The Americas held the largest share of the precision harvesting market in 2018. The US and Canada are the early adopters of precision harvesting technologies, which is the major reason for the large market share of this region. Farmers or growers in this region are increasingly adopting autonomous combine harvesting systems and equipment such as steering and guidance systems, sensors, display devices, and farm management software.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=194202698

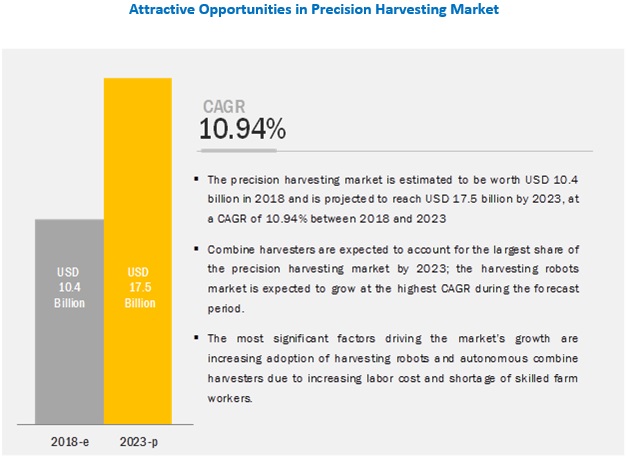

The precision harvesting market was worth USD 10.4 billion in 2018 and is projected to reach USD 17.5 billion by 2023, at a CAGR of 10.94% from 2018 to 2023. The major drivers for the precision harvesting market are increasing farm mechanization in developing countries in Asia Pacific and Africa, increasing adoption of harvesting robots and autonomous combine harvesters, and increasing labor cost owing to shortage of skilled labor. Precision harvesting has the potential to transform the agriculture sector, making traditional harvesting activities more efficient and economical. The increasing global food demand, extended profitability and crop yield, and minimum wastage of crops during harvesting are the other factors fueling the market’s growth. Also, government initiatives in many countries are helping farmers adopt advanced agricultural and technological tools to improve yield.

The precision harvesting market in Europe is expected to grow at the highest CAGR from 2018 to 2023. The increasing mechanization in Eastern European farms–Poland, Austria, Croatia, and Bulgaria—is a major factor contributing to the high growth of the precision harvesting market in this region. The market’s growth and demand for harvesting robots are also driven by increasing strain on food supplies to feed a swelling population, declining availability and rising cost of farm labor, challenges and complexities of farm labor, climate change, the growth of smart greenhouse and indoor farming, and the broader automation in the agriculture industry.

The precision harvesting market for corn application is expected to grow at the highest CAGR during the forecast period. Adoption of precision harvesting systems for corn application is comparatively high as compared to other crops; as a result, this segment held the largest market size. Innovations in harvesting equipment and a greater need to automate corn, cotton, and soybean farms due to the shortage of skilled labor are the major factors driving the growth of this segment.

The market for harvesting robots is expected to grow at the highest CAGR from 2018 to 2023. The rising demand for harvesting robots is being driven by increasing demand for food owing to increasing population, increasing strain on food supply, declining availability of farm workers, the rising cost of farm workers, and broader automation in the agriculture industry.

The precision harvesting market for services is expected to grow at the highest CAGR during the forecast period. Growing interest in automation in the agriculture industry and advancements in precision harvesting technology are expected to propel the demand for precision harvesting services during the forecast period. Increasing demand for managed services is also a major reason behind the high growth of the precision harvesting market for services.

The major players in the precision harvesting market have executed acquisitions, partnerships, and product launches and developments to grow in the market. For instance, in June 2018, John Deere launched the Intelligent Boom Control (IBC) for 1270G harvester in North America. IBC provides operators with increased accuracy and productivity. CNH Industrial acquired the agricultural grass and soil business of Kongskilde Industries, a part of the Danish Group Dansk Landbrugs Grovvareselskab (DLG A.m.b.A.).