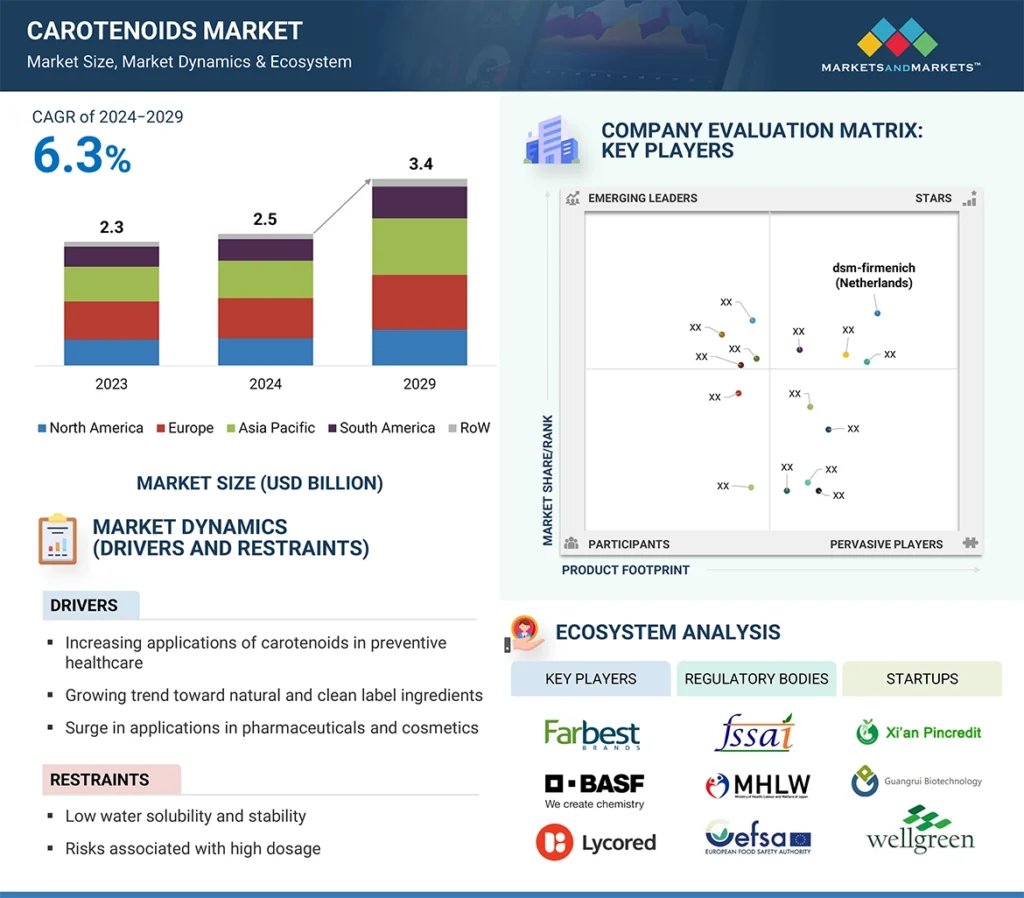

The global carotenoids market is on an impressive upward trajectory. Valued at USD 2.5 billion in 2024, the market is projected to reach USD 3.4 billion by 2029, growing at a CAGR of 6.3%. This surge is fueled by rising consumer demand for natural, nutrition-rich ingredients and expanding applications across food, beverage, cosmetics, and animal feed industries.

Why is the carotenoids market growing?

A variety of influential factors are driving the expansion of the carotenoids market:

- Rising Preference for Natural & Clean Label Products: Consumers today are more informed and health-conscious than ever. With increasing scrutiny of synthetic additives, carotenoids—naturally occurring pigments in fruits, vegetables, and algae—have emerged as preferred natural colorants and antioxidants.

- Increasing Focus on Preventive Healthcare: As lifestyle-related health concerns grow, carotenoids are gaining attention for their functional benefits. Known for supporting eye health, immune function, and overall wellness, they are widely incorporated into supplements, functional foods, and beverages.

- Advances in Extraction & Encapsulation Technologies: Innovations in extraction techniques and encapsulation have made carotenoids more stable, bioavailable, and cost-effective. These advancements have significantly enhanced their application range, from nutraceuticals to skin-care formulations.

- Growing Use in Animal Nutrition: The animal feed sector is also contributing to market growth. Carotenoids help enhance pigmentation in poultry and aquaculture and support overall animal health—making them indispensable in premium feed formulations.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158421566

By Source: Natural Carotenoids Lead the Growth

The natural carotenoids segment is expected to grow at the highest CAGR during the forecast period.

This growth is driven by:

- Strong consumer preference for natural ingredients

- Regulatory encouragement toward clean label solutions

- Improvements in natural extraction processes

- Wider R&D efforts to improve cost efficiency

As a result, natural carotenoids are quickly outpacing synthetic variants in demand and market share.

By Formulation: Beadlets Take Center Stage

The beadlet formulation segment is estimated to grow at the fastest pace.

Why beadlets?

- High stability

- Better bioavailability

- Easy incorporation into foods and supplements

With ongoing innovations making beadlet production more cost-effective, manufacturers are increasingly adopting this format, especially in functional foods and dietary supplements.

By Type: Astaxanthin Dominates

Among all carotenoids, astaxanthin stands out as the most dominant segment. Known as one of the world’s most powerful natural antioxidants, astaxanthin offers benefits such as:

- Anti-inflammatory properties

- Cardiovascular support

- Skin and eye health

- Enhanced athletic performance

Its natural sourcing from microalgae and seafood aligns perfectly with consumer demand for clean, sustainable ingredients. Technological improvements in astaxanthin production have also broadened its accessibility and affordability.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=158421566

Regional Outlook: Asia Pacific Leads the Growth Wave

The Asia Pacific region is set to witness the fastest market growth. Factors contributing to this include:

- Rising health awareness

- Shifting dietary preferences toward fortified foods

- Rapid urbanization and a growing middle-class population

- Strong demand for natural food additives and supplements

- Government initiatives supporting natural and functional ingredients

Countries like China, India, and Japan are emerging as major hotspots for carotenoid-enriched food and nutraceutical products.

Leading Carotenoids Companies:

Several global leaders are driving innovation, product development, and market expansion, including:

- DSM (Netherlands)

- BASF SE (Germany)

- Cyanotech Corporation (US)

- Givaudan (Switzerland)

- ADM (US)

- Zhejiang NHU Co. Ltd. (China)

- Divi’s Laboratories Limited (India)

- Allied Biotech Corporation (Taiwan)

- Lycored (US)

- Kemin Industries, Inc. (US)

- Fuji Chemical Industry Co., Ltd. (Japan)

- EW Nutrition (Germany)

- Döhler Group (Germany)

- ExcelVite (Malaysia)

- Farbest Brands (US)

These companies are investing heavily in R&D, expanding production capacities, and launching innovative carotenoid formulations to meet evolving consumer demands.