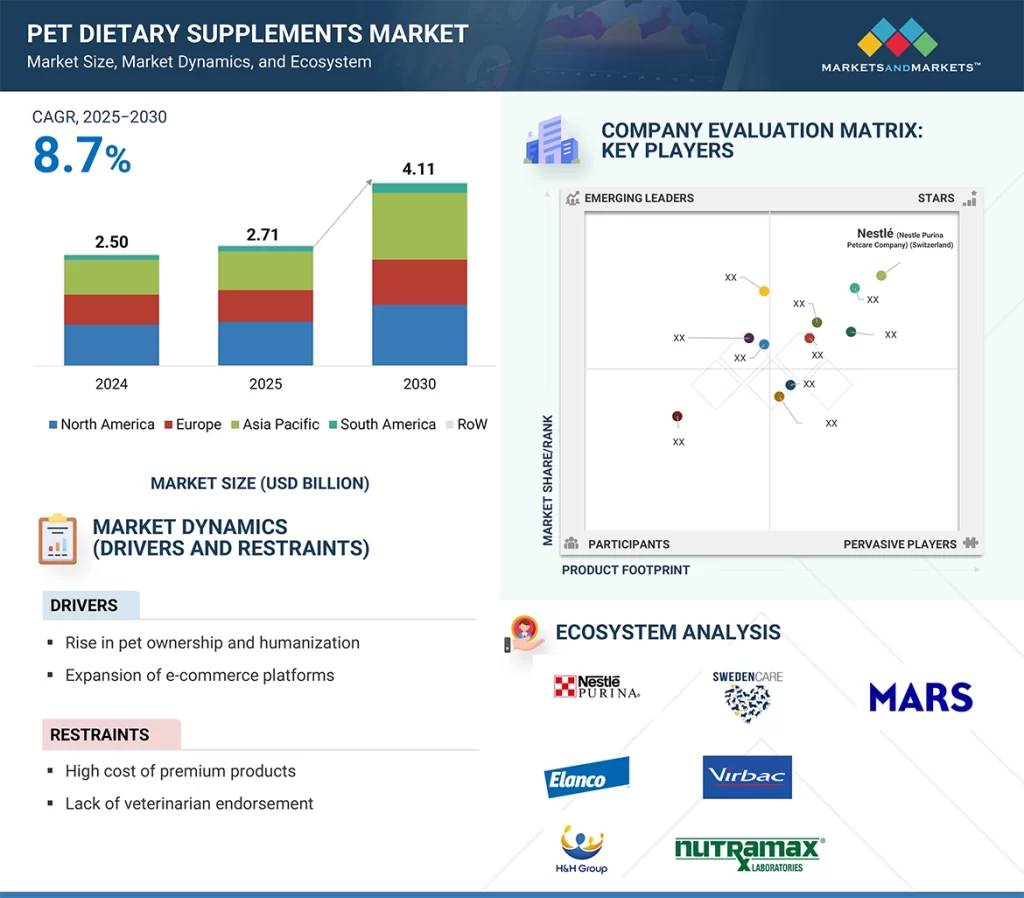

The pet dietary supplements market is estimated at USD 2.71 billion in 2025 and is projected to reach USD 4.11 billion by 2030, at a CAGR of 8.7%. The pet dietary supplements market is undergoing a transformative phase, marked by a steady rise in demand and innovation. This growth is primarily driven by an increased awareness among pet owners regarding preventive healthcare and wellness, aligning closely with human health trends. As the bond between humans and their pets deepens, pets are increasingly regarded as part of the family, and this emotional connection directly influences spending patterns. Consumers are now more willing to invest in premium, science-backed products that enhance the quality of life for their furry companions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=264349399

By supplement type, prebiotics & probiotics contribute a substantial share of the pet dietary supplements market.

While the pet dietary supplements market holds immense potential, a significant barrier to widespread adoption, particularly in price-sensitive regions, is the high cost of premium and specialized products. These supplements are typically formulated with high-quality, clinically tested ingredients, natural extracts, and proprietary blends, resulting in price points that are not accessible to all pet owners. This creates a gap between consumer interest in pet wellness and their actual purchasing power.

In emerging and developing markets, where pet nutrition and wellness awareness are still evolving, affordability plays a crucial role in decision-making. Many consumers in these regions tend to prioritize basic needs such as food, vaccinations, and hygiene products over supplements, which are often viewed as non-essential items. The benefits of dietary supplements are not always immediate or visibly measurable, making it harder to justify their cost, especially in households with tight budgets. Additionally, during economic downturns or shifts in financial priorities, supplements are the first items to be eliminated from pet care routines. Bridging this gap requires greater awareness, education, and innovation in pricing and packaging to ensure broader accessibility.

Soft chews to be the fastest-growing supplement form in the pet dietary supplements market.

The convenience of soft chews is another major contributing factor. Administering pills can sometimes be a challenge, especially for pets who may resist swallowing tablets or capsules. Powders, while effective, often require mixing with food, which some pets may find unappealing. Soft chews, on the other hand, are pre-dosed and easy to administer, requiring no additional effort from the pet owner. They are designed to be given directly as a treat, eliminating the need for complex dosing routines. This ease of use encourages greater compliance from both pets and owners, ensuring that pets receive their daily dosage consistently.

The improved compliance that soft chews offer is especially important when it comes to long-term supplementation. Many supplements, such as those for joint health, digestive support, or skin and coat improvement, require continuous use to deliver benefits. The treat-like format of soft chews helps ensure that pets are more likely to take their daily supplements without resistance, reducing the likelihood of missed doses. This convenience and ease of administration have made soft chews a preferred option for many pet owners who seek a consistent and stress-free way to support their pets’ health.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=264349399

The Asia Pacific region is anticipated to experience the fastest growth between 2025 and 2030

Awareness about pet health is also increasing across the Asia Pacific region. As pet owners become more knowledgeable about the link between nutrition and overall pet health, they seek supplements to address specific health concerns such as digestive issues, joint health, and immune support. The rise of e-commerce in the region has further contributed to this growing awareness, as online platforms provide a wealth of information, reviews, and product choices previously unavailable in traditional retail channels. With a more health-conscious younger demographic, pet owners in the region are increasingly interested in holistic pet care, fueling the demand for natural and science-backed supplements.

In countries such as China, the market is further supported by the increased availability of high-quality pet care products through both online platforms and pet stores. China’s large urban centers have seen significant improvements in pet care infrastructure, with local and international brands expanding their presence to cater to the growing middle class. In India, the market for pet supplements is still emerging. However, it is increasing rapidly as a growing urban middle class adopts pets and becomes more aware of the importance of nutrition and health maintenance for pets.

Leading Pet Dietary Supplements Companies:

The report profiles key players such as Nestlé (Nestlé Purina Petcare Company) (Switzerland), Elanco (US), H&H Group (Hong Kong), SwedenCare (Sweden), Mars, Incorporated (US), Nutramax Laboratories (US), Virbac (France), General Mills Inc. (US), Zoetis Services LLC (US), Wellness Pet, LLC (US), NOW Foods (US), Vetoquinol (France), Affinity Petcare S.A (Spain), FoodScience (US), and Thorne Vet (US).