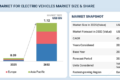

The global robotaxi market, size was valued at USD 0.4 billion in 2023 and is expected to reach USD 45.7 billion by 2030, at a CAGR of 91.8% from 2023 to 2030. The growing need for convenient and secure transportation is the main factor propelling the market for robotaxis. People are increasingly looking for less stressful and more convenient alternatives to driving oneself about. Additionally, The Robotaxis’ lower costs when compared to traditional taxi services or owning a private vehicle, as well as the growth of ride-sharing and Mobility-as-a-Service (MaaS) trends, are enticing more people to use them. The growing focus on sustainability, the necessity for efficient urban transit, and better safety as a result of eliminating human error are further factors that are driving the need for robotaxis. Due to legislative support, alliances, and changing attitudes regarding autonomous vehicles, this sector is growing.

Robotaxis to reduce operating costs and increase profit margins for ridesharing companies

In various aspects, robotaxis can potentially lower total operating costs and boost profit margins for ridesharing businesses. Driver salaries are sometimes the biggest expense for ridesharing companies. Robotaxis eliminates the need for paying drivers, which can drastically lower operating expenses. There are restrictions on the availability and the number of hours that human drivers can work. Robotaxis can run continuously for 24 hours without stopping due to technological advancements in battery and development in charging infrastructure. For ridesharing companies, higher utilization of robotaxi may lead to higher profit margins. As in the absence of drivers in the taxis is an opportunity for ride-hailing companies, such as Uber Technologies, Inc., Lyft, Inc., and Beijing Xiaoju Technology Co, Ltd., to reduce overall operating costs and increase profitability.

A majority of the startups in this market, such as Cruise LLC, Argo AI, Pony.ai, and Mobileye, are backed by renowned automotive manufacturers, ridesharing companies, and technology companies such as Ford, Volkswagen, Baidu, and Toyota, who have invested billions of dollars in the development of autonomous cars. In October 2022, Volkswagen (Germany) announced an investment of around USD 2.33 billion in Beijing robotics company Horizon (China) as it seeks to accelerate its deployment of autonomous vehicle tech in China. Waymo LLC, Baidu, Inc., and AutoX, Inc. are considered pioneers in this rapidly developing market as they are already offering robotaxi services to the public. Significant competition among these robotaxi makers and ride-hailing service providers is driving the market across the globe.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=132098403

Robotic assistance in goods delivery

Increased technological advancements and related AI applications for autonomous vehicles are expected to help create an increasing number of supporting services. Robotic assistance could also be used for delivery, picking up supplies, and other routine tasks by small businesses. The utilization of these services for autonomous cars and robotaxis is expected to be one of the key attractions for consumers to accept their services. For instance, Nuro, Inc. is one of the companies offering autonomous vehicles which can be used for the delivery of goods. The company has also received approval from NHTSA. Amazon used such autonomous vehicles for its deliveries as it acquired the autonomous vehicle company, Zoox in June 2020. In May 2022, following a partnership announced in late 2021, Motional, Inc. began end-to-end food deliveries for Uber Eats in Southern California using its autonomous IONIQ 5 robotaxi EVs. The pilot program marks the first autonomous deliveries for Motional’s robotaxis and the first autonomous vehicles used on the Uber Eats network.

Europe is anticipated to witness significant growth during the forecast period

The European region is estimated to be dominated by countries such as Germany, France, Norway, and the Switzerland. Technological advancements and developed & supportive infrastructure have helped the fleet operators to test and deploy easily in this region. The European Commission encourages global technology standardization and provides funds for R&D to increase the competitiveness of the EU automobile industry and maintain its position as a technological leader worldwide. Additionally, In July 2022, the EU passed the General Safety Regulation, the first legal framework to allow automated and fully driverless cars to become available on European roads. Member states anticipate its deployment will boost innovation and improve the competitiveness of the car industry. Furthermore, Growing technological trends for autonomous vehicles will greatly impact the market. This will boost the overall demand for self-driving taxis in the region. Several companies that offer self-driving shuttles around the world, like EasyMile, Navya, and 2getthere, are based in Europe.

Key Market Players

The robotaxi market is dominated by global players such as Waymo LLC (US), Baidu, Inc. (China), Beijing Didi Chuxing Technology Co., Ltd. (China), Cruise LLC (US), and EasyMile (France).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=132098403