New Revenue Pockets:

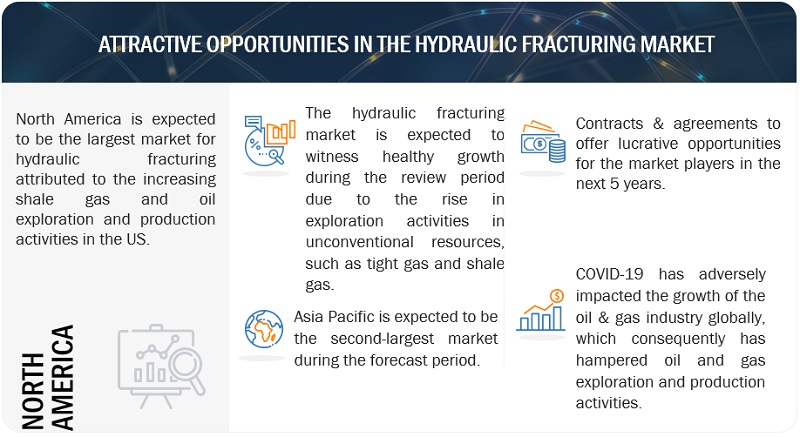

The global hydraulic fracturing market is projected to reach USD 74.4 billion by 2028 from an estimated USD 52.1 billion in 2023, at a CAGR of 7.4% during the forecast period. Increasing shale exploration and production activities globally will positively impact the hydraulic fracturing market.

Hydraulic fracturing, also known as fracking, is a well-stimulation technique used in the oil and gas industry to extract natural gas and oil from deep underground formations. It involves injecting a high-pressure fluid mixture consisting of water, chemicals, and proppants (typically sand or ceramic beads) into a wellbore. The fluid creates fractures or fissures in the rock formation, allowing hydrocarbons to flow more freely toward the wellbore.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=745

This report segments the hydraulic fracturing market based on technology into plug & perf and sliding sleeves. The sliding sleeve segment is expected to be the second-largest market during the forecast period. Open-hole completion system is a type of well-completion technology that does not require casings or liners across the formation. In multi-zone wells, sliding sleeves are used to regulate the zones, i.e., which zone to produce from and which ones to shut off (depending on the zone that is depleting or producing water in a large quantity). This technology allows operators to choose between multiple pay zones in a single wellbore by shutting off the flow and regulating pressure between zones.

This report segments the hydraulic fracturing market based on application into three categories: shale gas, tight oil, and tight gas. The tight oil segment is expected to be the second-largest segment during the forecast period. Tight oil is found in impermeable shale and limestone rock deposits. It is also known as shale oil. Tight oil can be processed into gasoline, diesel, and jet fuels and extracted using the hydraulic fracturing technique. The increase in tight oil production can be attributed to horizontal drilling in combination with hydraulic fracturing. In addition, technological advancements have increased the profitability of tight oil production, and it has become easy to recover tight oil from its resource base economically.

Ask Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=745

This report segments the hydraulic fracturing market based on region into five categories: North America, Latin America, Asia Pacific, Europe, and Middle & Africa. Latin America is expected to be the third-largest region during the forecast period. The scope of the regional market includes Argentina, Mexico, and Rest of Latin America. Latin America has significant oil and gas reserves. According to the BP Statistical Review of World Energy published in June 2022, South & Central America accounted for 9.0% of global oil production in 2022. Latin America’s high unconventional hydrocarbon potential has been widely recognized, especially in Argentina, Mexico, Colombia, and Chile. Colombia has 55 tcf of technically recoverable shale gas resources, which would place it fifth in South America, according to the US Energy Information Administration. Argentina has 802 tcf, and Mexico has 545 tcf of technically recoverable unconventional gas resources. In Latin America, Argentina has employed fracturing on a commercial scale, in particular in the Vaca Muerta Shale formation.

Key Market Players

Prominent companies in this market include Halliburton (US), Schlumberger (US), Liberty Oilfield Services LLC (US), Baker Hughes (US), and NexTier Oilfield Solutions (US).