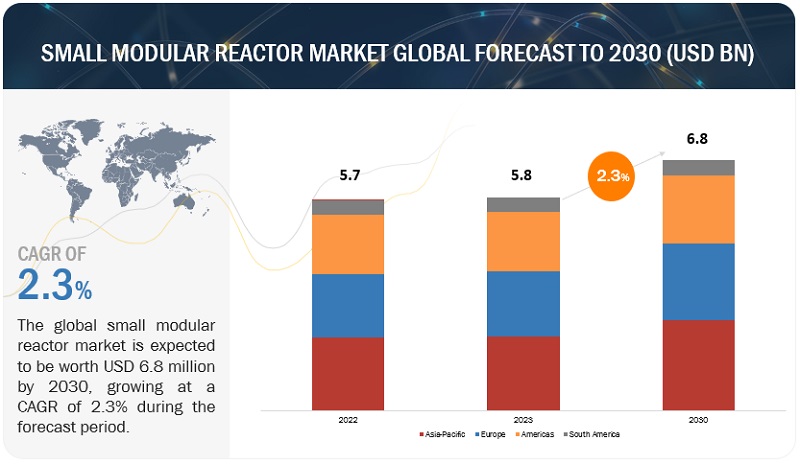

According to a research report “Small Modular Reactor Market by Reactor (HWR, LWR, HTR, FNR, MSR), Application (Power Generation, Desalination, Hydrogen Generation, Industrial), Deployment (Single, Multi), Connectivity, Location, Coolant, Power Rating & Region – Global Forecast to 2030″ published by MarketsandMarkets, the global Small modular reactor market is projected to reach USD 6.8 billion by 2030 from 5.8 billion in 2023, at a CAGR of 2.3% between 2023 and 2030. The Small modular reactor market size is estimated to be USD 5.8 billion by 2023 and is projected to reach USD 6.8 billion by 2030, at a CAGR of 2.3%. Factors such as the versatile nature of nuclear power and the relative advantages of SMRs such as modularization and factory construction are enabling the growth of the market.

Gases segment is expected to result in the segment occupying the second largest market share of the Small modular reactor

The gases segment accounted for a share of 22.6% of the small modular reactor market in 2022. The gas-cooled reactor uses helium as a coolant medium during the operation and can be easily pressurized and maintain a stable high temperature facilitating higher efficiency in the operations. Using gas as a medium in the reactor can stop the occurrence of corrosion on the surfaces of the reactor, which reduces the need for maintenance. These operational advantages are pushing the growth of the gases segment. Gas-cooled reactors use graphite as a neutron moderator and carbon dioxide gas as the coolant.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=5001546

High–temperature reactors by type is estimated to be the second largest and second–fastest growing market

The high-temperature reactor segment accounted for a 22.6% share of the small modular reactor market in 2022. High-temperature reactors are Generation IV technology reactors characterized using a graphite moderator and gases such as helium, carbon dioxide, or nitrogen as the primary coolants. The most developed HTRs are high-temperature gas-cooled reactors (HTGRs), which include two main types of reactor designs: pebble-bed reactors (PBR) and prismatic block reactors (PMR). These reactors can reach temperatures of up to 1,000° C and may use fuels that contain uranium enriched up to 20.0%, which has higher enrichment than LWR fuel. These reactors provide immense potential use of thorium-based fuels. HTGRs produce ~40% less high-level waste per unit of energy produced and less plutonium content compared with a single-pass typical cycle of LWRs. The waste reduction is a result of higher thermal efficiencies and increased burnup in HTGRs. The storage and disposal requirement of high-temperature reactors is about 50 times lower for HTGRs compared with LWRs. However, the regulators and designers face several challenges while developing and licensing HTRs, such as limited design experience, lack of construction codes, and unresolved questions concerning fuel development and safety analysis tools.

Power Generation is estimated to be the fastest growing market

The power generation segment held a 34.15% share of the small modular reactor market in 2022. SMRs are expected to be used for power generation, as they have simpler designs, economies of series production, short construction times, and reduced siting costs compared with large nuclear power plants. The power generated by SMRs is expected to be economical compared with other low-carbon alternatives and they help reduce carbon emissions and meet new energy demands. SMRs provide a stable and reliable baseload power supply, which makes them suitable for replacing and optimizing the use of retiring coal and other fossil fuel-fired power plants and replacing aging infrastructure. SMRs also have load following capabilities and can be integrated with renewable energies to provide flexible power, as these reactors can vary their output to meet the fluctuations in power produced using renewable energy. SMRs can be used to power isolated grid systems, remote communities, islands, and mining sites. All these factors are likely to boost the growth of the market for the power generation segment.

Grid–Connected segment by connectivity is estimated to be the second–fastest growing market

The grid-connected segment held a 65.03% share of the total small modular reactor market in 2022. Grid-connected SMRs have the potential to complement variable renewable energies, such as wind and solar, and integrate with smart grids and energy parks. SMRs can provide baseload power for grid-connected operations and can vary their output to meet the fluctuations in the supply of power produced by renewable sources. SMRs are expected to phase out conventional coal-fired power plants, as utilities want to replace retiring coal-fired plants with baseload plants of similar size that do not produce greenhouse emissions. SMRs can support grid modernization activities, such as smart grid and load growth, and help replace the existing aging infrastructure. These reactors can restart without receiving energy from the grid. This can help an electricity grid meet the system requirements in terms of parameters such as voltage, inertia, reactive capacity, and frequency when recovering from an outage.

Ask Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=5001546

Marine segment by location is estimated to be the second largest and second–fastest growing market

The marine segment held a 7.36% share of the small modular reactor market in 2022. SMRs can be deployed in marine environments either as barge-mounted floating power units or underwater power units. Marine SMRs generally use pressurized-water reactor technology. These reactors have long core lives and require little refueling. Marine SMRs provide several flexible deployment options, such as nuclear icebreaker ships and floating nuclear power plants.

Single–module power plant segment by deployment is estimated to be the second largest and second–fastest growing market

The single-module power plant segment held a 76.30% share of the small modular reactor market in 2022. Single-module SMR plants are stand-alone units that may be used individually to meet niche energy requirements or localized demand. Larger single-module SMR plants could be used to replace small fossil-fuel units or deployed for distributed generation. The licensing of single-module SMRs is expected to be simpler than that of multi-module SMRs, as the current regulatory and licensing frameworks generally rely on an extensive experience base, with single-module larger nuclear plants using light-water reactor technology. Single-module SMRs, especially under 10 Mwe, serve remote locations deprived of electricity and district heating applications. They incorporate all the essential components, such as the power generation unit, turbines, generators, control systems, and necessary support infrastructure, into a single unit.

Upto 100 MW segment by power rating is estimated to be the fastest growing segment in the small modular reactor market

The power rating of up to 100 MW holds a market share of 16.9% share of the small modular reactor market in 2022. SMRs are characterized by their compact size and modular design. The reactor unit can be manufactured in a factory and transported to the installation site. The modular design allows for scalability, where multiple SMR units can be deployed together to meet varying energy demands. The primary application of a 100 MW SMR is power generation. It can serve as a standalone power plant, providing clean and reliable electricity to communities, industries, or remote locations. The excess heat generated by a 100 MW SMR can be utilized for district heating, where thermal energy is distributed to nearby residential, commercial, and institutional buildings for space heating and water heating purposes.

Europe likely to emerge as the second-largest region in Small modular reactor market

Europe accounted for a 30.3% share of the global small modular reactor market in 2022. The scope of the European small modular reactor market includes Russia, the UK, France, and the Rest of Europe. The Rest of Europe includes Italy, Luxembourg, Denmark, the Czech Republic, Sweden, Ukraine, Finland, Estonia, Poland, and Romania. According to the BP Statistical Review of World Energy 2022, nuclear energy accounted for about 28.4% of the region’s electricity generation mix. The region accounted for 30.2% of the global nuclear power consumption.

Investments for the development of SMRs and the shift toward the use of clean energy to combat climate change are increasing the opportunities for the deployment of SMRs in this region. For instance, in November 2020, the government pledged USD 298 million to SMRs in 2021 as a part of the UK Research and Innovation (UKRI) through the Low-Cost Nuclear (LCN) program. In November 2019, UKRI provided an initial match funding of USD 23 million to the UK SMR consortium, led by Rolls-Royce, for the development of a conceptual SMR design. In June 2021, Rosatom (Russia) announced its plans to invest USD 7 billion in new nuclear technologies by 2030. The plan includes the development of four floating power units using RITM-200 reactors (55 MWe each) by the end of 2028 for the Baimskaya Mining and Refining Plant in Chukotka. It also aims to commission a land nuclear power plant that utilizes RITM-200 SMR technology by 2030 for the Kyuchusskoye gold deposit in Yakutia. Rosatom also has plans to launch pilot units, including SHELF and ELENA, in remote regions of the country. It intends on concluding the first export contract for its SMR power plants at the end of 2026. Factors such as the integration of SMRs with intermittent renewable energy and the decarbonization of the energy sector enhance the growth of the small modular reactor market in Europe.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=5001546

The overall key players are Westinghouse Electric Company LLC (US), NuScale Power, LLC. (US), Terrestrial Energy Inc. (Canada), Moltex Energy (Canada), GE Hitachi Nuclear Energy (US), X Energy, LLC. (US), X Energy, LLC. (US), General Atomics (US), ARC Clean Energy, Inc. (Canada), LeadCold Reactors (Sweden), Rolls-Royce (UK), Ultra Safe Nuclear (US), Toshiba Energy Systems & Solutions Corporation (Japan), Tokamak Energy Ltd. (UK), SNC-Lavalin Group (Canada), Afrikantov OKB Mechanical Engineering (Russia), China National Nuclear Corporation (China), Framatome (France), U-BATTERY (UK), and Seaborg Technologies (Denmark).