A Skyward Surge in Sustainable Aviation

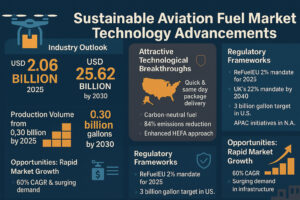

The Sustainable Aviation Fuel Market is undergoing a seismic shift. Once considered a fringe solution, sustainable aviation fuel (SAF) has now taken center stage in aviation’s race toward net-zero emissions. As the Sustainable Aviation Fuel Market Size skyrockets from USD 2.06 billion in 2025 to an expected USD 25.62 billion by 2030, the aviation world is witnessing one of the most critical transformations in its history. This exponential growth is underpinned by rapid technology advancements, evolving global regulations, and rising investor confidence.

As airlines and governments align on decarbonization goals, the Sustainable Aviation Fuel Industry is emerging as the most viable path to sustainable flight. This blog dives deep into the cutting-edge technology reshaping the SAF Market and how it intersects with policy, investment, and industry challenges.

Revolutionizing Fuel: Technological Breakthroughs

The Sustainable Aviation Fuel Market is fueled by scientific innovation. Leading-edge technologies are not only reducing carbon emissions but also redefining the cost-efficiency and scalability of SAF production. From direct air capture to advanced catalytic processes, innovation is the pulse of the SAF Industry.

Direct Air Capture Fuel Synthesis is now a tangible commercial reality. By extracting atmospheric carbon and synthesizing it with green hydrogen, companies like Heirloom are creating carbon-neutral fuels. United Airlines has already signed agreements to deploy this fuel offering a closed-loop carbon cycle that could redefine the Sustainable Aviation Fuel Market Share.

Advanced Alcohol-to-Jet Technology (ATJ) is accelerating too. With LanzaJet’s commercial-scale plant in Georgia producing 10 million gallons annually, the technology has crossed a pivotal threshold. Emitting 84% fewer emissions than fossil jet fuel, this innovation is propelling the SAF Market forward with modular, localized production.

Enhanced HEFA Pathways, the most established method in the Sustainable Aviation Fuel Industry, continue evolving. Improved catalysts and modular plant designs are slashing costs and boosting output. As a result, HEFA remains the backbone of current Sustainable Aviation Fuel Market Trends.

Hybrid Integration Models are making waves by co-producing SAF, renewable diesel, and biochemicals in single facilities. This diversification is optimizing economic resilience and fueling sustainable growth across the SAF Industry.

Feedstock Frontiers: New Inputs, Smarter Processing

Another significant trend reshaping the Sustainable Aviation Fuel Market is the diversification of feedstocks and the rise of AI-driven logistics.

AI-Driven Optimization is creating intelligent SAF supply chains. From farm to flight, algorithms now forecast feedstock demand, monitor quality, and manage logistics with carbon reduction in mind.

Expanded Feedstock Diversity has opened up new SAF Market potential. Agricultural residue, forestry waste, municipal solid waste, and captured industrial emissions are now viable raw materials. Initiatives like SAFFiRE are boosting the scalability of corn stover-derived SAF, widening the Sustainable Aviation Fuel Market Share.

Regulatory Skyways: Global Policy Momentum

Regulations are propelling the Sustainable Aviation Fuel Market to new heights. Aggressive mandates are compelling the aviation industry to adopt SAF at scale.

Europe’s ReFuelEU mandates a 2% SAF blend in 2025, rising to 70% by 2050. It includes a 1.2% requirement for synthetic fuels by 2030. This framework supports Sustainable Aviation Fuel Market Size growth with 20 million carbon allowances and strict penalties for non-compliance.

The UK’s SAF Mandate begins at 2% in 2025 and climbs to 22% by 2040. The planned Revenue Certainty Mechanism (RCM) adds pricing predictability, a key driver in attracting investment and securing Sustainable Aviation Fuel Market Share.

The U.S. SAF Grand Challenge targets 3 billion gallons by 2030. With help from the Inflation Reduction Act and USDA initiatives, the United States SAF Market is expected to explode by over 9000%.

Asia-Pacific and Emerging Economies are entering the SAF arena, too. India’s 1% mandate and future targets of 4–5% SAF by 2030 represent untapped SAF Industry potential. Japan’s government is also offering direct subsidies for SAF infrastructure.

Opportunities in Full Throttle: Market Growth Potential

As the Sustainable Aviation Fuel Market Trends upward, its global demand is surging from 0.30 billion gallons in 2025 to 3.68 billion gallons by 2030. With CAGRs exceeding 60%, the SAF Market is entering its most explosive growth phase.

North America leads with strong regulatory support, vast biomass, and a mature supply chain. Europe’s regulatory aggressiveness guarantees rapid adoption, while Asia-Pacific is set to outpace all with a projected CAGR of over 60%. India, in particular, could generate over 40 million tonnes of SAF by 2050.

Investors are eyeing infrastructure development and technology licensing as high-yield opportunities. The $19–45 billion in capital investment required for global scaling will reshape both the Sustainable Aviation Fuel Market Size and its underlying economic landscape.

Overcoming Altitude: Industry Challenges

Despite the excitement, the Sustainable Aviation Fuel Industry faces serious barriers. Production costs remain prohibitively high up to five times that of traditional jet fuel. Power-to-liquid SAF, while promising, can cost up to eight times more.

Feedstock availability is becoming critical. The HEFA method, dominant in today’s SAF Market, could hit a feedstock ceiling post-2030. This forces a strategic pivot toward ATJ and direct air capture.

Geographic concentration of SAF production presents distribution challenges, particularly for global carriers. Supply chain diversification will be critical for sustainable growth and future Sustainable Aviation Fuel Market Share.

Certification complexity also slows down scaling. While ASTM International is expanding pathway approvals, fragmented global regulations create uncertainty, dampening investment and slowing Sustainable Aviation Fuel Market Trends.

Top Five Players Shaping the Market

Neste (Finland) leads globally with 3 million tons annual SAF capacity. With major contracts from Boeing and DHL, Neste’s HEFA technology remains the benchmark.

World Energy (USA), a pioneer since 2016, is scaling operations with a $2 billion investment and aiming for 1 billion gallons by 2030.

Gevo Inc. (USA) champions ATJ innovation. Backed by Chevron and USDA support, Gevo plans to produce 1 billion gallons of SAF by 2030.

LanzaJet (USA) operates the world’s first ATJ plant in Georgia. Funded by Microsoft and Breakthrough Energy, its global expansion includes projects in the UK, India, and Japan.

TotalEnergies (France) combines HEFA and co-processing pathways, partnering with Airbus and Air France-KLM to supply over 1.5 million tons over ten years.

Sustainable Aviation Fuel Market Technology Advancements, Request Pdf Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=70301163

A Vision for the Future: Decarbonization Milestones

The next 25 years will define the SAF Industry’s trajectory. From 2025–2027, efforts will focus on scaling HEFA and deploying first-generation ATJ and Fischer-Tropsch facilities. From 2027–2035, power-to-liquid and DAC technologies will enter commercial maturity.

By 2035–2050, a fully circular SAF economy could become reality. This would enable 100% SAF usage across aviation, supported by harmonized regulations and complete decarbonization of air travel.

Strategic Action Plan for Stakeholders

Stakeholders across the Sustainable Aviation Fuel Industry must coordinate efforts. Investments between $19–45 billion are necessary to build capacity, support decentralized production, and create global distribution channels.

Policy alignment is essential. Without harmonized definitions and certification processes, SAF Market growth will be stifled. Supply chain resilience must be strengthened with diversified feedstock sources and AI-based logistics.

Technological diversity is key. Betting on a single pathway is no longer viable. The SAF Industry must embrace ATJ, DAC, Fischer-Tropsch, and hybrid models to ensure long-term viability and Sustainable Aviation Fuel Market Share.

Innovation as a Compass: The Role of R&D

Ongoing R&D will shape the Sustainable Aviation Fuel Market Trends in decades to come. Blockchain tools for traceability, AI for operational optimization, and biotechnological advances in feedstock conversion are all critical areas.

Governments and corporations must increase funding to accelerate the commercialization of second- and third-generation SAF technologies.

The Flight Path to Net-Zero

The Sustainable Aviation Fuel Market is no longer theoretical it is a rapidly expanding ecosystem at the heart of aviation’s green transformation. Backed by strong regulation, innovative technologies, and a clear commitment to climate goals, the SAF Industry is set to revolutionize how we fly.

While challenges remain, the industry’s trajectory is clear. Through collaborative effort, sustained innovation, and strategic investment, the global aviation sector can achieve its net-zero ambitions by 2050.