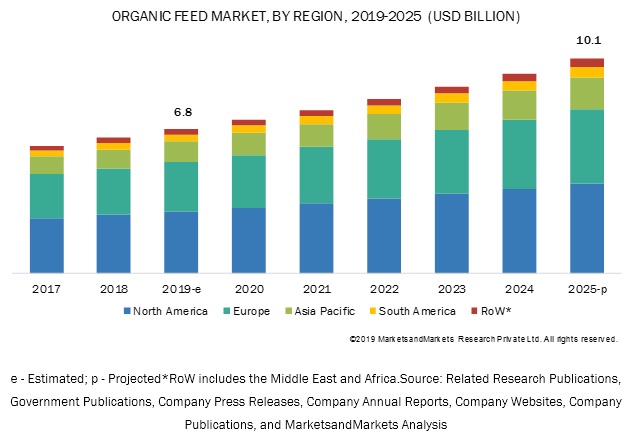

The global organic feed market size is estimated to be valued at USD 6.8 billion in 2019 and is projected to grow at a CAGR of 6.8% from 2019 to reach a value of USD 10.1 billion by 2025. The increasing instances of animal product contamination due to pesticides and insecticides, rising demand for organic food products, growing organic livestock farming, and adaption of organic farming practices by farmers due to the increasing health concerns among consumers are some of the key factors that are projected to drive the growth of the global market. Developing countries in Asia Pacific and South American regions are projected to create lucrative growth opportunities for organic feed manufacturers in the coming years.

The cereals & grains segment is projected to be the fastest-growing segment in the organic feed market during the forecast period.

The cereals & grains segment accounts for the largest share in the organic feed market. Cereals and grains in this study include corn, wheat, and barley. The US is among the largest producers of corn and wheat, as well as key raw materials used for manufacturing organic feed. According to the 2016 Certified Organic Survey (2015 to 2016), the US organic corn acreage increased from 166,841 in 2015 to 213,934 in 2016. Most of this production was used in organic feed rations. Due to these factors, the growth prospects for organic feed manufacturers remain high in the country.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=158519224

The poultry segment is projected to witness the fastest growth during the forecast period.

The poultry segment is estimated to account for the largest share in the organic feed market in 2019. It is also projected to be the fastest-growing market during the forecasted period. Poultry meat is the most popular natural and organic meat among consumers. According to the USDA, in the US, the largest volume of organic meat sales is for poultry. According to the USDA’s Economic Research Service (ERS), in 2016, the number of certified organic broilers produced totaled over 19 million in the US. The number of certified organic layer hens produced in the same year was over 15 million, and the number of certified organic turkeys produced was 410 thousand. In developing countries, organic feed manufacturers are focusing on capitalizing on significant growth prospects as consumers opt for organic products.

The pellets segment is projected to record the fastest growth during the forecast period.

Pellets are the most common and preferred form of organic feed. They also contain a high level of binders as compared to the mashed form of organic feed. The pelleted form of organic feed stimulates early organic feed intake. Pelleting of organic feed also reduces wastage, as it is easy to feed to animals, convenient to store, and is also preferred by backyard chicken farmers.

Increasing instances of contamination in animal products due to pesticides and insecticides to drive the growth of the organic feed market

Feed safety has become a matter of concern for many governments around the world, particularly those in North America and Europe. Consumers around the world are becoming more aware and informed about the extrinsic attributes of the meat they consume. Due to these factors, the importance of organic feed is increasing among consumers globally.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158519224

In conventionally produced feed, pesticides and insecticides are utilized widely, which may cause poisoning to feed crops, as certain bacteria such as E. Coli or Salmonella respond to these crop protection products. The consumption of feed products, which are made from these contaminated crops, have an adverse impact on the health of animals, and thereby, cause contamination in products, such as milk, egg, and meat derived from animals. Such pathogenic and parasitic diseases in meat products due to Salmonella, Listeria, and E. coli have raised concerns over meat quality and safety in the past decade.

For instance, in 2017, eggs contaminated with pesticide fipronil were found in Belgium and the Netherlands. In August 2017, a meat and egg quality issue arose in Germany, where a supermarket chain, Aldi, withdrew eggs from its shelves in Germany after the tests showed the possibility of insecticide contamination. Millions of eggs were recalled from shops and warehouses in these countries in the same year. Many countries, including South Korea and Slovakia, banned pork imports from Germany in the same year due to the health risks involved.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies, in the organic feed market. It consists of the profiles of leading companies, such as Cargill (US), BernAqua (Belgium), Country Heritage Feeds (Australia), ForFarmers (Netherlands), SunOpta (Canada), Ranch-Way Feeds (US), Aller Aqua (Denmark), Purina Animal Nutrition LLC (US), Scratch and Peck Feeds (US), Cargill (US), K-Much Feed Industry Co., Ltd (Thailand), The Organic Feed Company (UK), B&W Feeds (UK), Feeddex Compaies (US), Country Junction feed (US), Green Mountian Feeds (US), Unique Organic (US), Kreamer Feed (US), Yorktown Organics, LLC (US), and Hi Peak Feeds (UK).