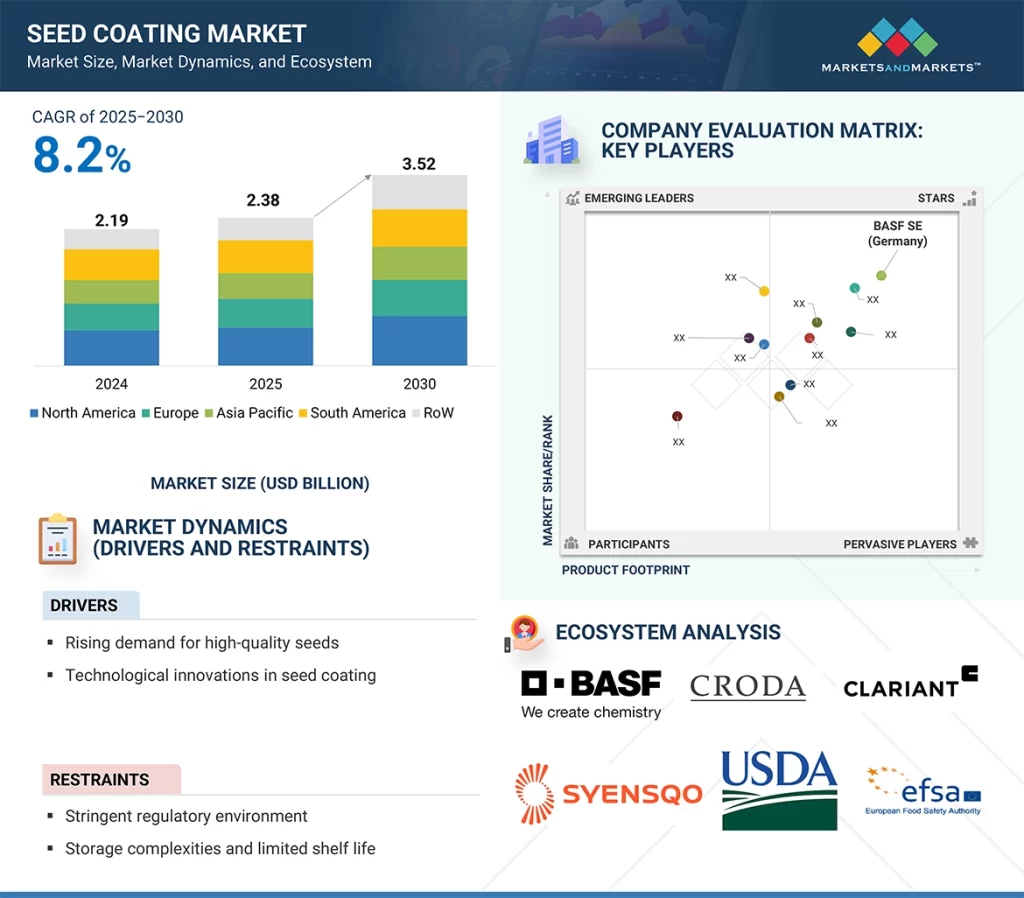

The seed coating market is projected to grow from USD 2.38 billion in 2025 to USD 3.52 billion by 2030, at a CAGR of 8.2% during the forecast period. The increasing global demand for high-yielding crops, advances in agricultural technology, and the increased emphasis on sustainable farming practices drive market growth for seed coatings. The key growth drivers include implementing precision agriculture, developing new seed treatment products that integrate nutrients, pesticides, and biologicals, and raising farmer awareness about the benefits of seed coating to enhance germination rates and crop uniformity. Support for the adoption of seed coating technologies is also being provided through regulatory encouragement for green agrochemicals and the need to be more productive at a lower cost of inputs in large agricultural economies.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=149045530

By additive, the polymer segment is estimated to lead the market during the forecast period.

Polymers are estimated to lead the seed coating market in the additive segment due to their role in enhancing coating functionality, seed handling, and performance. The materials are binding agents that ensure consistent adhesion of nutrients, protectants, and active ingredients on the seed surface. Their film-forming capacity enhances seed appearance, reduces dust-off, and supports precise application of chemical or biological treatment. With growing needs for multi-functional and crop-specific coatings, polymers provide the flexibility required to tailor solutions unique to different environmental settings and seed varieties. Further, progress in biodegradable and water-soluble polymers is catching up, particularly with regulatory limits on agricultural microplastics. The new-generation polymers ensure environmental compatibility without trading off coating integrity and performance. They facilitate the use of controlled-release nutrients and microbial products, in line with the general trend towards sustainable and precision agriculture. With seed companies continuing to look for high-performance additives that address both agronomic and environmental objectives, polymers are well-placed to continue a dominant position in the additive component of the seed coating market.

By crop type, the cereals & grains segment will hold the largest market share during the forecast period.

Cereals & grains will hold the largest market share under the crop type segment in the seed coating market, because of their global status as staple food crops with a broad basis of cultivation. Wheat, rice, maize, and barley are cultivated in large volumes in dominant farm belts of Asia, North America, and Europe, unleashing huge demand for enhanced seed treatment. Seed treatments on grains and cereals are increasingly popular for boosting germination rates, protection from early-season pests and diseases, and uniform emergence of crops. As a leading agenda to ensure food security globally continues, agriculture and seed companies are making investments in seed technologies that increase productivity and resistance in grain and cereal production.

In addition, the scalability of seed coating technologies is particularly well-adapted to large-scale cereal and grain production operations where precision and uniformity are most critical. Advances in coating materials, such as film coatings and encrustments, make it possible to deliver improved handling, planting efficiency, and compatibility with biologicals or micronutrients, which renders them attractive for cereal producers. Where climate conditions or soil deficiency for nutrients occur, coated cereal seeds add value through enhanced plant early growth and stress tolerance. These benefits are fueling the growth of the usage of seed coating in cereal and grain manufacturing, further cementing its dominance.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=149045530

North America is estimated to lead the market during the forecast period.

North America is estimated to dominate the seed coating market, backed by the high technological level of farm infrastructure in this region, the wide application of improved farming methods, and the good density of major players in the seeds and agrochemical industries. The US and Canada enjoy large-scale agricultural production systems oriented towards efficiency, precision, and productivity, becoming good markets for seed coating solutions. The region is mainly planted with high-value crops such as corn, soybeans, and canola, and these crops heavily benefit from seed treatments for stimulating germination, resisting early insects, and delivering micronutrients. Further, the region’s emphasis on sustainability and integrated pest management has increased the demand for biological and polymer-based coatings.

Ongoing investments in agri-tech R&D further drive North America; this includes the favorable government approach toward sustainable agriculture and partnerships between private players and research institutions. Seed coating manufacturers in the region are fostered by access to world-class R&D facilities, regulatory clarity, and a strong distribution network. With farmers seeking more effective, efficient, and environmentally friendly options, North America is still at the forefront of adopting and developing seed coating technologies.

Leading Seed Coating Companies:

The report profiles key players such as BASF SE (Germany), Syensqo (Belgium), Clariant (Switzerland), Croda International plc (UK), Sensient Technologies Corporation (US), Germains Seed Technology (UK), Milliken (US), Covestro AG (Germany), BrettYoung (Canada), Chromatech Incorporated (US), Centor Group (Netherlands), Michelman, Inc. (US), Precision Labs (US), CR Minerals, LLC (US), and Universal Coating Systems (US).