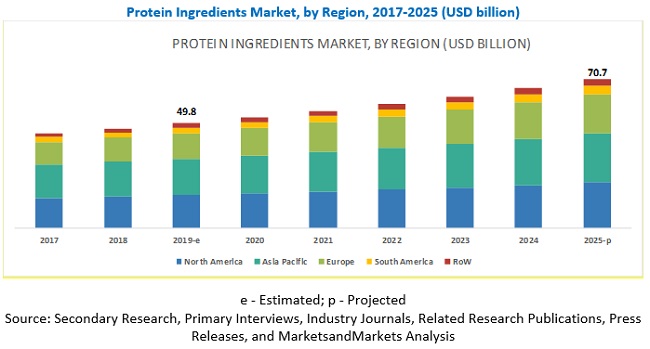

The global protein ingredients market size is projected to grow from USD 49.8 billion in 2019 to USD 70.7 billion by 2025, at a CAGR of 6.0% during the forecast period. The protein ingredients market is driven by factors such as the increasing demand for protein functionalities, awareness about healthy diet & nutritional food, new technological development in the protein ingredients industry, growth in demand for superior personal care and healthcare products, and increase in consumption of animal by-products, which are in turn supported by the economic growth, technological advancements, and consumer preference for functional products. However, factors such as stringent government regulations on animal-sourced protein are expected to restrain the market growth of animal protein.

Soy proteins with GM origin pose health risks and are a restraint for market growth.

Research studies have cited many health and environmental risks associated with the production and consumption of genetically modified (GM) commodities including soybeans. There are apprehensions that in the long term, GM soy alters the enzymatic activity and metabolic activity in the liver. Hence, they are opposed by the various industry stakeholders, including regulatory bodies of countries in Europe and Asian Pacific regions, who are demanding non-genetically modified (non-GMO) soybeans.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=114688236

Entering new sections through customization is a major opportunity for manufacturers

Manufacturers have been using functional properties of soy protein ingredients in developing versatile food products. Several new products such as in nut butter, cheese, burgers, and instant oatmeals have been launched by the manufacturers of soy protein ingredients. New sectors such as healthcare foods and sports beverages can provide a better market opportunity for soy proteins. These sectors can boost the growth of soy protein production if they are manufactured in a customized way. With advancements in technology, soy proteins can be isolated and functional properties can be enhanced to provide a wider scope of application.

Asia Pacific is projected to be the fastest-growing region during the forecast period.

Asia Pacific is projected to be the fastest-growing region during the forecast period. The market in the region is driven by increase in population growth especially in countries such as China and India. Further, rise in demand for healthy food products having high nutritional value such as soy, wheat, and vegetable protein is driving the market in this region.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=114688236

The major protein ingredients players include Cargill (US), ADM (US), DowDuPont (US), Kerry Group (Ireland), Omega Protein Corporation (US), Friesland (Netherlands), Fonterra (New Zealand), Arla Foods (Denmark), AMCO (US), Roquette (France), Gelita AG (Germany), Kewpie Corporation (Japan), AGARNA (Austria), AMCO Proteins (US), Hilmar Ingredients (US), Axiom Foods (US), and Burcon Nutrascience (Canada). Expansions formed the most dominant strategy adopted by major players, followed by acquisitions. This has helped them to increase their presence in different regions and increase their product portfolio.

Recent Developments:

- In August 2019, Cargill (US) invested USD 75 million to expand the production capacity for PURIS Pea protein at its Minneapolis facility due to surge in the demand for pea protein. This initiative was strategically taken by witnessing a growing demand for plant-based protein in the North American region. Through this they aim to cater to a large number of customers with tasty, sustainable and label-friendly pea protein across North America.

- In July 2018, ADM (US) and Cargill (US) launched their new joint venture SoyVen in Egypt to manufacture soybean meal and oil for customers in Egypt. Both the companies hold equal interest in the company. Their production plant is located in Borg Al-Arab whose daily production capacity is doubled to 6,000 MT, witnessing a growing demand for higher-protein soybean meal and oil by the Egyptian customers. This will also lower down the need for imports from the international markets.

- In November 2017, ADM expanded its ingredient portfolio with the launch of Nutriance, a range of wheat protein concentrates having applications in sports and geriatric nutrition.

- In April 2017, DowDuPont launched SUPRO XT 55, an isolated soy protein in protein beverages to increase its product portfolio.