An injection molding machine consists of a heated barrel equipped with a reciprocating screw (driven by a hydraulic or electric motor) which feeds the molten polymer into a temperature-controlled split mold via a channel system of gates and runners. The screw melts (plasticizes) the polymer and acts as a ram during the injection phase. An injection molding machine is used for manufacturing products made of plastics, rubber, metal, and ceramics. There are three types of injection molding machines – hydraulic injection molding machines, all-electric injection molding machines, and hybrid injection molding machines. They perform the following essential functions:

- Heating and melting plastic in the plasticator

- Injecting from the plasticator under pressure

- Maintaining the injected material under pressure for a specified period

- Cooling the thermoplastic molded part in the mold

- Opening the mold and then ejecting the part

- Closing the mold

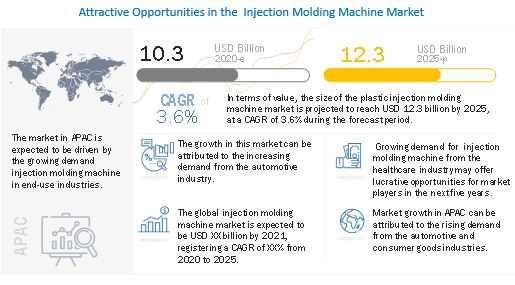

The market size of the injection molding machine is estimated at USD 10.4 billion in 2022 and is projected to reach USD 12.4 billion by 2027, at a CAGR of 3.67%. The larger market size and growing demand for injection molding machines are mainly driven by high demand from the packaging industry, rising awareness for energy savings, and increasing demand for consumer electronics. The disruptions in these end-use industries are driving the demand and technological advancement in the injection molding machines industry.

UPCOMING TRENDS AND DISRUPTIONS IMPACTING THE MARKET

The emergence of electric vehicles (EVs) to propel the demand for injection molds. The strong position of the automotive sector is a significant factor driving the need for injection molding machines. There have been technological advancements in the E-mobility segment across the globe, revolutionizing the related markets. The global EV industry has shown significant growth, and in 2019, the number of electric vehicles reached 2,264,400 units, which was 9% higher than that in the previous year. Various major companies have invested and announced the launch of electric vehicles in the coming 5-10 years.

Electric car companies and their OEMs are increasingly transitioning from metal to thermoplastic for many vital components. Using plastic instead of metal can help electric car companies reduce the weight of vehicles by as much as 30%. Injection-molded plastic parts are also cheaper to produce than their metal counterparts. This is also expected to enable electric car companies to lower the prices of cars and compete more effectively in the market. Increasing injection mold production for electric vehicles is expected to offer a good opportunity for players in the injection molding machine industry.

MAJOR PLAYERS PLAYING A VITAL ROLE IN THE MARKET

The injection molding machine market is highly competitive. Both global and regional players are competing with each other to cement their position in the worldwide market. The key manufacturers of injection molding machines include Haitian International Holdings Limited, Chen Hsong Holdings Limited, Sumitomo Heavy Industries Ltd., ENGEL Austria GmbH, Hillenbrand, Inc., and others. These players are manufacturing different injection molding machines including hydraulic, all-electric, and hybrid machines to produce molded parts in automotive, healthcare, consumer goods, packaging, and electronic & electrical industries. They are continuously adopting development strategies such as expansions, product launches, acquisitions, and contracts & agreements to strengthen their positions.

For example, in May 2022, Husky Injection Molding Systems, Ltd. announced the introduction of Husky’s RMTP technology. It offers a high-performance system designed to support the closed-loop conversion of washed flakes to preform by accepting food-approved grade melt from an upstream provider. By eliminating the drying and melting steps associated with traditional rPET preform manufacturing, this solution facilitates the effective production of packaging made from 100 percent rPET material, further supporting the circularity of PET. Similarly, in August 2021, Sumitomo Heavy Industries, Ltd. launched an all-electric double-shot injection molding machine SE400HS-Cl. CI series improves productivity due to its high-speed rotary unit, improving work efficiency by shortening the cycle time and temperature control piping, enhancing its capabilities.

DISRUPTIONS IN END-USE INDUSTRIES IMPACTING THE MARKET

The adoption of lightweight materials as a substitute for metal components in different end-use industries, such as the automotive, construction, and healthcare sectors, is disrupting the demand for injection molds suitable in each end-use industry and subsequently driving the need for injection molding machines. The demand for large-tonnage injection molding machines is rising to fulfill the vast demand and mass production.

There is a growing demand for large-tonnage plastic injection molding machines for making large, molded parts for automotive, electronics, and industrial applications. Earlier, due to plant infrastructure expenses, demand for injection molding machines was not beyond the 400-ton range, with 500 presses being the maximum limit. The market has changed over the years, and there is high demand for large parts. The ability of machinery manufacturers to build large energy-efficient machines that offer fast cycle time has increased. According to the Plastics Industry Association, the shipment of large machines is higher than that of small machines. Large injection molding machines provide companies with good business opportunities in various markets, including sports, agriculture, and automotive. Though this involves significant strategic planning and resources, it is a good investment. Instead of handling giant molds and transporting them from one place to another, it is better to transport a machine which is a one-time investment. These factors lead to a higher demand for large-tonnage injection molding machines.

CONCLUSION

The shift in industrial practices leads to changes in adjacent industries as well. There is a shift in automotive, construction, packaging, and other industries with the introduction of disruptive technologies. This disruption also impacts the adjacent market, including molded plastics, injection molds, and injection molding machines. The emergence of EVs, changes in packaging material, rise in usage of precision parts in consumer electronics, and other shifts are projected to drive the injection molding machines demand in coming years.