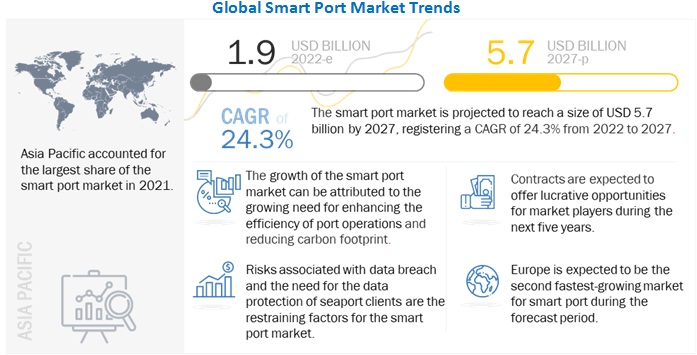

According to a research report “Smart Port Market by Technology (IoT, Blockchain, Process Automation, Artificial Intelligence), Elements (Terminal Automation, PCS, Smart Port Infrastructure), Throughput Capacity, Port Type – and Region – Global Forecast to 2027″ published by MarketsandMarkets, the global smart port market size will grow to USD 5.7 billion by 2027 from USD 1.9 billion in 2022, at a CAGR of 24.3% during the forecast period. Growing maritime trade activities internationally across industries, Growing decarbonization of the maritime industry which increases the health benefit and reduce carbon emission globally, hence these are driving the demand for smart ports globally. As the real-time geospatial data improve a large number of port operations such as it improved the freight operations by increasing visibility and assisting shipping companies which will help to navigate the current supply chain and it helped to grow the smart port market. Moreover, the fourth industrial revolution, referred to as Industry 4.0 (4IR), is the cyber-physical transformation of manufacturing also creating demand for the smart port as the primary application of 4IR was for smart factories so it will help in increasing the demand for the smart port market. An example of 4IR technology used in the ports is Dongwon Global Terminal (DGT) which is selected for CyberLogitec’s terminal operating system (TOS) so it is used for fully automated Busan New Port terminal, with using current technology such as Big data and Internet of Things (IoT). As the government initiatives in the development of smart port infrastructure which is made to opportunities for growth of the smart port market. In the current scenario as new technology develops so it was helping to upgrade the existing port with a large amount of development in the new port. As per this opportunity, the European Union (EU) is involved to upgrade and developing new ports because of commodities that are imported and exported, and around exchange within the EU.

The smart port market includes prominent Tier I and Tier II manufacturers like IBM, ABB, General Electric, Accenture, and Siemens. These companies have their manufacturing facilities spread across Europe, North America, Asia Pacific, and other regions. Technology like the Internet of Things (IoT) which is involved machine learning, sensor, connectivity, process, and people. The software which has the Internet of Things (IoT) is the amongst the largest share of technology in the smart port industry. This technology is used to increase the efficiency of the smart port and the growth of these industries is expected to also lead to the growth of the smart port market.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=165784113

The port type segment is expected to dominate the smart port market, by seaport, during the forecast period.

There are two types of port types such as seaport and inland port. A seaport is a protected area on a sea location where ships stop to load and unload cargo. As the increasing seaborne trade activities help the growth of the smart port industry. According to UNCTADs Global Commerce Update, which was published in July 2022, the value of global trade grew to a record USD 7.7 trillion in Q1 2022, a rise of approximately USD 1 trillion from Q1 2021. Rising commodity prices, which represent an increase of about USD 250 million from Q4 2021, are the main factor driving the rise since trade volumes have climbed to a noticeably lesser level. The Seaport footprints will need to expand by up to 3,689 square kilometers (1,424 square miles) globally over the next three decades to account for both sea level rise and rising demand, according to a report released by Earths Future in 2020.

The throughput capacity segment is expected to be the largest and fastest growing market, of extensively busy ports, during the forecast period.

There are three types of throughput capacity segments such as extensively busy ports, moderately busy ports, and scarcely busy ports. As the extensively busy ports handle a capacity of more than 19 million TEU per year. There is some region in which there are some ports globally that come under extensively busy ports such are the region China, Singapore, & South Korea which are the major corridor for trade activities. These ports have the smart infrastructure and have made significant investments in port features such as terminal automation, cargo handling, port community systems, smart infrastructure, and safety and security.

The Asia Pacific likely to emerge as the largest smart port market

The Asia Pacific region accounted for the largest share of the smart port market in 2021. The region is experiencing rapid development fueled by the growth of major economies, such as China, Singapore, India, South Korea, Japan, Hong Kong, Indonesia, and Australia. It is a dominant region in the smart port industry. It is also considered a lucrative region for maritime trade. As the increase in seaborne trade has subsequently led to an increase in demand for ships that are used to transport manufactured goods to various regions globally. The growth of the smart port industry decreased as a result of the Covid-19 pandemic in 2020 which directly impacted this region, which declined by around 1.5% in 2020. The rise in the number of ships will contribute to the growth of propulsion systems and engines in the Asia Pacific region. As per the Journal of Commerce’s annual list of the top 50 container ports in the global in these Asia Pacific has been ranked the 9th out of the 10. Regarding port development, the ports in these regions have grown in tandem with the economic development of most countries which reflecting the region has the fastest economic growth. The Organization for Economic Cooperation and Development (OECD) projects that by 2050, the volume of maritime trade will have tripled, raising the demand for global freight. The Asia Pacific region has an increasing number of ports each year, and those that already exist are expanding. This is because the majority of cargo transit occurs via maritime routes. The program aims to boost the effectiveness of the regions current port facilities through automation, information technology, streamlining of work procedures, the use of new equipment, and employee training. It will help to grow in the smart port industry and drive forward.

Request Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=165784113

The smart port market is dominated by major players that have a wide regional presence. Some of the key players in the smart port market are IBM (US), ABB (Switzerland), General Electric (US), Accenture (Ireland), Siemens (Germany), Trelleborg (Sweden), Wipro (India), Port of Rotterdam (Netherlands), and Royal HaskoningDHV (Netherlands).