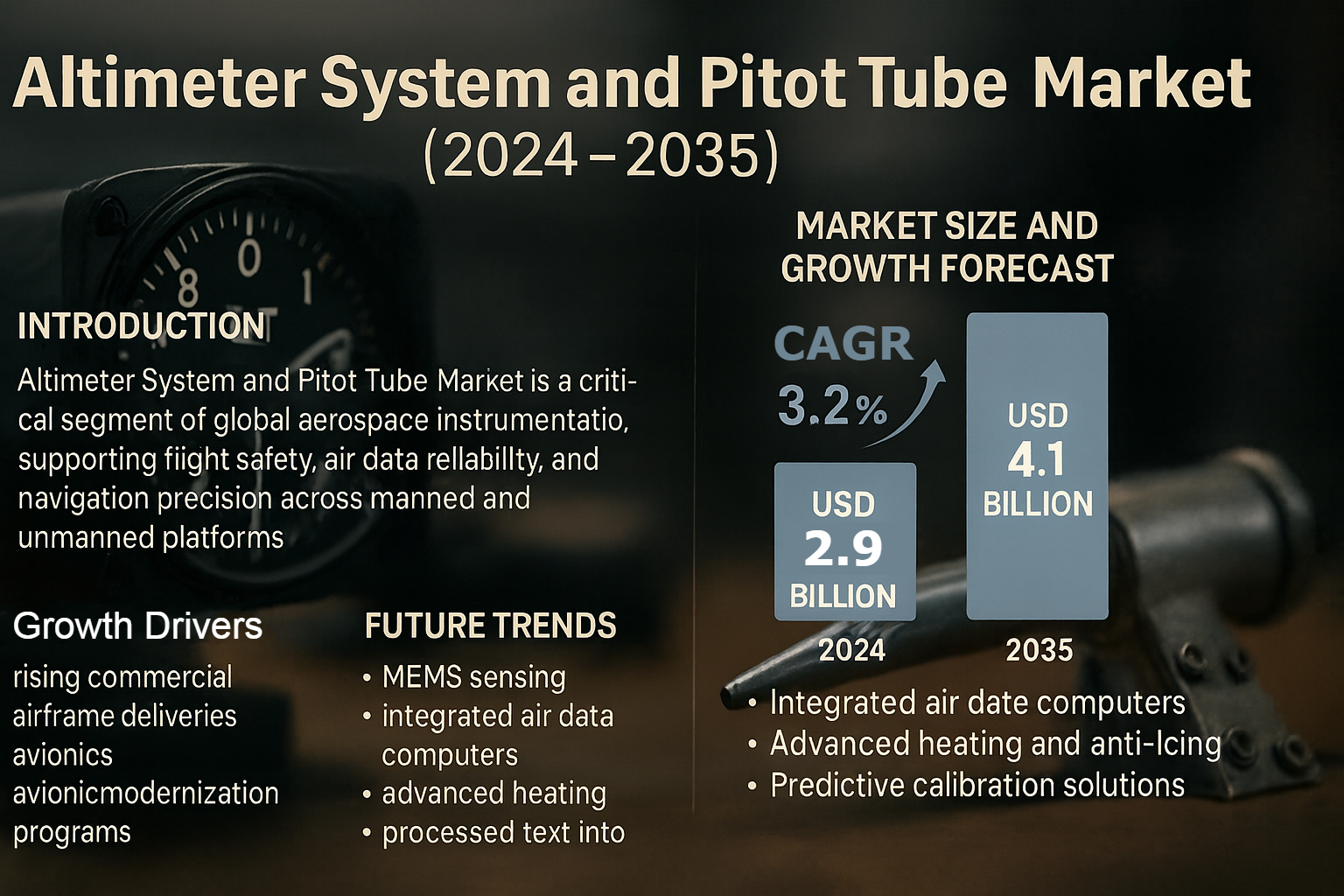

The Altimeter System and Pitot Tube Market is a critical segment of global aerospace instrumentation, supporting flight safety, air data reliability, and navigation precision across manned and unmanned platforms. Estimated at USD 2.9 billion in 2024, the market is forecast to reach around USD 4.1 billion by 2035 at a CAGR of 3.2%. The market’s steady expansion is driven by increasing commercial airframe deliveries, avionics modernization programs, and the rapid adoption of unmanned aerial systems that require compact, lightweight, and robust air data sensing. Regulatory imperatives from agencies such as the FAA and EASA, together with RTCA/DO-160 environmental testing requirements, continue to sustain aftermarket demand for certified pitot static components and altimeters. As aviation digitizes, the market’s future will be shaped by MEMS sensing, integrated air data computers, advanced heating and anti icing measures, and predictive calibration solutions that reduce aircraft downtime and lifecycle cost. Peripheral trends in aviation operations, including the growth of the Drone Detection Market, port security, and low altitude traffic management, also influence procurement timing and integration specifications for modern pitot and altimetry systems.

Altimeter systems and pitot tubes form the physical and logical interface between the atmosphere and an aircraft’s flight control and navigation systems. These components measure static and dynamic pressure to enable barometric altitude and airspeed determination, feeding data into air data computers, flight management systems, autopilots, and collision avoidance modules. Given their critical safety function, durability and reliability under icing, contamination, and foreign object damage are paramount. Over the 2024–2035 forecast horizon the demand mix will be shaped by three principal vectors: baseline demand from commercial aircraft production and long term aftermarket replacement cycles, retrofit programs for military and business fleets, and an expanding installed base of unmanned and advanced air mobility platforms that require miniaturized, power efficient pitot static assemblies. The market’s supply side responds with a mix of tier-1 avionics OEMs, specialist probe manufacturers, and sensor innovators leveraging MEMS and digital signal processing.

Market Size and Growth Drivers

The global altimeter system and pitot tube market is valued at USD 2.9 billion in 2024 and projected to grow to approximately USD 4.1 billion by 2035. This steady growth at a CAGR of about 3.2 percent reflects ongoing aircraft deliveries, avionics modernization, and the proliferation of UAVs and eVTOL demonstrators. Fleet renewals at Airbus and Boeing, as well as regional manufacturing programs such as COMAC in China and new small jet programs, sustain line fit demand. At the same time, aging in service fleets generate aftermarket demand for replacement probes, transmitters, and calibration services mandated by continuous airworthiness rules. Technological drivers include MEMS sensor accuracy improvements, the migration from analog to digital air data buses, and the integration of self test diagnostics and heating elements to mitigate pitot icing risks.

Segmentation Overview

Market segmentation spans systems (air data systems, static systems, integrated pitot static assemblies), platforms (commercial, military, unmanned, general aviation), components (pitot probes, static ports, sensors, transmitters, displays), and applications (altitude measurement, airspeed detection, navigation integration, environmental sensing). Air data systems account for the largest share because they deliver processed altitude, airspeed, and Mach values to flight computers and provide redundancy for safety critical functions. Static systems persist in legacy installations and value sensitive retrofit programs. Integrated systems that combine pitot, static and angle of attack sensing are gaining traction on next generation fly by wire aircraft and high performance UAVs that demand lower weight and fewer external penetrations.

Platform Dynamics

Commercial aviation remains the dominant market for altimeters and pitot tubes due to sheer fleet size and frequent certification and recertification cycles. Narrowbody production and retrofit schedules drive measurable volume, while widebody and regional aircraft contribute consistent aftermarket opportunities. Military aviation displays cyclical procurement tied to modernization and upgrade programs, with transport, trainer, and fighter fleets often requiring sensor replacements or enhanced heating and ice mitigation features. Unmanned aerial systems are the fastest growing platform segment; their need for low cost, lightweight, and power efficient pitot adapter assemblies creates room for innovative MEMS based sensing. General aviation and business jets maintain steady aftermarket demand, and as glass cockpits proliferate, digital altimetry displays and integrated air data units become more common.

Regional Outlook

North America holds the largest market share supported by a mature aerospace manufacturing ecosystem, dominant OEMs, and a dense MRO network. The FAA’s oversight and frequent airworthiness directives sustain market activity, particularly in the aftermarket. Europe follows closely with strong contributions from Thales, Safran, Meggitt, and other suppliers that support Airbus, regional OEMs, and defense programs. Asia Pacific offers the highest growth potential, driven by rapid fleet expansion in China, India, and Southeast Asia and the development of local MRO capacity and indigenous airframe programs. The Middle East’s expanding fleets and investments in defense modernization create demand for high performance probes and altimetry systems, while Latin America and Africa exhibit gradual growth tied to general aviation expansion and selective defense upgrades.

To Know About the Assumptions Considered for the Study Download the PDF Brochure

Regulatory Environment and Certification

The altimeter and pitot market is tightly coupled with regulatory frameworks and certification standards. Requirements include RTCA/DO-160 for environmental testing, DO-178C and DO-254 where software and digital hardware assurance are involved, and international certification paths under FAA and EASA rules. Pitot static systems must meet functional reliability and redundancy expectations; many aircraft require dual or triple independent sensing channels to conform with certification criteria. Anti icing heating performance and blockage detection features are frequent regulatory focal points following historical incidents attributed to pitot icing. Mandatory calibration and inspection intervals, often every 12 to 24 months for commercial fleets, create recurring revenue for calibration labs and service providers.

Technological Trends Shaping the Market

Advancements in MEMS technology, digital air data processing, integrated heating control, and telemetry enabled calibration are transforming the product landscape. MEMS pressure sensors deliver comparable accuracy to legacy transducers with lower mass and cost, enabling wider adoption on UAVs and eVTOL platforms. Digital signal processing and sensor fusion reduce susceptibility to transient errors and enhance the ability to detect blockage conditions via self test algorithms. Smart probes with embedded heaters and diagnostics can proactively report health metrics to Aircraft Health Monitoring systems, preventing in flight anomalies. Additive manufacturing allows complex probe geometries that improve aerodynamic flow characteristics and offer rapid prototyping for niche platforms. The integration of air data outputs into health and usage monitoring systems paves the way for predictive maintenance and longer service intervals when combined with reliable traceability systems.

Pitot-Icing, Contamination, and Environmental Hardening

Pitot icing remains a central reliability concern. Manufacturers focus on improved heating elements, enhanced surface treatments, and fluid dynamic probe designs that minimize ice accretion at low energy cost. Contamination from insects, dust, and hydraulic fluids also drives innovation in protective covers, drain designs, and advanced self clearing features. Environmental hardening for salt spray, corrosion resistance, and thermal cycling increases life expectancy in maritime and tropical operations. For military and special mission aircraft, ruggedized probes and sealed transmitter housings provide resilience against harsh operational environments.

Aftermarket, MRO, and Calibration Services

Aftermarket demand accounts for a significant portion of market revenues. Pitot probes and altimeter components experience wear, damage from FOD and bird strikes, and degradation of heating elements over time. MRO facilities perform routine inspections, calibrations, and replacements governed by airworthiness schedules. Calibration services tied to ISO/IEC 17025-accredited labs and digital calibration records are critical to maintaining compliance. Predictive calibration models that use sensor health telemetry can optimize shop visits and reduce unnecessary replacements, lowering overall fleet costs.

Opportunities in Unmanned and Advanced Air Mobility

UAVs and AAM platforms present notable opportunities for compact pitot static systems and low power altimeters. These platforms demand miniaturized sensors that minimize weight penalty while maintaining sufficient accuracy for navigation and payload stabilization. The anticipated commercialization of eVTOL services post 2030 will require cost effective, high reliability air data solutions integrated with urban air mobility traffic management systems. For cargo and delivery drones operating in dense urban environments, precise altitude sensing and fast response pitot probes improve obstacle avoidance and low altitude flight safety.

Business Models and Value Chains

Traditional OEM sales of probes and altimeters are being supplemented by recurring service models and data enabled offerings. Suppliers now offer extended warranties, predictive maintenance subscriptions, and curated calibration packages. Tier-1 avionics vendors embed their air data units within larger avionics suites sold on new aircraft, whereas specialist probe manufacturers often rely on aftermarket channels and MRO partnerships for volume. Strategic alliances with calibration labs and software providers enable end to end air data lifecycle management for airlines and defense operators.

Competitive Landscape and Key Players

The altimeter and pitot market is competitive and technologically diverse. Major tier-1 avionics OEMs coexist with specialist probe manufacturers and sensor innovators, each with distinct routes to market. Key players include Honeywell International Inc., Collins Aerospace (RTX Corporation), Thales Group, Safran Electronics & Defense, Garmin Ltd., Meggitt PLC, Aerosonic Corporation, and Kollsman Inc. (part of Elbit Systems). These companies emphasize safety certified designs, compliance with DO-160 and airworthiness standards, and innovations in heating, contamination resistance, and digital diagnostics. Cross supply partnerships, M&A to expand testing and calibration capabilities, and targeted R&D investments in MEMS sensing and analytics underpin product roadmaps.

Honeywell International Inc.: Honeywell is a diversified avionics and aerospace supplier with a substantial presence in air data computers, pitot static modules, and integrated sensor suites. Honeywell’s product portfolio leverages in house avionics integration expertise and global aftermarket support networks, making the company a preferred supplier for major commercial and defense OEMs. Honeywell invests in sensor diagnostics and software that allow its probes and altimeters to interface directly with aircraft health monitoring systems.

Collins Aerospace (RTX Corporation): Collins Aerospace, as part of RTX Corporation, offers a broad range of avionics, including pitot static systems, air data computers, and flight deck instrumentation. Collins’ strength lies in system level integration and in service support for large commercial and military platforms. Its experience with certified flight systems positions it well to supply integrated air data assemblies for modern glass cockpits and fly by wire architectures.

Thales Group: Thales supplies avionics and instrumentation with a strong presence in Europe and global defense markets. The company’s altimetry and pitot solutions emphasize integration with navigation and flight control suites and often accompany Thales’ larger avionics contracts. Thales’ approach focuses on digital air data processing and ensuring compliance with stringent certification regimes for both civil and military customers.

Safran Electronics & Defense: Safran offers precision air data sensors and pitot static assemblies with a focus on performance under adverse environmental conditions. The company supports a wide range of platforms from business jets to military transport aircraft. Safran’s R&D emphasizes sensor miniaturization, heating efficiency, and integration with avionics suites to offer turnkey air data solutions.

Garmin Ltd.: Garmin is a significant supplier to general aviation and business aircraft sectors, providing altimeters and pitot static assemblies optimized for light aircraft and retrofit markets. Garmin’s products focus on ease of integration with glass cockpit displays, competitive pricing, and strong distributor and MRO channel support, making them popular in the general aviation aftermarket.

Meggitt PLC: Meggitt, known historically for sensors and flight test instrumentation, provides pitot and pressure sensing systems with application in commercial and defense markets. Meggitt’s heritage in high reliability sensors and flight test requirements informs its product development for air data systems that meet rigorous performance standards.

Aerosonic Corporation: Aerosonic specializes in pitot static probes and temperature sensing systems, supplying a diverse range of platforms from business jets to regional aircraft. The company’s emphasis on proven mechanical designs and compatibility with multiple avionics vendors supports broad aftermarket adoption and ease of replacement in service.

Kollsman Inc. (Elbit Systems): Kollsman, now under Elbit Systems’ ownership, provides altimeters and flight instruments with a strong pedigree in precision naval and airborne systems. Kollsman’s products often integrate with military avionics suites, and the company benefits from Elbit’s global defense reach to supply sensors for niche mission requirements.\

Case Studies and Real-World Implementations

A large North American carrier implemented a predictive calibration regimen for pitot static systems by combining smart probe telemetry with MRO scheduling software. The initiative reduced unscheduled AOG events tied to probe failures and extended average time between replacements, translating into quantifiable operational savings.

A defense modernization program in Europe replaced legacy analog probes with digitally enabled pitot static assemblies featuring embedded heating control and self test capabilities. The digital probes improved blockage detection and reduced false warnings, streamlining flight deck workload and enhancing mission readiness.

A UAV manufacturer adopted MEMS based pitot sensors for a fleet of long endurance surveillance drones. The switch reduced per unit weight, decreased power draw, and lowered unit cost while maintaining navigational accuracy sufficient for ISR missions, enabling larger payloads or longer endurance.

Pricing, Procurement Cycles, and TCO

Pricing for pitot and altimeter systems varies by complexity, platform certification, and integration scope. Line fit units on new aircraft command higher margins due to certification and integration work, while commodity replacement probes compete on price and availability. Total cost of ownership assessments increasingly consider calibration frequency, heating element longevity, downtime cost, and software lifecycle fees. Vendors offering bundled calibration subscriptions or predictive maintenance credits lower visibility issues and improve procurement appeal.

Challenges and Market Risks

Key challenges include exposure to environmental contamination and pitot icing, which can lead to high stakes in flight incidents if not mitigated. Rapid avionics innovation can make existing test benches and calibration rigs obsolete, raising barriers for smaller MROs to support new sensor types. Regulatory changes and divergent regional certification pathways complicate global supply and aftermarket support. Cybersecurity of digital sensor outputs is an emerging concern as air data telemetry becomes networked with aircraft health management systems. Finally, competition from low cost suppliers may pressure margins in commoditized replacement products.

Intersections With the Drone Detection Market and Operational Implications

The proliferating Drone Detection Market intersects with the altimeter and pitot segment primarily through low altitude traffic management, port operations, and integrated safety ecosystems. As airports and many maritime terminals deploy drone detection and counter UAS systems, there is increasing demand for reliable altitude and air data reporting to integrate manned aircraft awareness with low altitude unmanned activity. Urban air mobility operations and drone corridors require precise altimetry and validated air data feeds, making accurate pitot static systems part of a broader safety fabric that includes drone detection, flight path deconfliction, and surveillance. Suppliers who understand how sensor data will coexist with drone detection feeds and low altitude traffic management systems may find differentiated opportunities to supply integrated sensor suites and data fusion modules.

Sustainability and Manufacturing Trends

Sustainability considerations are prompting lighter materials, energy efficient heater designs, and recyclable packaging. Additive manufacturing shortens prototyping cycles and allows weight optimized probe designs. Manufacturers pursue RoHS compliance and report lifecycle environmental metrics to support operator ESG objectives. Predictive maintenance reduces wasteful part replacements and contributes indirectly to fuel efficiency gains by minimizing AOG induced schedule disruptions.

Future Outlook and Strategic Recommendations

Through 2035 the altimeter system and pitot tube market will grow steadily, supported by new aircraft production, UAV proliferation, and continual regulatory pressure to maintain accurate air data systems. Suppliers should invest in MEMS sensor platforms, develop robust self test and heating solutions, and expand calibration as a service offerings to capture recurring revenue. MROs must modernize calibration tooling and training to support new digital sensor types. OEMs and operators should prioritize supplier partnerships that offer lifecycle support, software updates, and predictive maintenance agreements. Finally, cross domain integration with drone detection and low altitude traffic management systems will create new specification requirements and market niches.

The altimeter system and pitot tube market is indispensable to aviation safety and navigation integrity. As the aerospace industry evolves toward electrified propulsion, distributed sensing, and ubiquitous telemetry, the air data segment will remain a backbone technology. Innovation in MEMS sensing, heating efficiency, digital diagnostics, and integrated air data management will determine market leadership. The market is projected to expand from USD 2.9 billion in 2024 to USD 4.1 billion by 2035, representing a manageable but meaningful growth trajectory. Strategic focus on product reliability, certification agility, aftermarket service models, and ecosystem integration including awareness of adjacent sectors like the Drone Detection Market will position suppliers and MROs to capture the next decade of opportunities.

Related Repor:

Altimeter System and Pitot Tube Market by Platform (Commercial, Military, UAV, General Aviation), by Component (Sensors, Display Units, Transmitters, Pitot Tubes), by System (Static, Air Data, Integrated), by Application (Altitude Measurement, Airspeed Detection, Flight Navigation, Environmental Monitoring), by End User, and by Region — Global Forecast to 2035