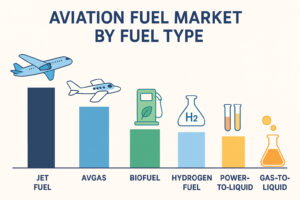

The aviation fuel market is at the center of transformation as the aviation industry faces mounting pressure to reduce its carbon footprint while meeting the rising demand for air travel. Aviation fuel is more than just an energy source; it is the foundation of global mobility, linking continents and powering commercial airlines, defense fleets, and private aviation. Historically, jet fuel and Avgas have dominated the skies, but with climate change concerns, the industry is shifting toward sustainable options such as biofuels, hydrogen fuel, and synthetic alternatives like power to liquid (PtL) and gas to liquid (GtL). This evolution is not only technological but also regulatory, as governments and industry bodies set ambitious decarbonization targets that reshape the aviation fuel market landscape.

Market Overview and Growth Potential

The aviation fuel market has always been influenced by macroeconomic cycles, geopolitical tensions, and oil price fluctuations. In the current decade, the growth trajectory is increasingly determined by sustainability initiatives and advancements in alternative fuels. The global aviation fuel market is expanding in terms of value as demand for air travel rises in both developed and emerging economies. At the same time, innovations in sustainable aviation fuel production are opening new investment opportunities. Analysts project that by 2035, alternative fuels such as biofuel, hydrogen, PtL, and GtL will claim a significant share of the market alongside traditional fuels. Market growth is further supported by collaborations between airlines, energy companies, and governments working together to scale up production and establish robust infrastructure for future fuel adoption.

Jet Fuel: The Dominant Fuel Type

Jet fuel, specifically Jet A and Jet A-1, continues to dominate the aviation fuel market. Its widespread availability, high energy density, and compatibility with existing aircraft engines make it indispensable for global aviation operations. Jet fuel remains the backbone of commercial aviation, defense fleets, and cargo operations. The environmental challenges associated with carbon dioxide and other greenhouse gas emissions are driving the industry to gradually reduce its reliance on jet fuel. In recent years, efforts to blend jet fuel with sustainable aviation fuels have gained momentum. Airlines are under increasing pressure to meet emission reduction targets, and while jet fuel will continue to dominate in the short term, its market share is projected to decline as biofuels and hydrogen become commercially viable alternatives.

Avgas: Niche Market for General Aviation

Avgas, or aviation gasoline, serves as the primary fuel for piston engine aircraft, making it essential for smaller aircraft used in general aviation, pilot training, and certain regional aviation services. Unlike jet fuel, Avgas represents a niche segment but is still critical for maintaining the vitality of smaller aviation markets. The challenge with Avgas is its reliance on lead additives, which face growing scrutiny from environmental regulators. As a result, there is a push to phase out traditional Avgas and replace it with unleaded alternatives. While Avgas does not command the same scale as jet fuel, its importance in the aviation fuel ecosystem cannot be overlooked, especially in markets like the United States where general aviation forms a large part of air traffic activity.

Biofuel: The Sustainable Alternative

Sustainable aviation fuel, often produced from feedstocks such as used cooking oil, algae, and agricultural waste, represents the most promising alternative to conventional jet fuel. Biofuels can reduce lifecycle carbon emissions by up to 80 percent compared to fossil fuels, making them central to aviation’s decarbonization strategies. Airlines are increasingly entering into long term agreements with fuel producers to secure biofuel supply, while governments provide incentives and mandates to accelerate adoption. The challenge lies in scaling up production capacity to meet global demand and ensuring cost competitiveness. Biofuels are already being blended with jet fuel in commercial flights, and their use is projected to grow significantly in the next decade. As technology matures and economies of scale are achieved, biofuels will transition from a supplementary option to a mainstream fuel type.

Hydrogen Fuel in Aviation

Hydrogen fuel is considered a revolutionary step toward zero emission aviation. Its potential lies in its ability to produce only water vapor when used in fuel cells, eliminating carbon emissions entirely. Hydrogen can be deployed in both combustion and fuel cell applications, offering flexibility in how aircraft are designed and powered. Its adoption faces significant hurdles, including storage, infrastructure, and safety concerns. Hydrogen requires cryogenic storage at extremely low temperatures, which demands entirely new refueling and airport infrastructure. Despite these challenges, leading aerospace manufacturers and energy companies are investing heavily in hydrogen research. Governments in Europe and Asia are also funding pilot projects to accelerate hydrogen adoption in aviation. While hydrogen fuel may not achieve mass adoption in the immediate future, it represents one of the most transformative shifts in aviation fuel technology.

Power-to-Liquid (PtL) Fuels

Power to liquid fuels are synthetic fuels produced by using renewable energy to capture carbon dioxide and convert it into hydrocarbons. This technology allows for the creation of drop in fuels that are chemically identical to jet fuel, making them fully compatible with existing engines and infrastructure. PtL fuels have the potential to close the carbon cycle by reusing captured carbon, thus significantly reducing aviation’s net emissions. Although still in the early stages of commercialization, PtL is attracting attention as a long term solution to aviation’s carbon problem. Europe is leading in developing PtL projects, supported by strong regulatory frameworks and government funding. If production costs can be lowered, PtL fuels could play a vital role in achieving net zero aviation goals by mid century.

Gas-to-Liquid (GtL) Fuels

Gas to liquid technology converts natural gas into liquid hydrocarbons, producing cleaner burning fuels that can be used in aviation. GtL fuels have lower sulfur content and produce fewer particulates, improving air quality while maintaining compatibility with existing jet engines. Although not entirely carbon neutral, GtL fuels offer a transitional solution by reducing emissions compared to traditional jet fuel. Regions with abundant natural gas resources, such as the Middle East and North America, are particularly interested in GtL aviation fuels. Cost remains a critical barrier to widespread adoption, but as energy companies expand production, GtL could serve as an interim step while the industry transitions to fully sustainable alternatives like hydrogen and PtL.

Regional Market Insights

The aviation fuel market is influenced by regional dynamics, with distinct patterns emerging across North America, Europe, Asia Pacific, and the Middle East. North America is investing heavily in sustainable aviation fuel infrastructure, supported by federal initiatives and airline fuel producer partnerships. Europe is at the forefront of regulatory action, mandating SAF blending and leading hydrogen adoption programs. Asia Pacific is experiencing the fastest growth in passenger air traffic, driving demand for both conventional and alternative fuels. The Middle East, home to some of the world’s largest airlines and abundant natural resources, is positioning itself as a hub for GtL and synthetic fuel production. Each region’s approach reflects a balance between economic growth, environmental responsibility, and energy security.

Future Outlook and Innovation Pathways

The future of the aviation fuel market lies in diversification. No single fuel type is expected to dominate; instead, a combination of jet fuel, biofuel, hydrogen, PtL, and GtL will shape the fuel ecosystem. Artificial intelligence and digitalization will play a significant role in optimizing fuel efficiency, managing supply chains, and predicting demand. Investments in research and development are accelerating innovation, while global collaborations are essential for scaling new fuel technologies. By 2050, the aviation industry aims to achieve net zero emissions, and the fuel sector will be at the heart of this transition. The journey will require not only technological breakthroughs but also global alignment in policy, infrastructure, and financing.