MarketsandMarkets Research Report’s View on Revenue Impact?

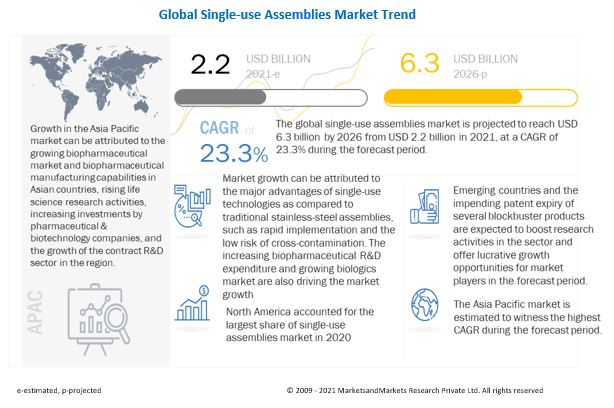

The Global Single-use Assemblies Market is projected to reach USD 6.3 billion by 2026 from USD 2.2 billion in 2021, at a CAGR of 23.3% during the forecast period.

Factors Responsible for Growth and In-Depth Analysis?

The growth of the single-use assemblies market can primarily be attributed to the major advantages of single-use technologies as compared to traditional stainless-steel assemblies, such as rapid implementation and the low risk of cross-contamination. The increasing biopharmaceutical R&D expenditure and growing biologics market are also driving the market growth.

A single-use solution has numerous advantages over traditional bioprocessing technologies, due to which the adoption of single-use assemblies is growing continuously. These include the faster implementation of single-use assembly components in the bioprocess cycle and a lower risk of cross-contamination. Single-use assemblies are ergonomically designed to hold integrated single-use flow paths for faster set-up and reduced space requirements.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46226549

Leading Key Players and Analysis:

The Prominent players operating in the single-use assemblies market are Thermo Fisher Scientific, Inc. (US), Sartorius Stedim Biotech (France), Danaher Corporation (US), Merck KGaA (Germany), Avantor, Inc. (US), and Saint-Gobain (France).

Thermo Fisher Scientific is one of the leading players in the market. The company offers a range of single-use assemblies for downstream, upstream, and fill-finish stages of bioprocessing. The company’s BioProcess containers and transfer assemblies are single-use flexible container systems for critical liquid handling applications in biopharmaceutical & biomanufacturing operations. In the last few years, the company has majorly focused on expanding its bioproduction capabilities and market presence. In 2020, it saw significant growth in its Life Sciences segment, driven by the demand for diagnostic testing for COVID-19; the demand for bioproduction products, including single-use assemblies, saw a significant surge.

Geographical Analysis in Detailed?

North America accounted for the largest share of the single-use assemblies market in 2020.

In 2020, the Asia Pacific region accounted for the fasted growing region of the single use assemblies market. This can be attributed to the growing biopharmaceutical market and biopharmaceutical manufacturing capabilities in Asian countries, rising life science research activities, increasing investments by pharmaceutical & biotechnology companies, and the growth of the contract R&D sector.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=46226549

Industry Segmentation:

The biopharmaceutical & pharmaceutical companies segment accounted for the largest share of the end user segment in the single-use assemblies market in 2020.

On the basis of end users, segmented into biopharmaceutical & pharmaceutical companies, contract research & manufacturing organizations (CROs & CMOs), and academic & research institutes. In 2020, the biopharmaceutical & pharmaceutical companies segment accounted for the largest share of the single use assemblies market. The demand for biopharmaceuticals among the geriatric population is increasing as the elderly are more prone to diseases/disorders, which are treated using biologics. This has resulted in the increased focus of biopharmaceutical companies on developing affordable biologics at lower costs. As single-use assemblies have wide applications in each stage of the production cycle, their adoption is increasing with the growth in the production of biologics and biosimilars.

The standard solutions segment accounted for the largest share of the solutions segment in the single-use assemblies market in 2020.

Based on solution, Segmented into standard solutions and customized solutions. In 2020, the standard solutions segment accounted for the largest share of the single use assemblies market. The adoption of standard solutions is high in the pharmaceutical & biopharmaceutical industries due to the advantages these solutions offer, such as manufacturing process efficiency with reduced capital costs, improved flexibility with the use of pre-qualified components for building assemblies, reduced implementation time, and more flexibility with production planning.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=46226549