The Global Advanced Driver Assistance System (ADAS) Market is projected to reach USD 74.9 billion by 2030, from USD 27.2 billion in 2021, at a CAGR of 11.9%. The growth of the market is driven by the growing demand for driver assistance systems and stringent safety mandates for a safer driving experience.

Upcoming safety mandates and increasing focus on sophisticated driving assistance features would spur the growth of ADAS solutions. Increasing focus on active safety systems and car assessment programs would drive the demand for ECUs in modern vehicles.

The increasing number of accidents due to distractions as well as alcohol-impaired driving fatalities have become a major concern for lawmakers and have sparked the demand for advanced safety features such as driver monitoring systems, automatic emergency braking, lane departure warning, and others.

Top Players:

Robert Bosch (Germany), Continental AG (Germany), ZF Friedrichshafen (Germany), Denso (Japan), Aptiv (UK), Valeo (France), Hyundai Mobis (South Korea), Veoneer (Sweden), Magna International (Canada).

Startups:

Luminar Technologies (US), ADASKY (Israel), Bright Way Vision (Israel), TriEye LTD (Israel).

The European Union has outlined Vision Zero, an initiative to mitigate road deaths to zero by 2050. The authority targets to reduce fatalities and injuries by 50% by 2030. The strategic plan also includes mandating major safety features such as lane departure warning, automatic emergency braking, and drowsiness and attention detection in new vehicles by 2022.

Request FREE Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1201

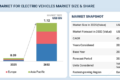

Governments in countries such as India, China, the US, and European countries are subsidizing electric infrastructure, which has resulted in the growth of the BEVs segment. OEMs are focusing on launching new electric variants of existing ICE models. In addition, owing to tough competition from major EV manufacturers such as Tesla, major OEMs have planned to introduce more safety and driving assistance features to stay competitive. Leading automakers such as Nissan, Tesla, and Audi are increasingly focusing on green vehicles with more driving comfort features. Hence, the demand for ADAS solutions in the electric vehicle segment is expected to rise during the forecast.

Increasing investment by major OEMs and tier 1 auto component manufacturers to develop L3 driving systems is likely to spark the adoption of more driving assistance systems in upcoming vehicles. For instance, ZF unveiled its coASSIST level 2+ driving system in January 2020 in an under USD 1,000 price range. Such affordable ADAS solutions will increase the penetration of major ADAS features in a standard ADAS package. According to the company, it will be in production with a major Asian OEM by the end of 2020. ZF offers copilot, a scalable ADAS solution for level 2+ to level 4 driving systems, which was co-developed with NVIDIA.

OEMs are also increasingly working closely with tier 1 players and software providers to deploy autonomous driving systems. Components for fully autonomous vehicles such as LiDAR are currently expensive, and the reliability of these components is still being explored. However, the cost of LiDAR is significantly decreasing over time. For instance, Volvo announced plans to produce vehicles with LiDAR in 2022. The automaker partnered with Luminar, a major LiDAR technology focus startup. According to the company, LiDAR cost can be low as USD 1,000 for level 5 autonomy and USD 500 for driving assistance if produced at a scale. LiDAR systems are also being used in the development of fully autonomous cars by companies such as Waymo (US), Ford Motor Company (US), Nissan Motor Company (Japan), and others. These autonomous cars have performed well under controlled conditions and are expected to be fully commercialized in the coming years. More development in L3, L4, and L5 driving systems would further strengthen the ADAS market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1201

ADAS Market and Key Application:

- Adaptive Cruise Control – Adaptive cruise control (ACC), also known as autonomous cruise control, is an advanced version of cruise control. In cruise control, the vehicle is maintained at a steady speed as the system takes over the throttle. However, in ACC, the vehicle adjusts its own speed to keep a safe distance from the vehicles ahead. The factors positively affecting the growth of adaptive cruise control are technology upgrades and the increasing need for passenger safety. The rising number of accidents has led to an increase in the installation of adaptive cruise control in vehicles.

- Automatic Emergency Braking – Automatic emergency braking (AEB) is a safety feature that alerts drivers about an imminent crash and enables them to use the maximum braking capacity of the vehicle. AEB automatically applies the brakes if a situation becomes critical, and the driver is not responsive. AEB comes in 3 categories, namely, low-speed systems, higher speed systems, and pedestrian systems. Low-speed systems work on city streets to detect another vehicle in front of the car.

- Blind Spot Detection – A blind spot detection system detects other vehicles that fall in the ‘blind spot range’ of the driver, usually on the side or rear of the vehicle. A blind spot is an area around the vehicle that cannot be easily viewed by the driver. When another vehicle enters the blind spot range, the sensors detect it and send visual or audio alarms to the driver.

Recent Developments:

- In year 2021 Robert Bosch (China) Investment Ltd., (Bosch China) developed an automated valet parking with Hycan Automobile Technology. This technology will be installed in Hycan Z03. When the driver activates the automated valet parking function on the smartphone, the vehicle will automatically drive to the parking lot as commanded and park at the destinated location by accurately identifying the direction while avoiding obstacles. The automated valet parking technology is categorized under Level-4 autonomous driving.

- In year 2021 ZF launched its next-generation mid-range radar to support advanced ADAS functions and enhance the available ZF coASSIST semi-automated system on the Dongfeng Aeolus Yixuan MAX in China. ZF’s mid-range radar is a high-performance 77GHz front radar designed to meet 2022+ Euro NCAP 5-Star Safety Ratings and enable semi-automated driving functions.

- In year 2021 ZF and Mobileye were selected by Toyota Motor Corp. to develop Advanced Driver Assistance Systems (ADAS) for multiple vehicle platforms in the next few years. As part of the agreement, ZF, one of the world’s number one producers of automotive cameras driven by Mobileye technology, will also supply its Gen21 mid-range radar and be responsible for the integration of camera and radar in Toyota vehicles.

- In February 2020, Veoneer was selected to supply active safety systems based on next-generation vision and radar systems. Veoneer’s scalable system has been developed to meet Euro NCAP 5-star safety rating as well as provide several driver assistance features such as highway assist, lane centering control, stop and go adaptive cruise control, automatic emergency braking, traffic sign recognition, and automated high beam control.

- In February 2020, Continental announced a new production plant for ADAS in Texas, US, with an investment of USD 109 million over the next 3 years. The new production facility will manufacture radars from 2021.

- In January 2020, ZF launched ZF coASSIST, a Level 2+ automated driving system, which is its first step into the modular Level 2+ hardware and software suite and highlights ZF’s capabilities as a full system supplier. From 2020, ZF will equip production vehicles with this new ZF system for a major Asian manufacturer.