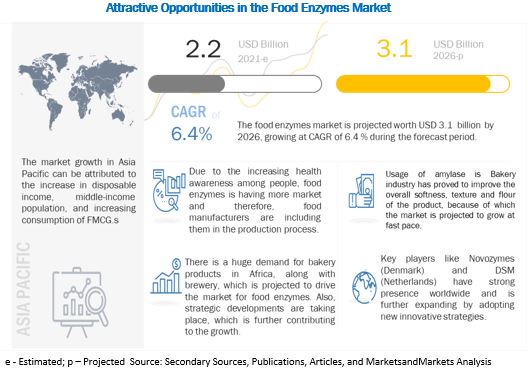

The report “Food Enzymes Market by Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases), Source, Application (Food & Beverages), Formulation, and Region(North America, Europe, Asia Pacific, and South America) – Global Forecast to 2026” The food enzymes market is estimated to be valued at USD 2.2 billion in 2021 and is projected to reach USD 3.1 billion by 2026, recording a CAGR of 6.4%, in terms of value. The growing demand for diverse range of food products, clean label trend, and increase in disposable income are the factors that are projected to drive the growth of the food enzymes market globally.

COVID-19 Analysis

The impact of COVID-19 food enzymes is expected to be significant, as the current pandemic has highlighted the significance of safe, healthy, and nutritious eating. While ingredient sales span across the countries, key companies in the food enzymes market have also begun to establish regional production. R&D and sales department and are also optimizing supply chains for the distribution of raw materials. Amidst the COVID-19 outbreak, food ingredient companies are facing significant challenges to address the increased demand for food enzymes to include changing tastes and preferences. A rapid and unexpected spike in demand for functional foods during the pandemic resulted in manufacturers, suppliers, and retailers struggling to ensure a continued supply of raw materials in the market. Disruptions in the supply chain during the COVID-19 lockdown across the countries were challenging for the food enzymes market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=800

Opportunities: Innovative technological platforms

The global food enzymes market has many small-scale manufacturers trying to compete with the market leaders in terms of the application specificity of the food enzymes produced. This, in turn, is dependent upon the quality of production strain developed by manufacturers. Various technology licensors provide small-scale manufacturers with the opportunity to produce programmable enzymes, which can be scaled up to produce large volumes. Dyadic International Inc. (US) is one such licensor that provides its C1 platform technology to smaller players to produce large volumes of high-mobility food enzymes on-site.

Threats: Changes in food enzymes safety regulations in Europe

The European market for food enzymes held a share of about 30.0% of the global market in 2015. As enzymes are naturally present in ingredients used to make food, earlier, their safety and toxicity were not of much concern. However, the advent of large-scale production of food enzymes through strains of genetically modified microorganisms has led to increased scrutiny on the use of enzymes in Europe’s food & beverage industry. In the past, the regulation of enzymes used as processing aids was not carried out at the EU level. Of the member states, only Denmark and France evaluated these processing aids before their use in the food & beverage industry. This inconsistency in the assessment criteria of food enzymes among nations prompted the framing of a new EU legislation.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=800

The North American region dominated the food enzymes market with the largest share in 2020, whereas Asia Pacific is expected to witness the highest growth rate.

The food enzymes market in North America was dominant due to the increasing demand for enzymes in food applications. Technological innovations in machinery, optimization of production, logistics, and globalization of business have made the food & beverage industry one of the essential sectors in North America. However, the shift of food operations from developed regions, such as North America and Europe, to Asia Pacific, has further contributed to the growth of the food enzymes market in the Asia Pacific region.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as DuPont (US), Associated British Foods plc (UK), DSM (Netherlands), Novozymes (US), CHR. Hansen Holdings A/S(Denmark), Kerry Group (Ireland), Jiangsu Boli Bioproducts Co., Ltd. (China), Biocatalysts Ltd. (UK), Puratos Group (Belgium), Advanced Enzyme Technologies Ltd (India), Amano Enzyme Inc. (Japan), Enzyme Development Corporation (US), ENMEX, S.A. de C.V. (Mexico), Aumgene Biosciences (India), Creative Enzymes (US), SUNSON Industry Group Co., Ltd (China), AUM Enzymes (India), Xike Biotechnology Co. Ltd. (China), and Antozyme Biotech Pvt Ltd (India).